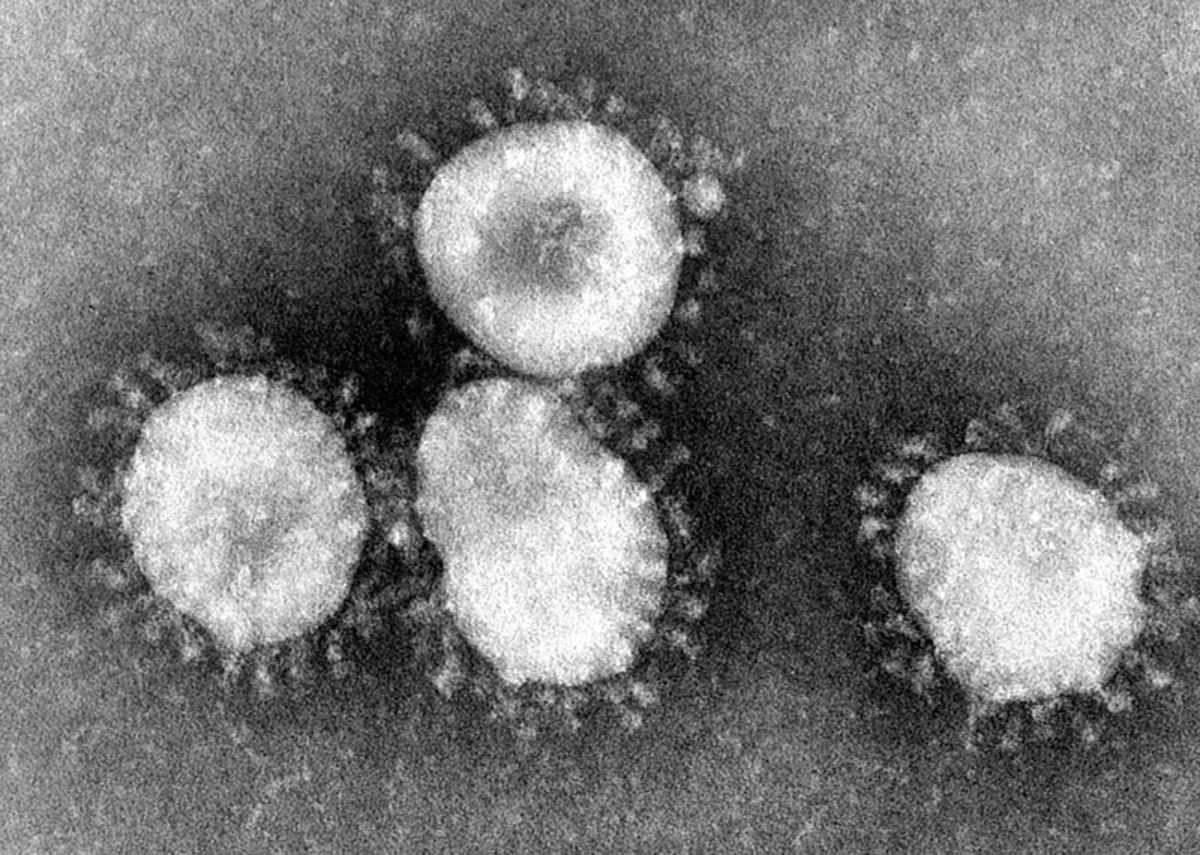

We’ve written a lot of hedge fund obituaries in our time, both for the industry (premature) and for individual funds (usually not). There are, of course, all sorts of ways for a hedge fund to die: quantitative easing, manager boredom, confused political and economic outlooks, low volatility, frustration, Brian Hunter. But now we have a novel cause of death, specifically the 2019 Novel Coronavirus, which has claimed more than 5,000 human lives and, now, one limited partnership.

Hedge-fund manager Solus Alternative Asset Management LP, known for its investment in retail chain Toys “R” Us, told investors this week that it is shutting its flagship fund and will restrict redemptions as it works to sell off holdings… The firm in the letter told investors it has received unexpected withdrawal requests this year and that the turbulence caused by the coronavirus has made it difficult to raise cash as it normally would to fulfill those requests by selling holdings.

Solus’ flagship may be the first official casualty in the hedgefundiverse, but others are getting sick. For it seems that, like the current wave of highly restrictive restrictions put in place by authorities around the world, Ray Dalio’s efforts at containment were too little, too late.

Bridgewater’s flagship hedge fund, Pure Alpha II, declined 2.4% over the first six days of March, leaving it down 10.6% for the year, the investor said. Major Markets, another large fund, was also down about 12% for 2020 through March 6, the person said.

As Pure Alpha II and Major Markets begin their self-quarantine periods, someone else is doing the same. JPMorgan Chase CEO Jamie Dimon, who does not—as far as we know—have COVID-19, but who may have had a coronavirus panic-induced heart attack, is also safely ensconced in his own bed, where hopefully people and tennis balls are keeping their distance.

“We are delighted to share with you the good news that Jamie left the hospital today and is back at home,” the bank’s co-presidents, Gordon Smith and Daniel Pinto, said Thursday in a staff memo. “While we do not plan to provide regular updates about this, we want you to know that his doctors said he is doing very well in all aspects of his recovery. He is in good spirits and looking forward to reengaging with our team soon.”

Hedge Fund Solus Shutting Flagship Fund, Citing Coronavirus Turmoil [WSJ]

Ray Dalio’s Bridgewater hedge funds post mixed results amid market turmoil [CNBC]

Jamie Dimon discharged from hospital and ‘doing very well,’ JPMorgan tells staff [CNBC]

Global coronavirus death toll tops 5,000 [N.Y. Post]