Last

March,

I

wrote

here

about

SingleFile,

a

company

whose

mission

is

to

help

businesses

navigate

complex

regulatory

environments

effortlessly

by

automating

outdated

filing

processes

and

leveraging

AI

technology

in

a

unified

cloud

platform.

Today,

it

took

a

major

step

in

driving

that

mission

forward

with

news

that

it

has

raised

$9

million

in

Series

A

funding,

bringing

its

total

funding

to

$24

million

since

its

founding

in

2019,

including

$15

million

raised

in

the

past

12

months.

The

round

was

led

by

VC

firm Foundry

Group,

which

participation

from

existing

investors

including

Pioneer

Square

Labs

and The

LegalTech

Fund,

as

well

as

law

firms

Wilson

Sonsini,

Cooley,

DLA

Piper, Fenwick

&

West, Perkins

Coie,

and

individual

lawyers

from

the

firm K&L

Gates.

“This

new

round

of

funding

marks

a

significant

milestone

for

SingleFile

as

we

continue

to

revolutionize

the

way

businesses

and

their

trusted

advisers

handle

ever-increasing

and

repetitive

compliance

burdens,”

said

Aaron

Finn,

SingleFile’s

CEO.

The

Seattle-based

company

company

will

use

the

funding

primarily

to

expand

its

technology

platform

and

scale

operations,

with

a

particular

focus

on

research

and

development

to

bring

additional

compliance

capabilities

to

its

platform,

Finn

said.

The

company

has

also

expanded

its

executive

team,

adding

Mindy

Lauck

as

chief

product

officer

and

Teresa

Kotwis

as

chief

financial

officer.

Lauck

has

been

a

CEO

and

product

leader

at

multiple

companies,

while

Kotwis

likewise

has

been

CFO

at

a

number

of

startups

and

established

companies.

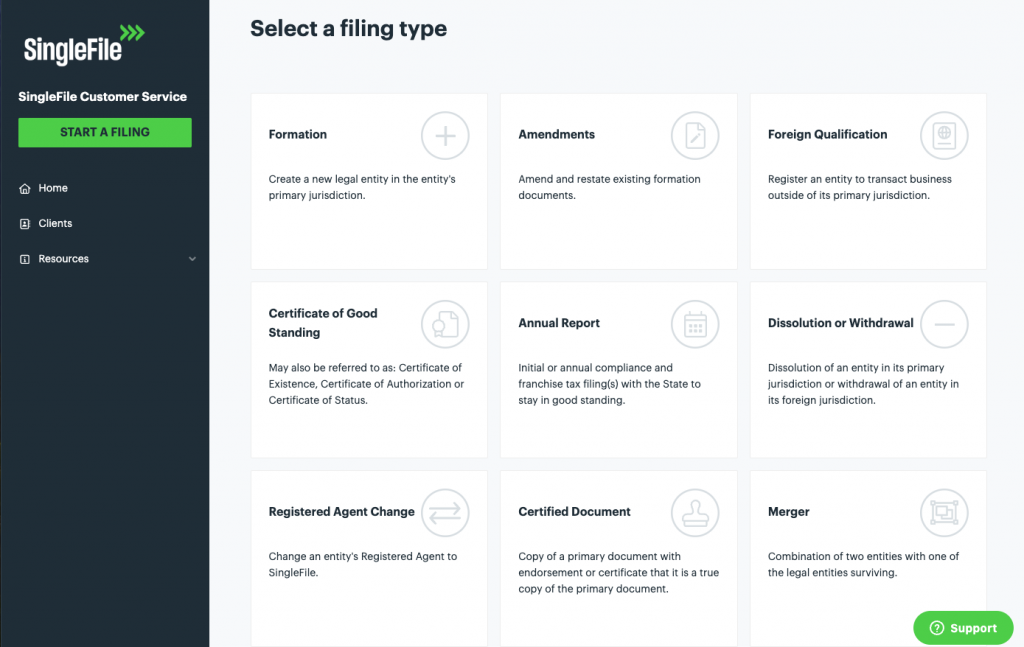

Digital

Compliance

Platform

The

company,

which

spun

out

of

Pioneer

Square

Labs’

Seattle

incubator

in

2019,

serves

law

firms,

corporations

and

investor

firms

with

a

digital

platform

for

filing

and

tracking

annual

reports

and

other

state-required

filings.

It

also

offers

entity

management

and

resident

agent

services.

Last

year,

in

anticipation

of

the

beneficial

ownership

filing

requirements

under

the

Corporate

Transparency

Act

taking

effect,

the

company

launched

a

module

specifically

for

CTA

reporting.

The

CTA

requirement

helped

the

company’s

business

pipeline

“blow

up,”

Finn

told

me

last

March.

Despite

current

uncertainty

around

CTA

implementation

due

to

various

legal

challenges,

Finn

said

the

company

continues

to

see

substantial

growth,

particularly

in

relation

to

CTA

compliance.

