There’s never been a better time to launch a blank-check company. Jeff Smith is doing it. The Moneyball guy is doing it. Bill Ackman’s doing the biggest one ever. Everyone is doing it, and we do literally mean everyone and anyone.

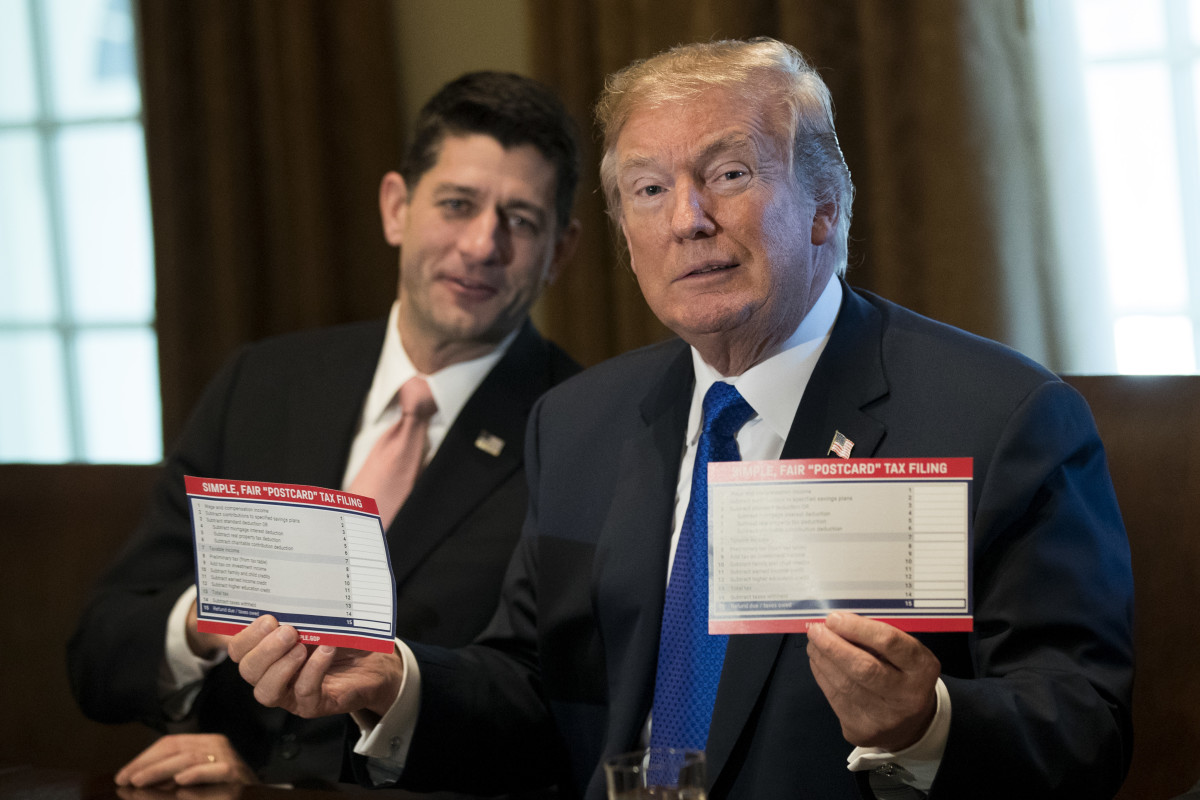

Paul Ryan… will serve as chairman of a vehicle known as Executive Network Partnering Corp., which will seek to raise roughly $300 million in an initial public offering, people familiar with the deal said…. ENPC, which will serve as the new vehicle’s ticker symbol, will be a twist on the traditional SPAC, with longer-term incentives for its backers and potentially slimmer fees for underwriters, the people said.