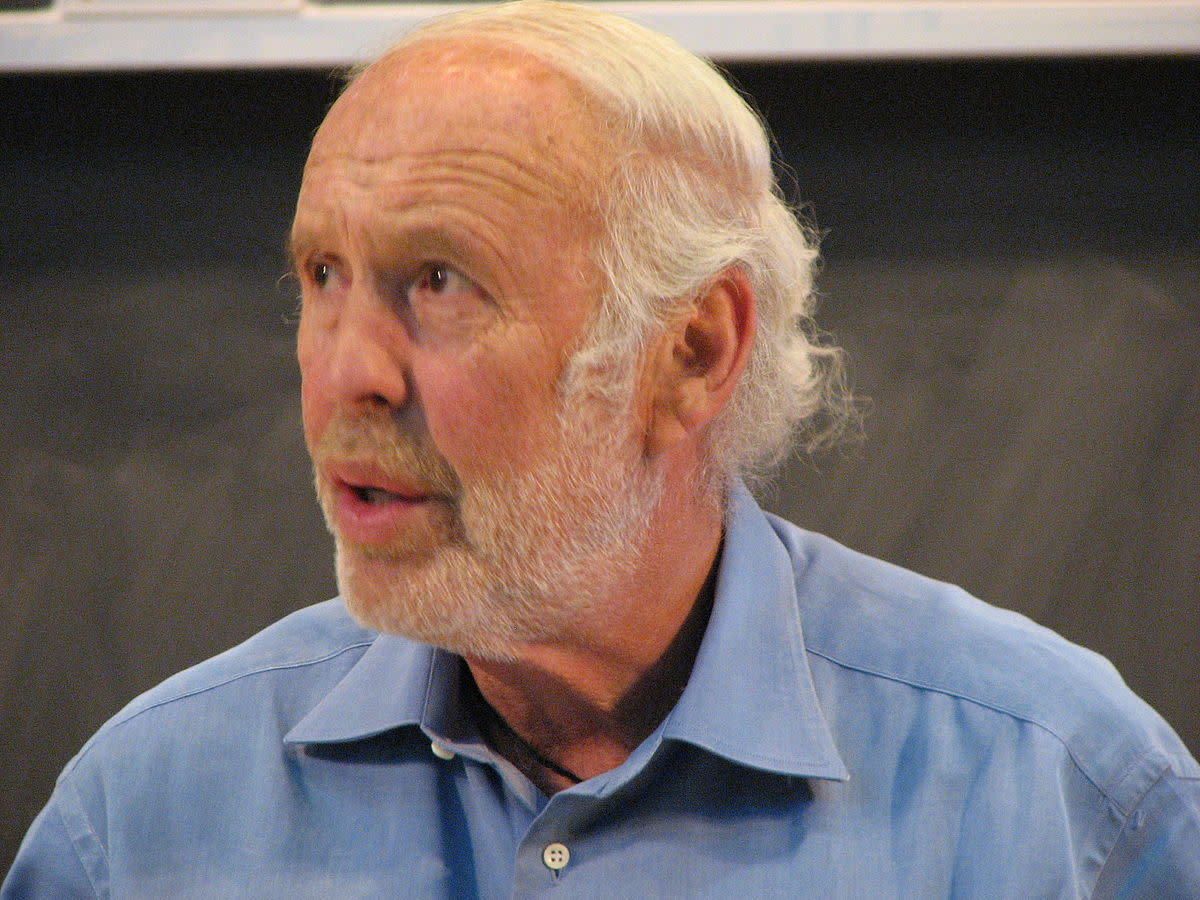

There’s a new book on Renaissance Technologies coming out next month. This is pretty remarkable in and of itself, given the hedge fund’s allergy to publicity, amply demonstrated by one would-be quant being completely unaware he was boring the world’s most successful quant with his story about his planned quant hedge fund. More remarkable still is that some 40 RenTechers and RenTech alums were interviewed by the author, Wall Street Journal reporter Greg Zuckerman, including founder Jim Simons himself, an incredible feat given that speaking to the Journal is a firing offense at the firm. Most remarkable yet is that the book is able to report that RenTech’s famed Medallion fund—closed to all but RenTech employees, dangled as the greatest perk in hedge fund history, and so sought after that former RenTech no. 2 Robert Mercer was willing to prostrate himself before his boss’ son to get a bigger piece of the action—has, in fact, returned twice the $55 billion that we thought.

Although rumors of its performance have long circulated on Wall Street and in the press, the actual numbers are even more mind-blowing: From 1988 to 2018, Medallion returned 66.1% annually before fees. Net of fees, the gains were 39.1%. Estimated trading profits during those 30 years amounted to $104.5 billion.

We can only hope this attention to detail extends to a precise plotting of number of packs a day smoked by Simons and its impact on RenTech’s performance. And while the book, The Man Who Solved the Market, is ostensibly a biography of Simons, there’s apparently plenty of new data points on the unfathomable strangeness of Mercer.

It is a far more nuanced portrait of the conservative influencer than the ones usually found in the popular press. Mercer is a preternaturally calm and measured scientist, brilliantly rigorous and evidence-based in all things market-related. Yet outside of mathematics, he believes the wildest unfounded conspiracy theories, and buys into all manner of debunked nonsense. It is as if Mercer is an extreme version of everyone’s best and worst selves — a brilliant and rational professional, but driven by biases and seething emotions in his political life.

Weirder than hoarding piss and arguing for the health benefits of thermonuclear war and becoming an auxiliary cop in New Mexico and the demerit system for housekeepers and the alleged white supremacy? This thing is gonna be a way more exciting and better read than fucking Principles.

How Jim Simons Built the Best Hedge Fund Ever [Bloomberg]