In

fact,

it

experienced

its

most

significant

growth

since

inception

during

November

and

December,

with

usage

by

law

firms

increasing

more

than

threefold

compared

to

the

previous

year.

“Even

with

the

CTA

uncertainty

that

happened

during

that

time,

it

was

still

quite

a

lot

of

growth

for

us

and

quite

a

lot

of

customers

wanting

to

get

filed

before

that

original

deadline

and

some

just

wanting

to

get

ready

to

file,”

Finn

said

in

an

interview.

He

said

the

company

continues

to

gain

significant

traction

in

the

legal

market,

and

now

serves

more

than

60

law

firms,

including

33

Am

Law

200

firms,

and

more

than

4,000

customers

overall.

One

System

of

Record

But

as

much

as

the

CTA

has

been

a

boon

to

SingleFile’s

business,

Finn

emphasizes

that

it

is

not

its

only

business

or

even

the

majority

of

its

business.

“We

believe

that

all

of

your

information,

all

of

your

legal

entity

information,

needs

to

be

maintained

in

one

system

of

record

so

that

when

information

changes,

it

can

update

any

compliance

filings

that

are

required,”

he

said.

The

company

positions

itself

as

bringing

modern

technology

to

what

has

traditionally

been

a

manual,

paper-intensive

industry.

“The

whole

thesis

of

our

company

is

that

modern

technology

can

help

take

the

manual

paperwork

burden

out

of

this

industry,”

Finn

said.

“We’re

seeing

it

really

blossom

with

CTA,

combined

with

filing

and

registered

agent

services.”

Customers

particularly

benefit

from

the

SingleFile’s

cloud-native

platform,

Finn

believes.

“Because

we’re

using

cloud-based

technology,

it

allows

any

of

the

constituents

that

are

involved

in

these

compliance

filings

to

be

able

to

participate,

while

the

company

maintains

the

data

in

one

place

and

has

that

system

of

record.”

‘A

Generational

Business’

Jaclyn

Freeman

Hester,

partner

at

Foundry

Group,

cited

the

company’s

“sticky

product”

and

strategic

distribution

model

as

factors

in

the

decision

to

lead

the

round.

“SingleFile

has

the

makings

of

a

generational

business

—

a

sticky

product

that’s

delivering

exceptional

value

to

customers,

a

strategic

distribution

model,

and

best-in-class

SaaS

metrics,”

she

said.

The

company

plans

to

use

the

new

funding

to

expand

beyond

its

current

offerings

into

additional

compliance

areas.

Finn

indicated

that

customers

have

requested

capabilities

for

blue

sky

filings,

SEC

filings,

and

business

licensing,

among

other

compliance

requirements

that

are

typically

handled

manually

or

through

consultants.

“We

just

want

to

keep

bringing

more

and

more

of

this

compliance

work

into

our

automation

and

into

our

intelligent

network.”

While

law

firms

are

a

primary

channel

for

SingleFile’s

services,

the

company’s

business

model

typically

involves

building

direct

relationships

with

the

law

firms’

clients.

The

exception

is

in

private

wealth

or

private

client

groups

at

law

firms,

where

the

firms

themselves

become

the

direct

clients.

‘Jurisdictional

Intelligence’

SingleFile

competes

with

traditional

players

in

the

registered

agent

and

legal

filing

industry

such

as

CT

Corporation,

owned

by

Wolters

Kluwer,

and

CSC

Global.

The

company

differentiates

itself

through

what

Finn

describes

as

its

“jurisdictional

intelligence”

—

a

cloud-native

infrastructure

that

helps

legal

entities

registered

across

multiple

jurisdictions

understand

and

maintain

their

compliance

requirements.

“Think

about

all

the

government

agencies

that

have

all

these

requirements

that

businesses

need

to

follow,”

Finn

said.

“…

How

do

we

go

and

take

all

this

jurisdictional

intelligence

and

bring

it

into

one

system

that’s

smart

enough

to

understand

and

compare

and

make

sure

that

any

legal

entity

that

might

be

registered

in

multiple

jurisdictions

across

the

globe

knows

what

compliance

requirements

they

have

to

follow

to

maintain

good

standing.”

Looking

ahead,

Finn

sees

opportunities

to

expand

the

platform’s

capabilities

to

address

the

broader

landscape

of

corporate

compliance

requirements.

He

said

the

federal

Office

of

Management

and

Budget

has

estimated

that

compliance

with

federal

code

paperwork

requirements

alone

creates

over

10

billion

hours

of

burden

annually

on

the

U.S.

economy,

with

a

significant

portion

falling

on

businesses — and

that

figure

does

not

include

all

the

state

codes

a

business

has

to

follow.

“You’re

talking

tens

of

billions

of

hours

of

non-tax

compliance

work

that

has

to

be

done

just

in

the

U.S.

alone

for

hundreds

of

millions

— 40

million

to

100

million

—

legal

entities,”

Finn

said.

“You’re

talking

about

a

lot

of

paperwork

burden

for

a

lot

of

people.”