IOLTA

account

compliance

and

other

financial

management

tasks

pose

big

challenges

to

law

firms

—

even

to

full-time

accountants.

For

a

litigator

without

formal

financial

training,

keeping

the

books

in

order

—

and

the

firm

ready

to

pass

a

bar

association

audit

—

can

be

even

more

daunting.

Mix

in

the

financial

errors

that

can

arise

simply

from

having

disparate

systems,

and

you’ve

got

a

minefield

to

navigate.

But

with

the

right

all-in-one

platform,

you

can

position

yourself

for

success.

MyCase

Accounting

is

a

built-in

legal

accounting

solution

that

works

within

your

case

management

system,

automating

three-way

trust

reconciliations,

business

intelligence,

expense

tracking,

and

other

financial

processes.

Because

this

tool

is

included

directly

in

the

MyCase

system,

all

transactions

are

automatically

synced

and

recorded.

This

includes

entering

time,

tracking

expenses,

generating

invoices,

and

receiving

payments,

among

other

functions.

With

these

items

housed

in

the

MyCase

Accounting

module,

they

can

be

directly

matched

with

bank

transactions,

particularly

easing

bank

reconciliations.

Here’s

a

look

at

how

MyCase

Accounting

could

reshape

your

financial

workflow.

If

you’d

like

to

sign

up

for

a

free

trial,

feel

free

to

do

so

here.

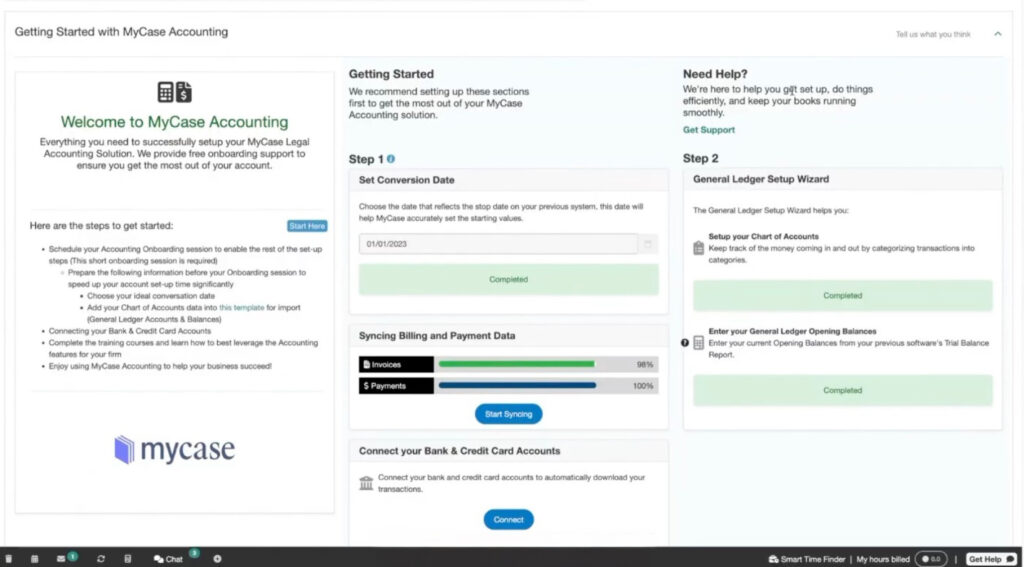

Getting

Started

Signing

up

for

MyCase

Accounting

includes

an

onboarding

period,

complete

with

training

from

the

company’s

accounting

specialists.

The

onboarding

period

will

take

you

through

your

first

three-way

trust

reconciliation

process.

A

subscription

also

includes

a

license

for

your

accountant

to

use

the

system

free

of

charge,

so

you

don’t

need

to

share

any

sensitive

data

outside

of

the

system

for

taxes

and

other

purposes.

