Corporate

law

departments

have

elevated

the

legal

operations

profession

in

recent

years,

making

these

roles

central

to

their

ongoing

quest

for

ever-more

efficiency.

With

its

recent

launch

of

CounselLink+™,

LexisNexis

has

provided

a

new

tool

to

help

in-house

lawyers

and

legal

operations

professionals

meet

these

demands.

The

“+”

in

“CounselLink+”

refers

to

integration

—

users

of

the

system

now

have

access

to

all

of

their

organization’s

customizable

tech

stack,

as

well

as

all

of

the

additional

Lexis

products

they

subscribe

to,

with

one

password.

The

result

is

a

comprehensive

system

with

the

capability

to

organize

and

streamline

all

aspects

of

a

corporate

law

department’s

work.

Lexis

products

are

embedded

throughout

CounselLink+

—

its

Practical

Guidance

tool

is

integrated

into

the

contract

management

system

to

assist

with

templates

and

drafting,

for

one

example.

A

streamlined

work

intake

feature

also

allows

the

law

department

to

seamlessly

field

and

respond

to

requests

and

questions

from

the

full

business.

And

Lexis’

proprietary,

market-leading

AI

applications

are

thoughtfully

embedded

throughout

the

system

to

further

boost

efficiency.

These

integrations

enable

users

to

share

data

across

systems

far

more

easily

than

they

could

with

a

patchwork

of

tech

solutions

in

place.

This

in

turn

helps

them

find

new

efficiencies

in

creating

and

managing

contracts,

or

evaluating

legal

risks,

or

managing

matters

and

spending,

or

fielding

and

responding

to

enterprisewide

questions,

among

other

tasks.

The

unified

system

also

eases

the

process

of

tracking

all

of

the

law

department’s

contributions

—

and

presenting

this

data

to

showcase

its

value

to

the

organization

and

refine

its

operations.

It’s

a

system

that

will

add

conveniences,

ease

user

adoption,

and

bolster

tech-focused

legal

operations

professionals

and

end-user

lawyers

alike.

If

you’re

curious

about

this

product

and

would

like

to

book

a

demo,

you

can

do

so

here.

Or,

first,

you

can

read

on

for

a

tour

of

select

features

of

CounselLink+.

