The blooming weed industry promised massive revenues, a nascent agrarian industry, a booming supply chain, and soaring local taxes. While it has delivered on all of those things in limited fashion, recent earnings calls from market leaders like Tilray ($NASDAQ:TLRY) have analysts and investors worried that we may be seeing an early floor — or at least normalization — of the industry’s ability to earn as prices settle and operational costs become reality.

Yesterday, Tilray reported a third-quarter net loss of almost $36 million, or 36 cents per share. That’s up from last year when it reported losses of $19 million, or 20 cents per share. That said, revenue rose to $51.1 million from $10.1 million.

But skyrocketing losses are the focus of investors today, and they appear to have a lot to do with sinking weed prices. Tilray reported that the average price per gram of weed it sold sunk from $6.21 to $3.25.

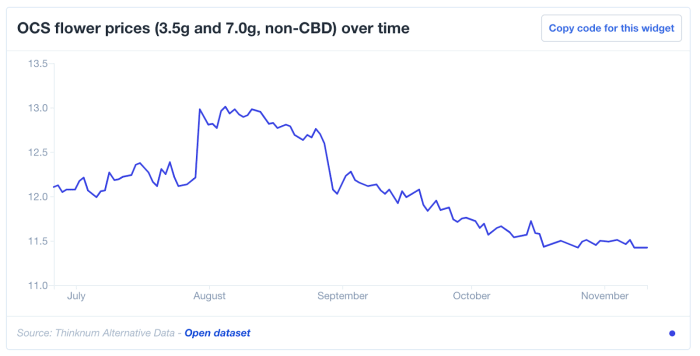

Tilray isn’t alone here: The price of weed across the industry has been dropping, including at Tilray competitor OCS — Ontario Cannabis Store ($PRIVATE:ONTARIOCANNABISSTORE) — where we have pricing data for the past few months.

At OCS, the price of 3.5- and 7.0-gram non-CBD products is showing a steady decline, mirroring that of Tilray and other companies in the space. Since August, the average price has dropped from $13 to $11.42.

While Tilray points to higher operational costs and the acquisition of Manitoba Harvest and Natura Naturals, declining prices will only continue to squeeze revenue and subsequent earnings.

The company has entered a bit of a hiring slowdown as it picks up the pieces as well – openings are down as much as 33% since last summer as the stock price inches to the $20 mark.

Joshua Fruhlinger is the publisher of Thinknum Media.