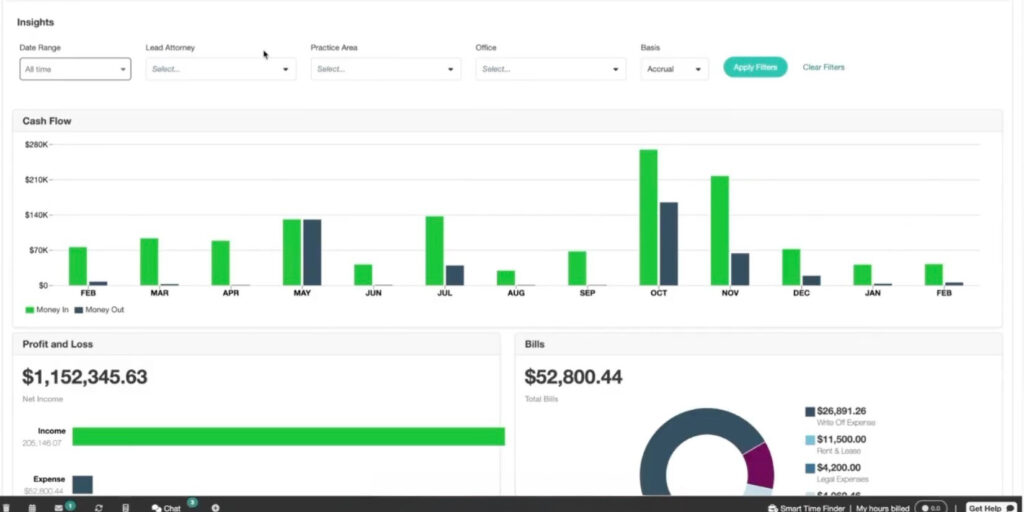

MyCase

Accounting,

at

the

outset,

provides

detailed

business

intelligence

data.

As

a

legal-specific

tool,

financial

performance

can

be

segmented

by

lawyer,

office,

practice

group,

or

other

custom

filters.

The

data

is

synced

with

the

full

MyCase

system,

so

these

metrics

will

automatically

populate

throughout

the

day-to-day

operations

of

the

firm.

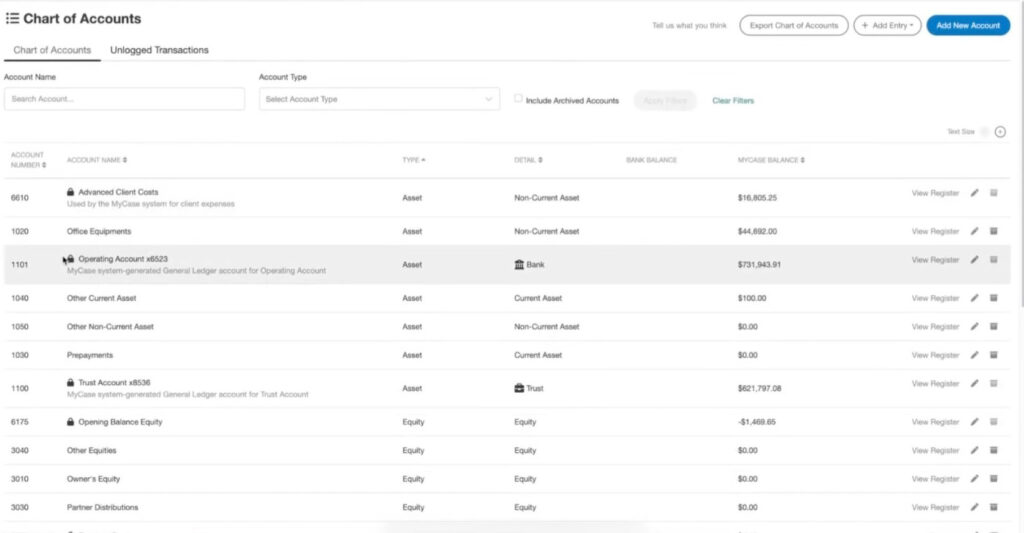

Tracking

Your

Accounts

When

it’s

time

to

examine

your

financials,

MyCase

Accounting

presents

you

with

a

Chart

of

Accounts

interface.

It

comes

pre-populated

with

legal-specific

account

types,

but

it

is

also

customizable.

Users

can

also

add

sub-accounts,

for

example,

one

for

federal

taxes

under

a

payroll

account.

Some

accounts

will

be

marked

“locked”

because

they

are

linked

to

the

front-end

billing

processes.

This

means

that,

as

soon

as

a

lawyer

creates

an

invoice,

or

collects

a

payment,

or

records

an

expense,

it’s

going

to

automatically

update

the

correct

accounts

listed

here.