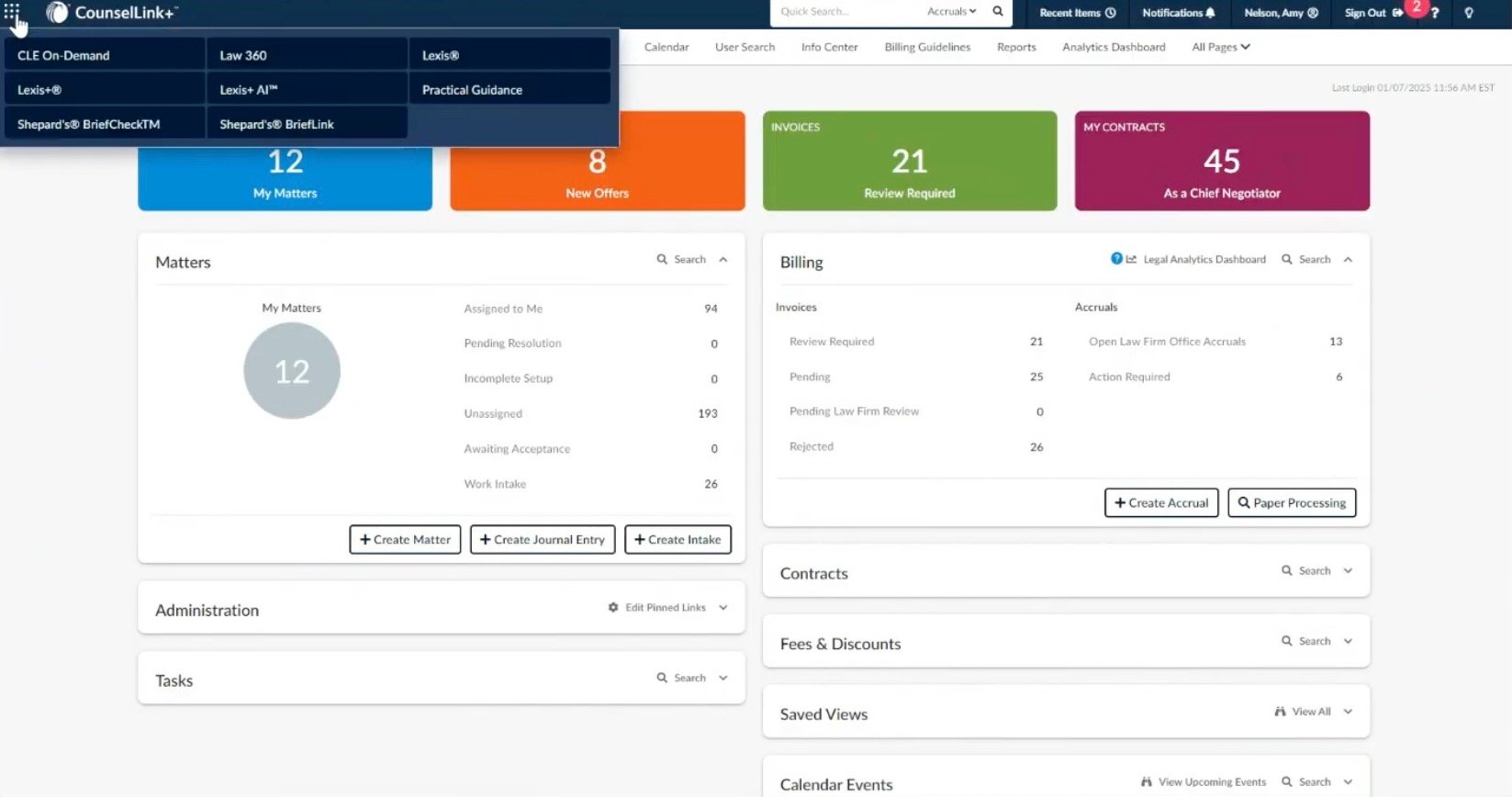

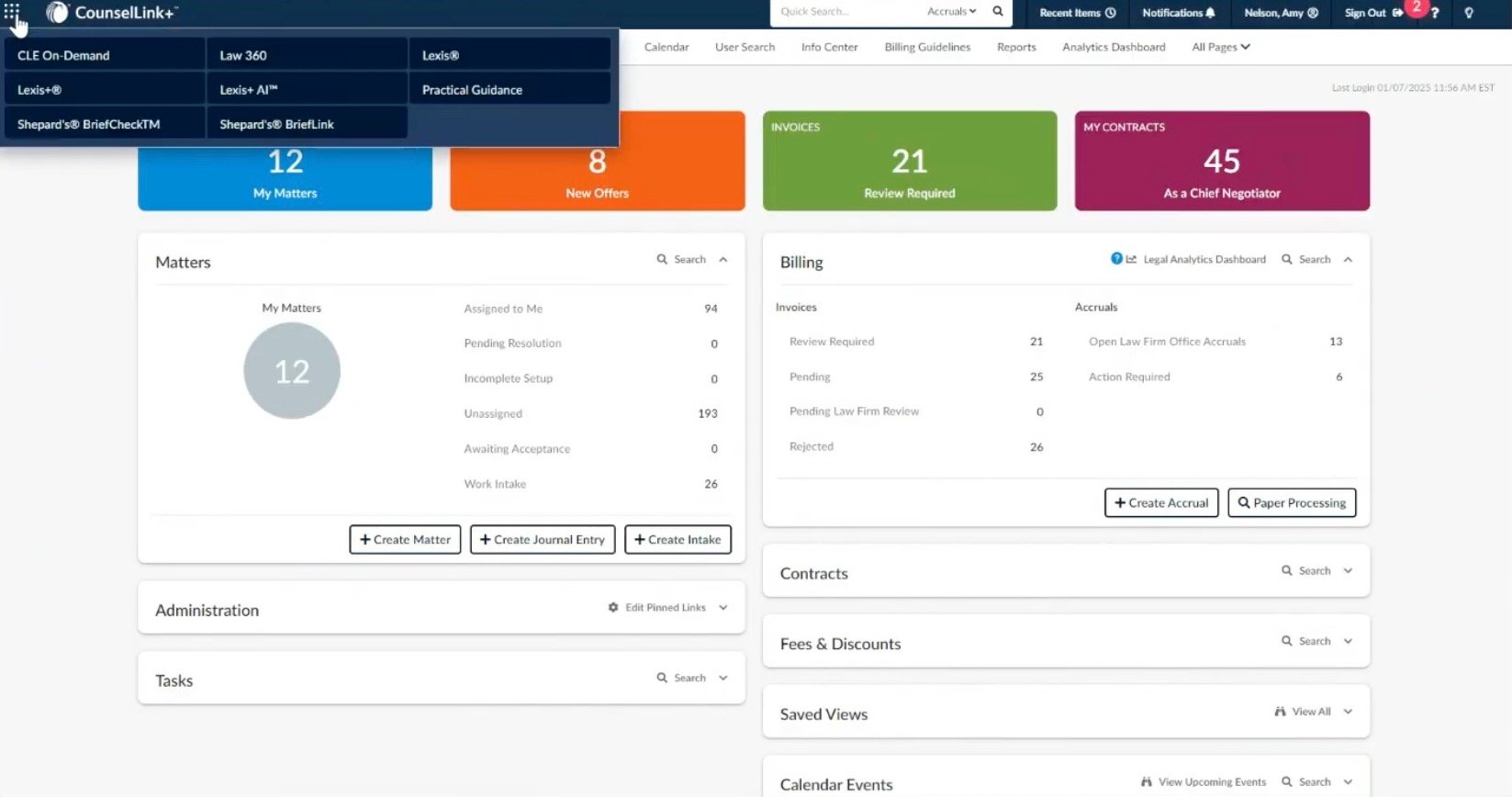

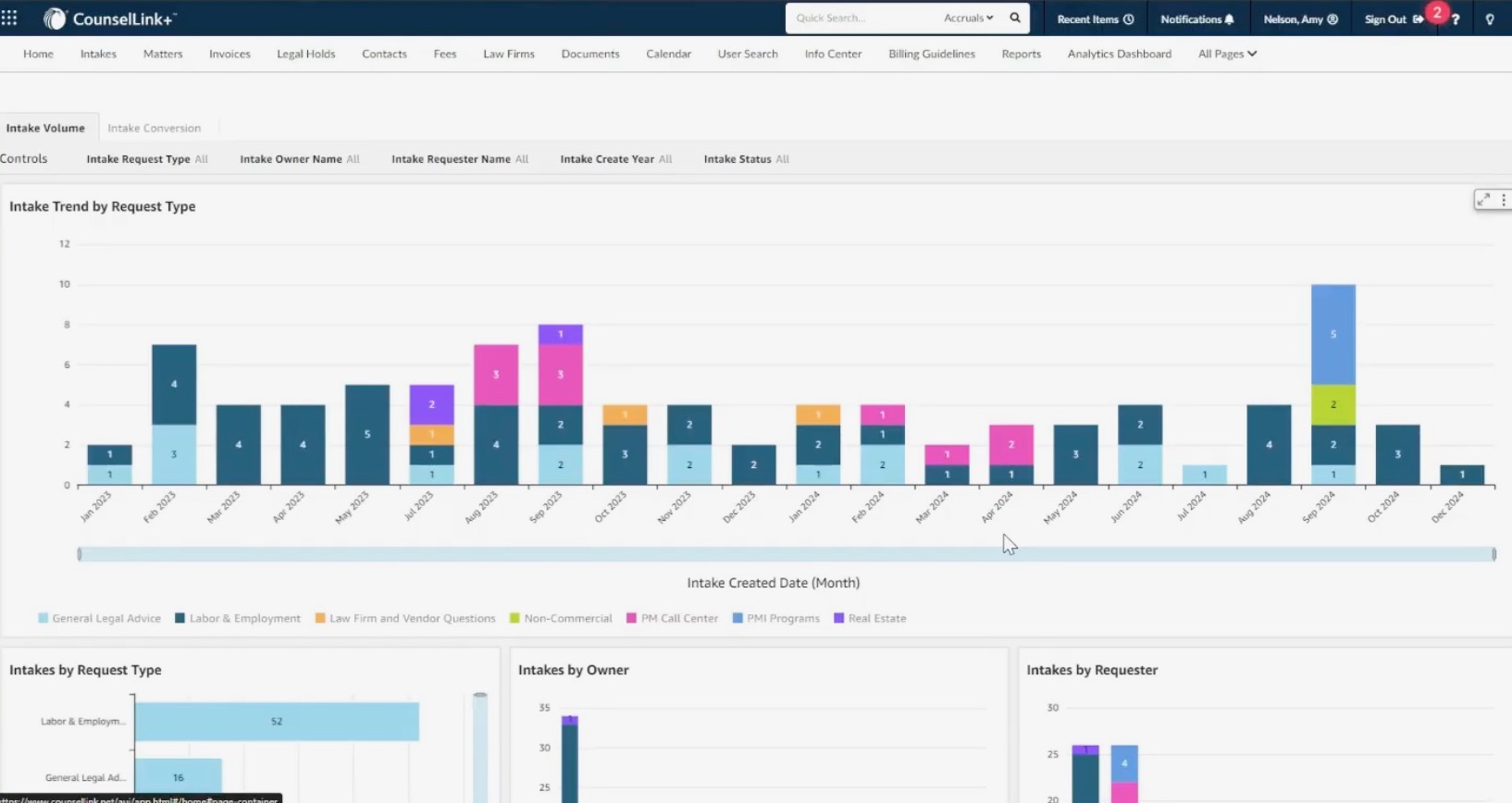

Getting

Started

The

CounselLink+

system’s

homescreen

provides

immediate

access

to

numerous

systems

and

products.

Internally,

one

click

will

take

you

to

all

of

your

systems

—

matter

or

work

management,

financial

management

including

eBilling,

vendor

management,

contract

lifecycle

management,

organizationwide

requests,

and

data

analytics.

CounselLink+

also

includes

one

click

access

to

any

other

Lexis

products

your

organization

subscribes

to,

including

Lexis+

AI,

Law360,

Practical

Guidance,

and

more.

This

means

that

your

research

system

is

incorporated

with

all

of

your

other

workflow

products,

removing

the

need

to

toggle

between

disparate

systems.

