Private-equity firm GPB Capital Holdings says it’s “extremely disappointed” by the reams of criminal and civil charges leveled against the firm, its CEO and two of his associates—one of whose lawyers trumpets his client as “a good man with a spotless record”—from Boston to Birmingham, Ala. The firm promises to present “significant evidence in its favor,” and boy oh boy will it need it, because there sure was enough in the opposite direction to catch the attention of the Justice Department, SEC, FINRA, a whole host of clients, and the powers that be in New York, New Jersey, Massachusetts, Illinois, Georgia, Missouri, South Carolina and Alabama.

Authorities say Messrs. Gentile and Schneider were aware that GPB’s funds weren’t generating sufficient returns to pay the promised distributions and authorized repeated use of investor cash to cover the dividends…. [New York State Attorney General Letitia] James said GPB and Ascendant, a related marketing company, and Messrs. Gentile, Schneider and Lash “fleeced” more than 1,400 New Yorkers who had invested more than $150 million in the firm’s private-equity funds. She said the funds never delivered promised profits and that the defendants instead used the investments to subsidize “their own lavish lifestyles.”

Ooh, tell us more!

Among other things, GPB allegedly used fund money to cover the costs of private jets, including a $90,000-a-year flight attendant, all-terrain vehicle rentals and more than $29,000 in expenses that an auditor said included “David’s 50th Bday,” according to the state’s complaint. It also claims GPB spent $355,000 on a 2015 Ferrari FF used by Mr. Gentile….

GPB also faces several federal class-action lawsuits in which plaintiffs have accused the firm of running a Ponzi scheme that used fresh investor capital to pay dividends to earlier investors.

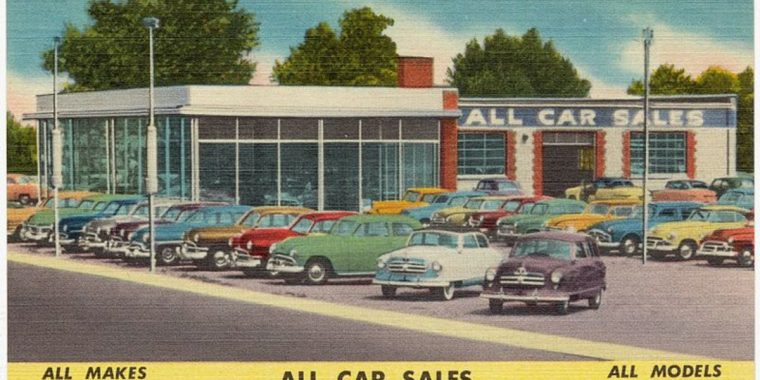

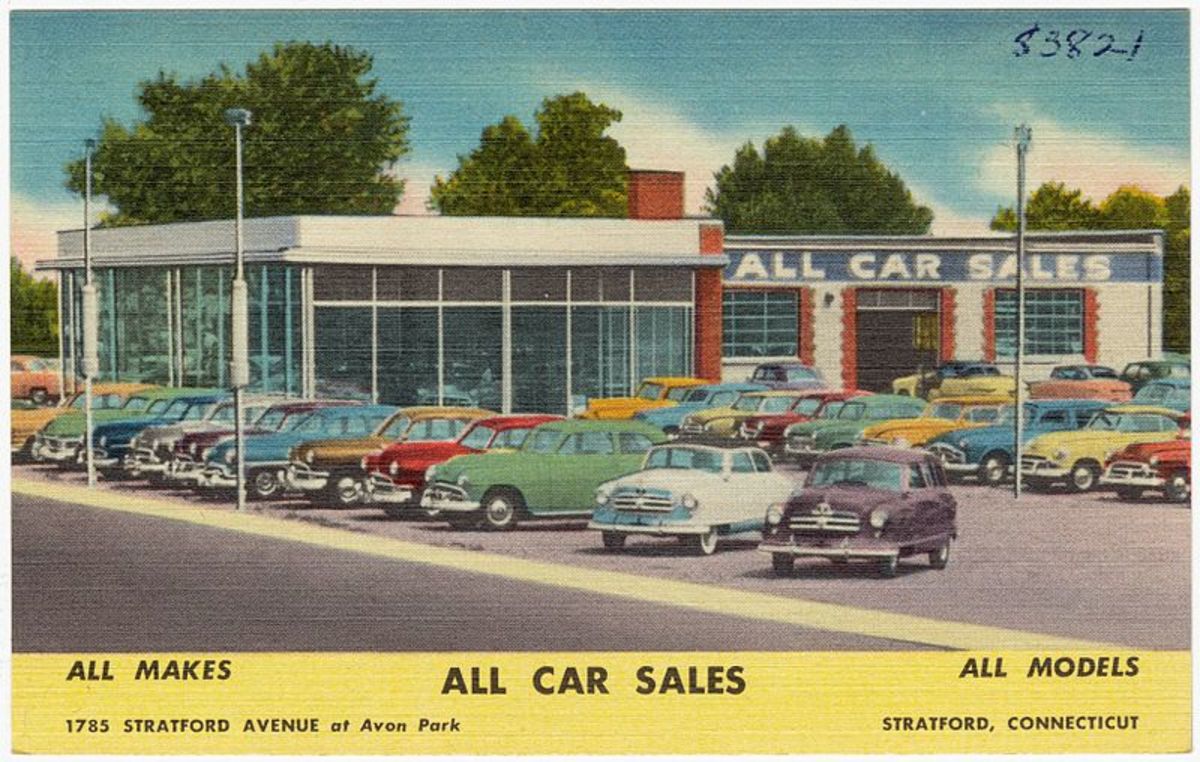

Last month, a Financial Industry Regulatory Authority arbitration panel in Detroit ruled in favor of an investor who claimed that a $225,000 investment in a GPB automotive fund had been misused, documents show.

All standard stuff as alleged Ponzi schemes go, but this one’s got a fun, contemporary twist, as well.

Additionally, GPB faces charges involving retaliation against a whistleblower who alerted the SEC to what was going on at the firm…. In its complaint, the SEC also said GPB fired a senior auto dealer executive involved in running some of its dealerships after he had raised a number of concerns, including GPB’s use of investor funds to cover dividend payments.

There had better be rather significant evidence, indeed.

GPB Capital Faces Fraud Charges Over $1.7 Billion Ponzi-Like Scheme [WSJ]