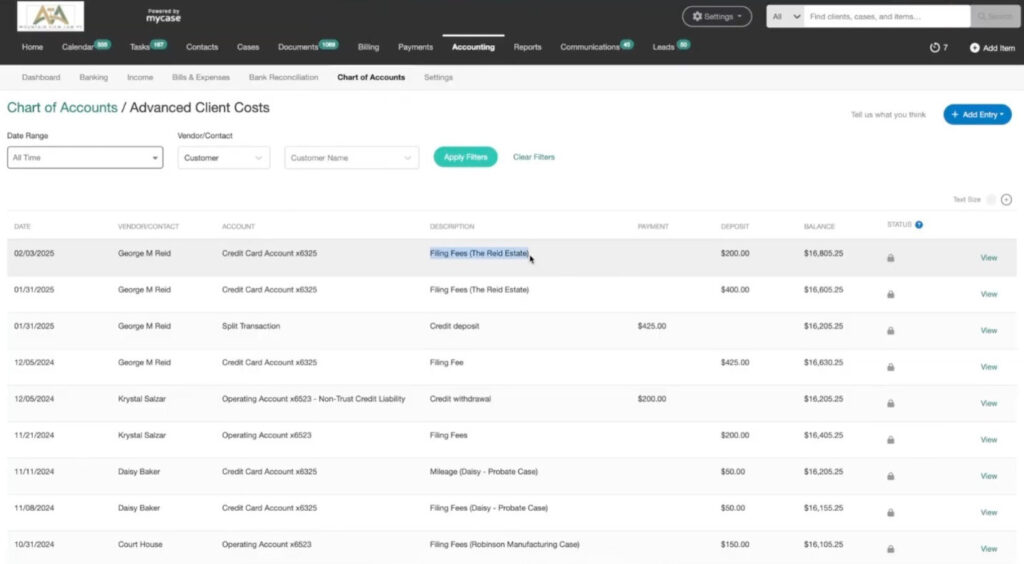

To

drill

down

further,

opening

an

account

file

generates

a

ledger

listing

every

transaction

for

that

account.

Each

entry,

in

turn,

can

be

opened

to

view

detailed

data.

These

include

all

debits

and

credits

the

entry

is

linked

to,

and

any

invoice

in

which

it

was

included.

In

the

bottom

corner,

you

can

see

two

boxes

labeled

“not

cleared”

and

“not

reconciled.”

Once

the

transaction

has

been

posted

with

the

bank,

the

“not

cleared”

box

will

turn

green,

and

once

the

entry

is

included

in

a

monthly

reconciliation,

that

box

will

turn

green

as

well.

The

status

will

also

be

updated

in

the

Chart

of

Accounts

view,

and

these

processes

will

allow

you

to

quickly

find

items

that

need

to

be

addressed.

Easing

Compliance

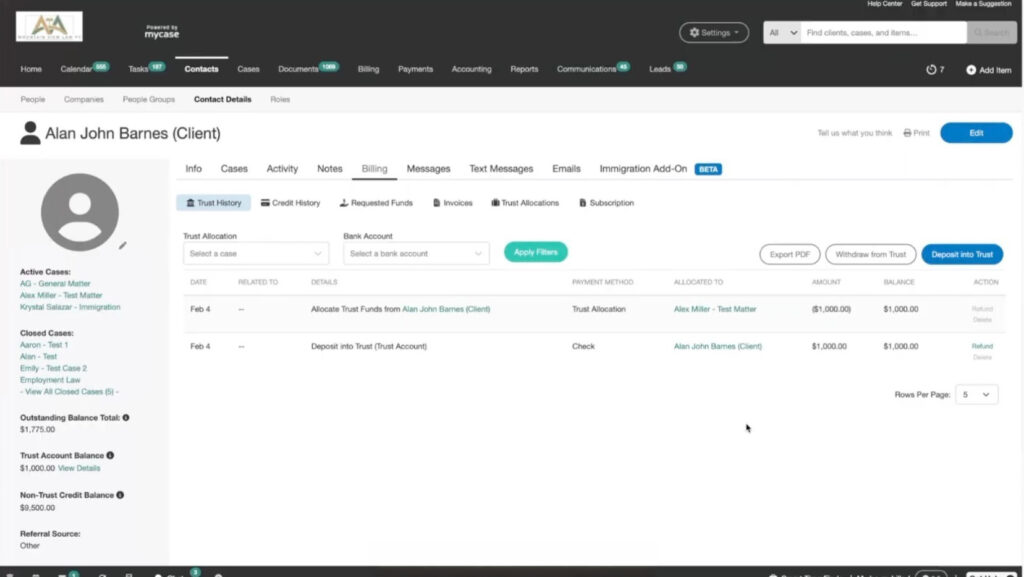

It’s

hard

to

overstate

the

benefits

of

a

unified

system

in

remaining

compliant

with

legal

accounting

rules.