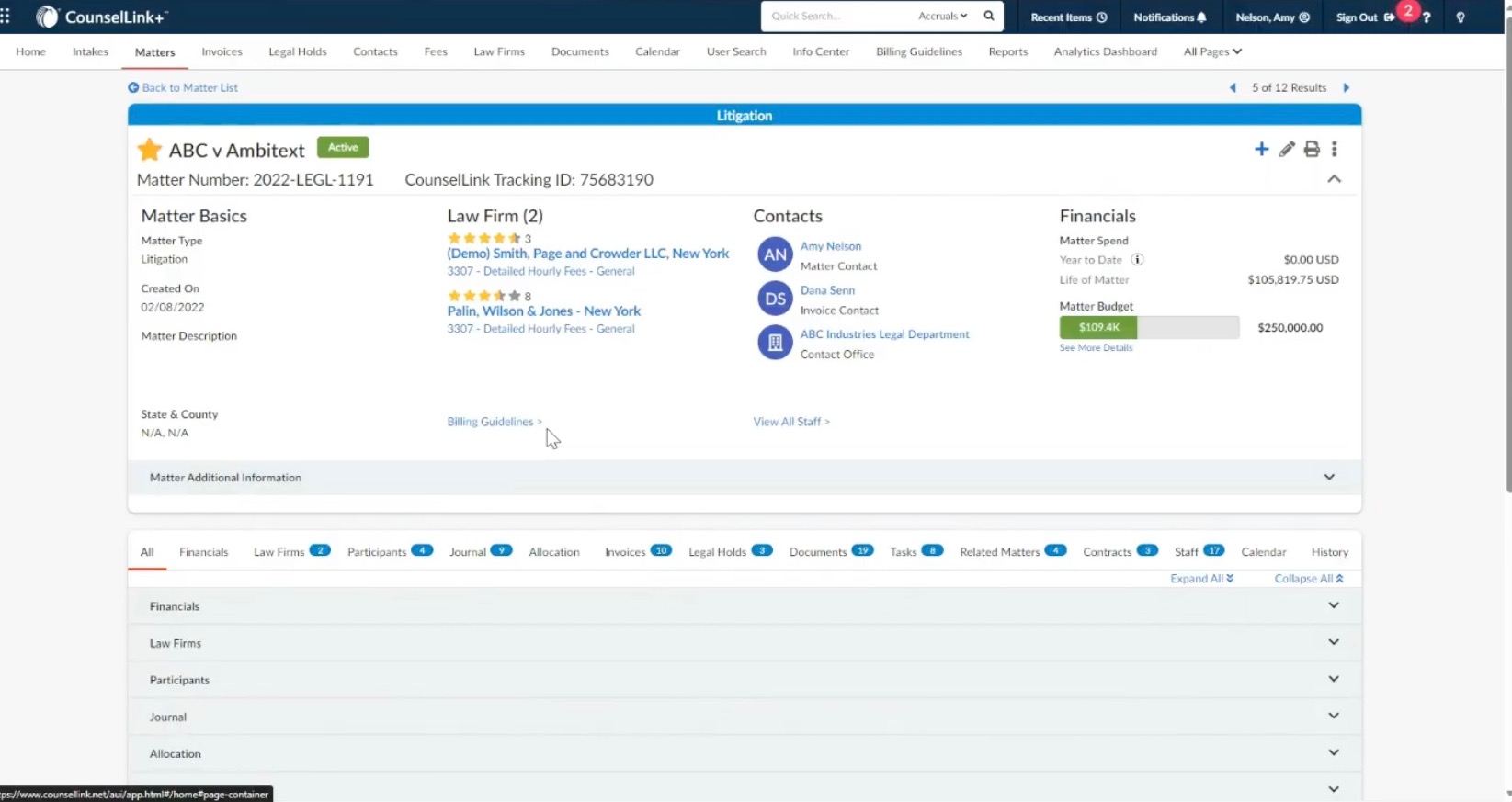

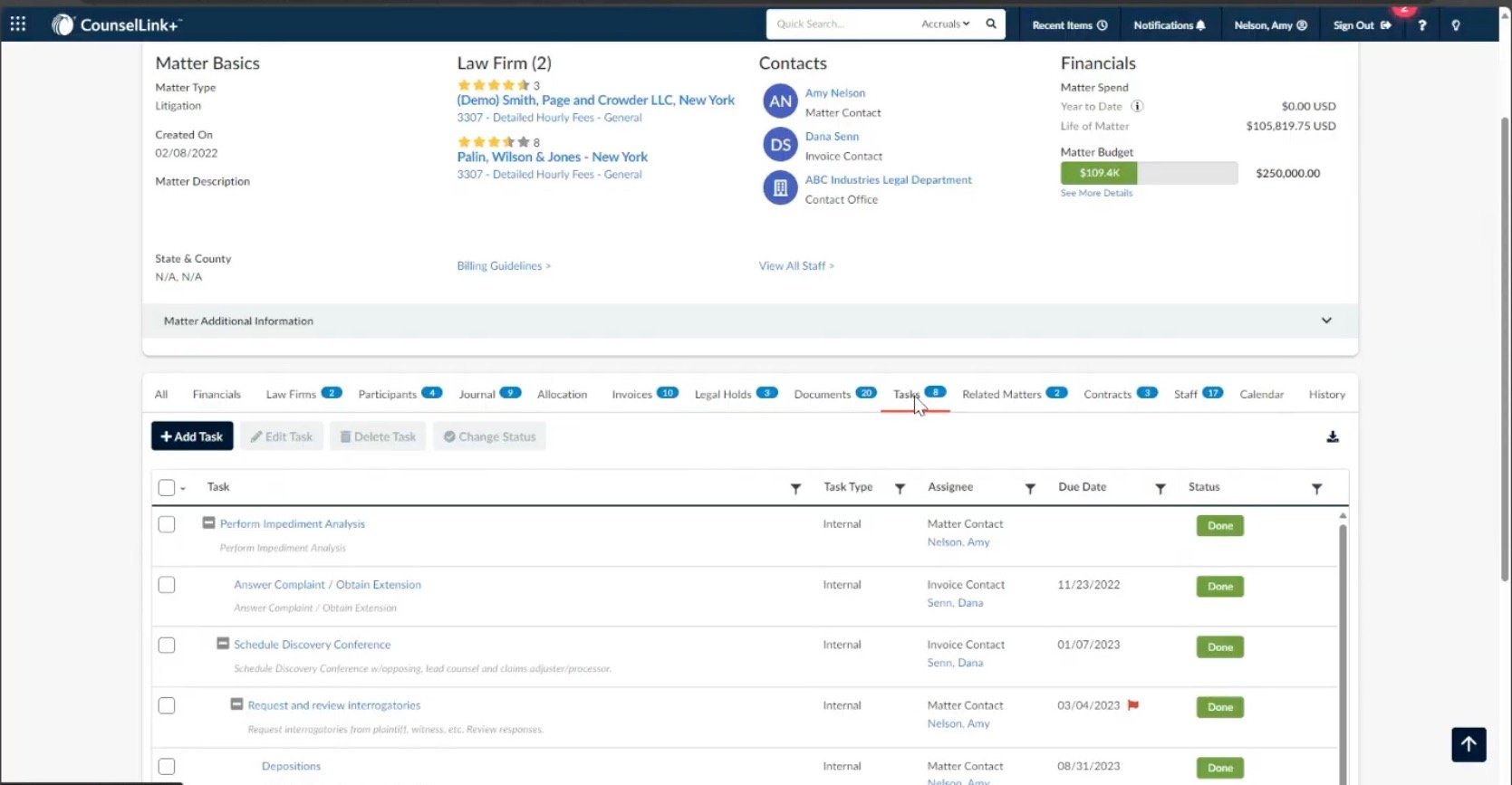

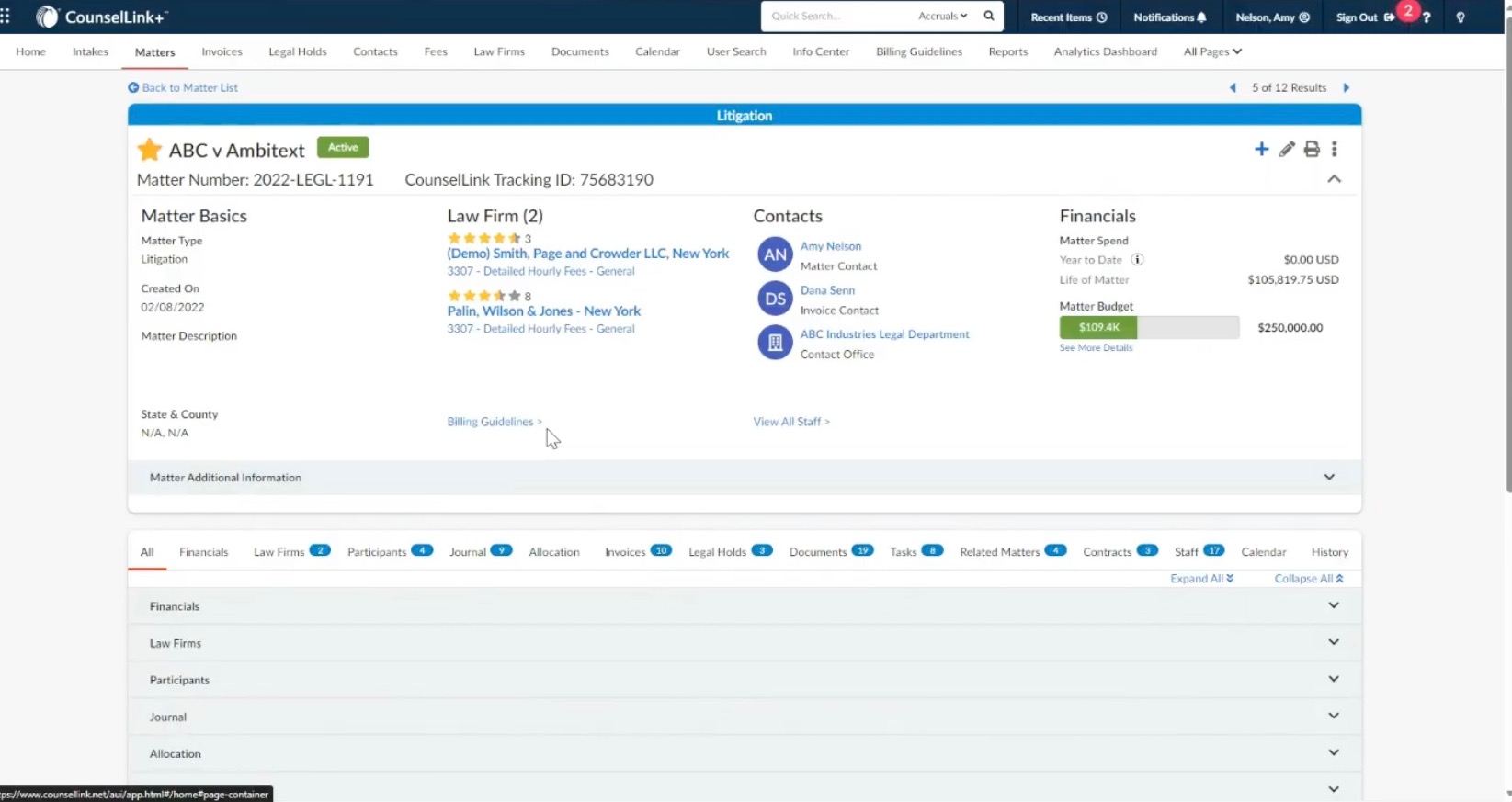

The

Work

Intake

System

CounselLink+

is

organized

into

matters,

and

each

matter

provides

a

comprehensive

overview

of

every

item

to

track

—

these

include

law

firm

relationships,

eBilling,

documents,

and

contracts.

Matters

can

be

generated

manually

or

imported

from

other

systems,

and

they

can

automatically

include

data

and

documents

through

API

functionality.

The

system

is

also

highly

configurable,

allowing

each

enterprise

to

customize

the

KPIs

it’s

following.

Once

a

matter

is

created,

it

takes

you

to

a

matter

portal

that

allows

you

to

view

all

of

its

related

documents

and

metrics.

Tabs

contain

exhaustive

detail

on

everything

from

budget

in

reserve

to

internal

stakeholders.

Matters

can

also

be

created

with

the

CounselLink+

feature

called

“Work

Intake.”

The

Work

Intake

system

allows

the

legal

department

to

share

a

customizable

form,

most

likely

on

the

company’s

intranet,

that

will

allow

anyone

in

the

organization

to

ask

a

question

or

make

a

request.

It’s

a

process

that

eliminates

the

need

to

chase

down

requests

in

the

form

of

voicemails,

emails,

and

other

contacts,

instead

bringing

them

all

into

one

standardized

system.

The

routing

of

the

form

is

also

customizable

—

employment-related

requests

can

go

to

an

employment

lawyer,

while

questions

about

a

vendor

can

go

to

the

legal

operations

team,

for

example.

Requests

may

simply

be

questions

that

are

asked

and

answered,

or

they

may

be

promoted

to

matters.

But

whatever

the

outcome,

the

CounselLink

system

will

track

all

of

the

work

the

legal

department

is

performing.

