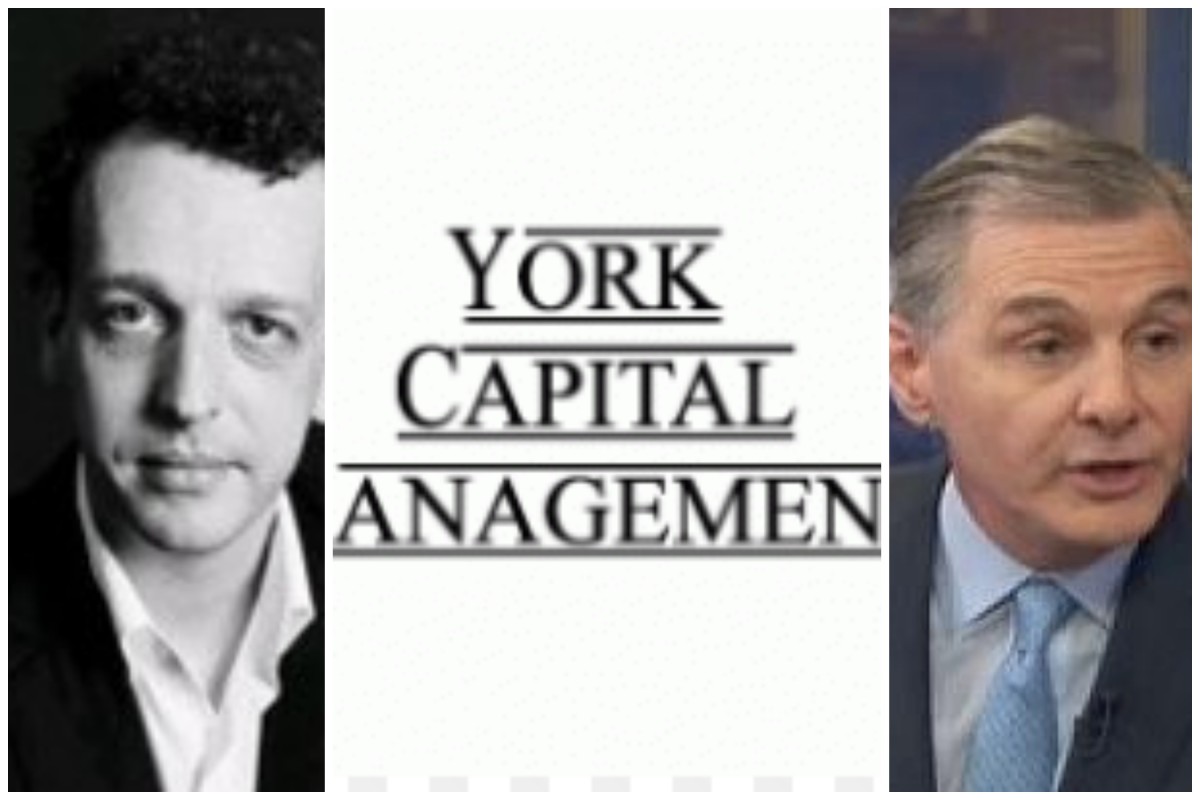

Allowing clients access to their money is a real pain in the ass. Post some underwhelming returns or worse for a few years straight and all of a sudden the goddamned ingrates want it back. So, uh, Jamie Dinan and York Capital aren’t going to do it anymore. (And not just temporarily this time.)

Mr. Dinan said he planned to shut down York’s European hedge funds and to turn its flagship U.S. hedge fund into one running mainly internal money. The strategies together manage less than $3 billion after years of weak performance and investor defections.

York still expects to run roughly $9 billion in private equity, private debt and other vehicles that lock up client capital for longer periods.