To

start,

the

MyCase

system

will

automatically

generate

a

trust

ledger

for

each

of

the

firm’s

clients

—

which

is

included

with

all

MyCase

systems,

not

just

MyCase

Accounting.

Clicking

into

a

client

file

will

display

all

related

debits

and

credits

involving

your

trust

account.

Adding

the

MyCase

Accounting

tool,

however,

will

pull

all

of

this

information

directly

into

the

three-way

trust

reconciliation

process.

Your

trust

assets,

liabilities,

and

bank

balance

will

all

be

put

into

a

prebuilt

system,

complete

with

guardrails

to

ensure

compliance.

Additionally,

MyCase’s

back-end

payment

processing

is

powered

by

its

sibling

company

LawPay,

meaning

all

of

the

payment

data

is

automatically

synced

to

MyCase

Accounting.

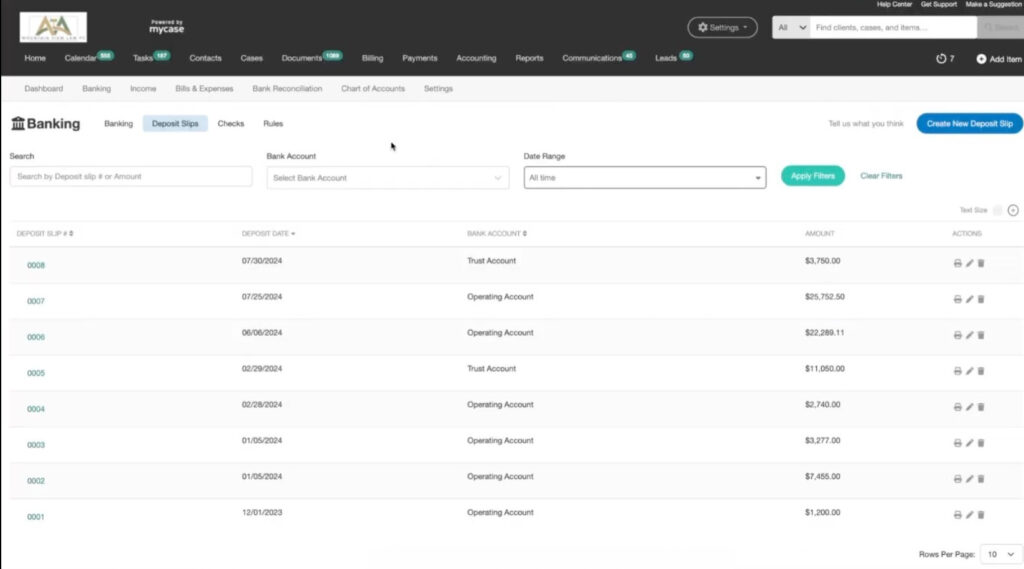

This

means

MyCase

Accounting

can

create

automated

deposit

slips

for

any

online

payment.

These

individual

deposit

slips

will

then

be

automatically

matched

to

the

bank

statement,

saving

additional

time

because

they’re

essentially

auto-reconciled

in

this

process.

This

also

ensures

trust

and

operating

funds

are

handled

separately,

eliminating

risks

of

commingling

funds

and

helping

ensure

compliance

with

legal

accounting

rules.

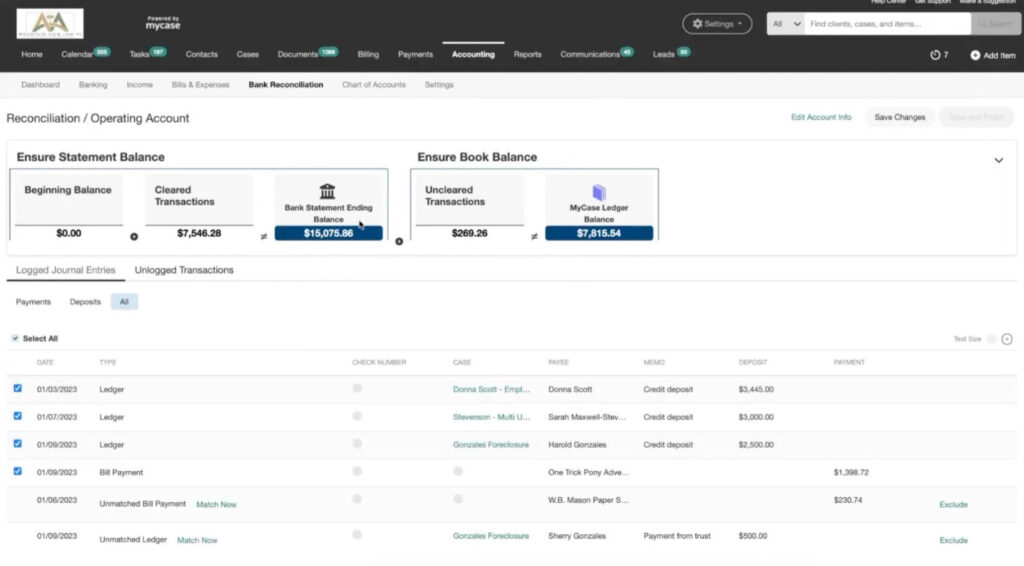

The

broader

reconciliation

process

is

similarly

automated.

Here,

a

sample

law

firm

operating

account

has

each

transaction

displayed

to

begin

a

reconciliation.

If

there

are

any

discrepancies

—

maybe

a

misplaced

check

that

never

has

made

it

into

the

bank

account

—

the

MyCase

Accounting

system

will

identify

that

and

allow

you

to

fix

it.

A

double-check

of

the

transactions,

a

click

of

“save

changes,”

and

your

account

has

been

reconciled.

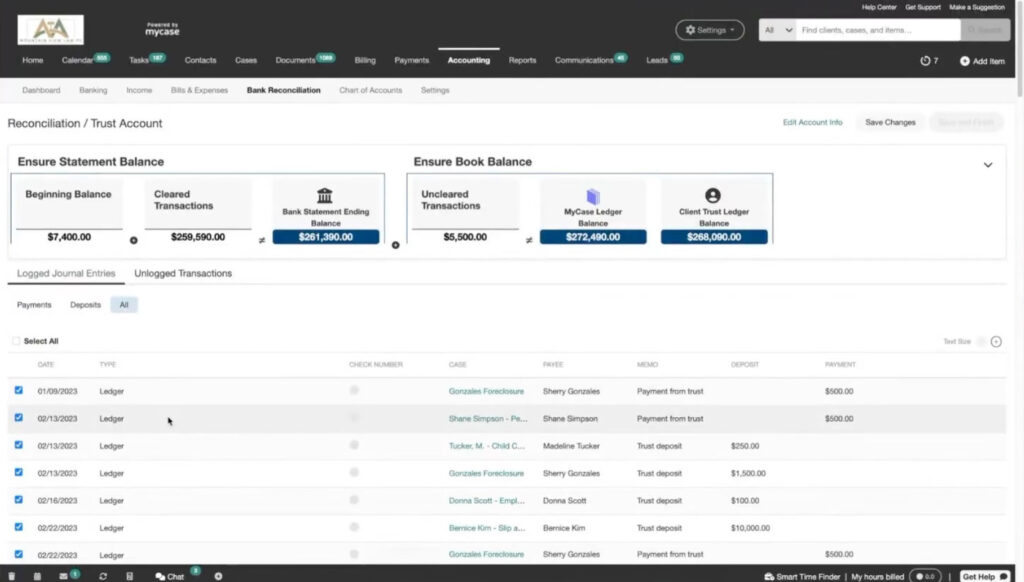

The

far

more

complicated

three-way

trust

reconciliation

process

is

similarly

boiled

down

in

MyCase

Accounting.

To

begin,

each

transaction

is

auto-linked

to

the

relevant

account

and

client

record.

Once

these

transactions

are

double-checked

—

and

matching

numbers

are

confirmed

—

one

click

will

auto-generate

your

reconciliation

report.

This

report

will

include

individual

client

trust

ledgers,

bank

transactions,

and

invoices,

automatically

drawn

from

the

full

MyCase

system.

All

of

the

records

can

be

filtered

by

month

or

date

in

the

event

of

a

bar

association

audit,

and

the

relevant

reports

can

be

generated

by

MyCase

Accounting

immediately.

A

Complete

System

MyCase

Accounting

demonstrates

the

advantages

of

having

one

unified

system

for

all

of

your

firm’s

business

needs.

It

is

constantly

working

in

the

background

to

ensure

everything

from

case

data,

to

client

accounting,

to

IOLTA

compliance

records,

to

business

intelligence

is

accurate

and

up

to

date.

It

will

ultimately

ease

your

bookkeeping

processes,

eliminate

waste,

and

become

a

key

component

of

your

firm’s

financial

success.

If

you’d

like

to

sign

up

for

a

free

trial

of

MyCase,

feel

free

to

do

so

here.