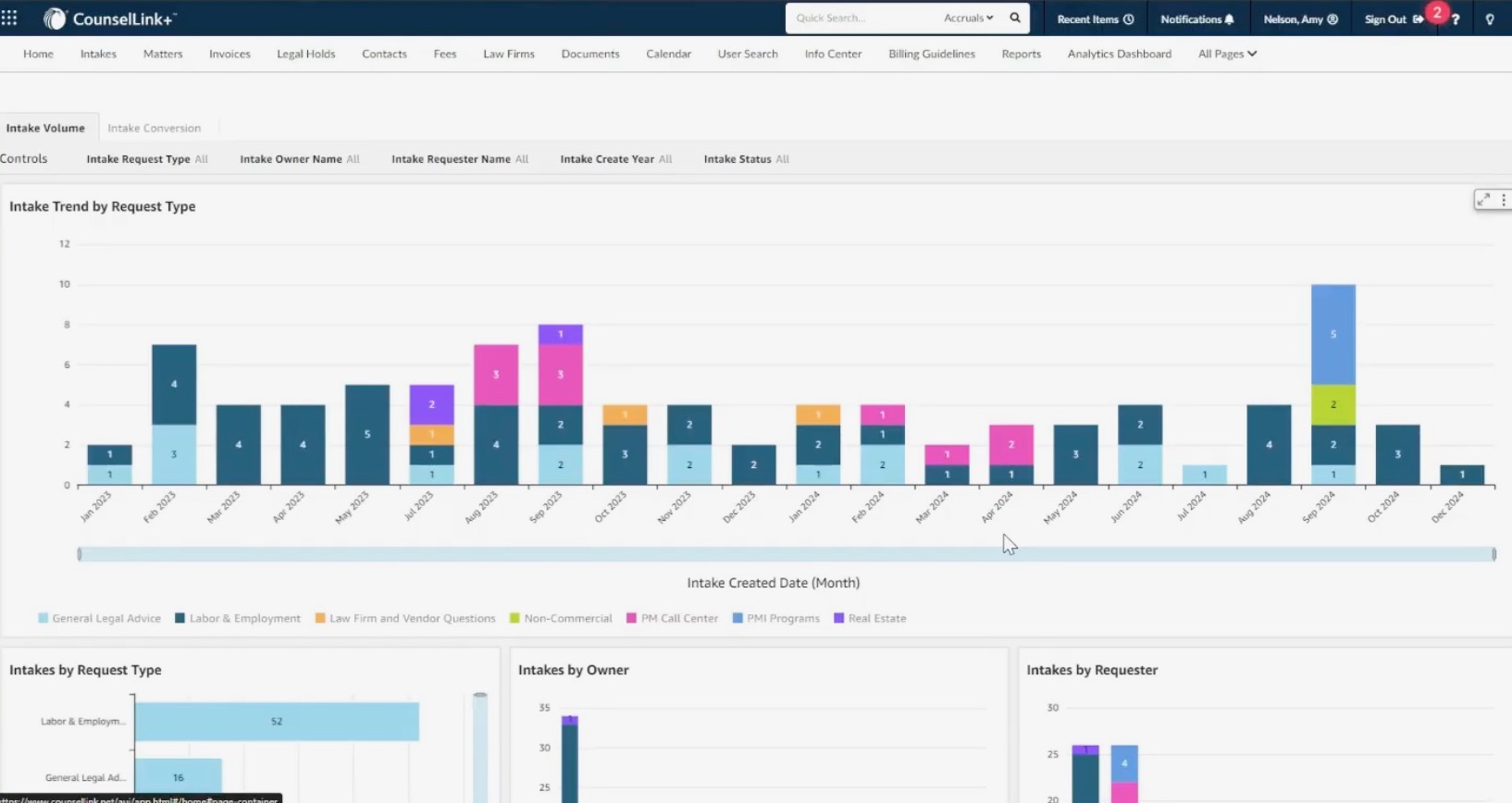

While

just

about

any

system

will

tell

you

high-level

metrics

like

number

of

cases

handled,

this

system

excels

in

tracking

all

of

the

work

a

legal

team

is

performing.

CounselLink+

will

track

all

of

the

questions

that

come

into

a

law

department

—

the

volume,

the

number

of

questions

that

are

converted

into

matters,

the

practice

area

of

each

inquiry,

and

more.

In

addition

to

demonstrating

value,

this

data

also

gives

the

law

department

the

opportunity

to

refine

its

processes

and

maximize

efficiency.

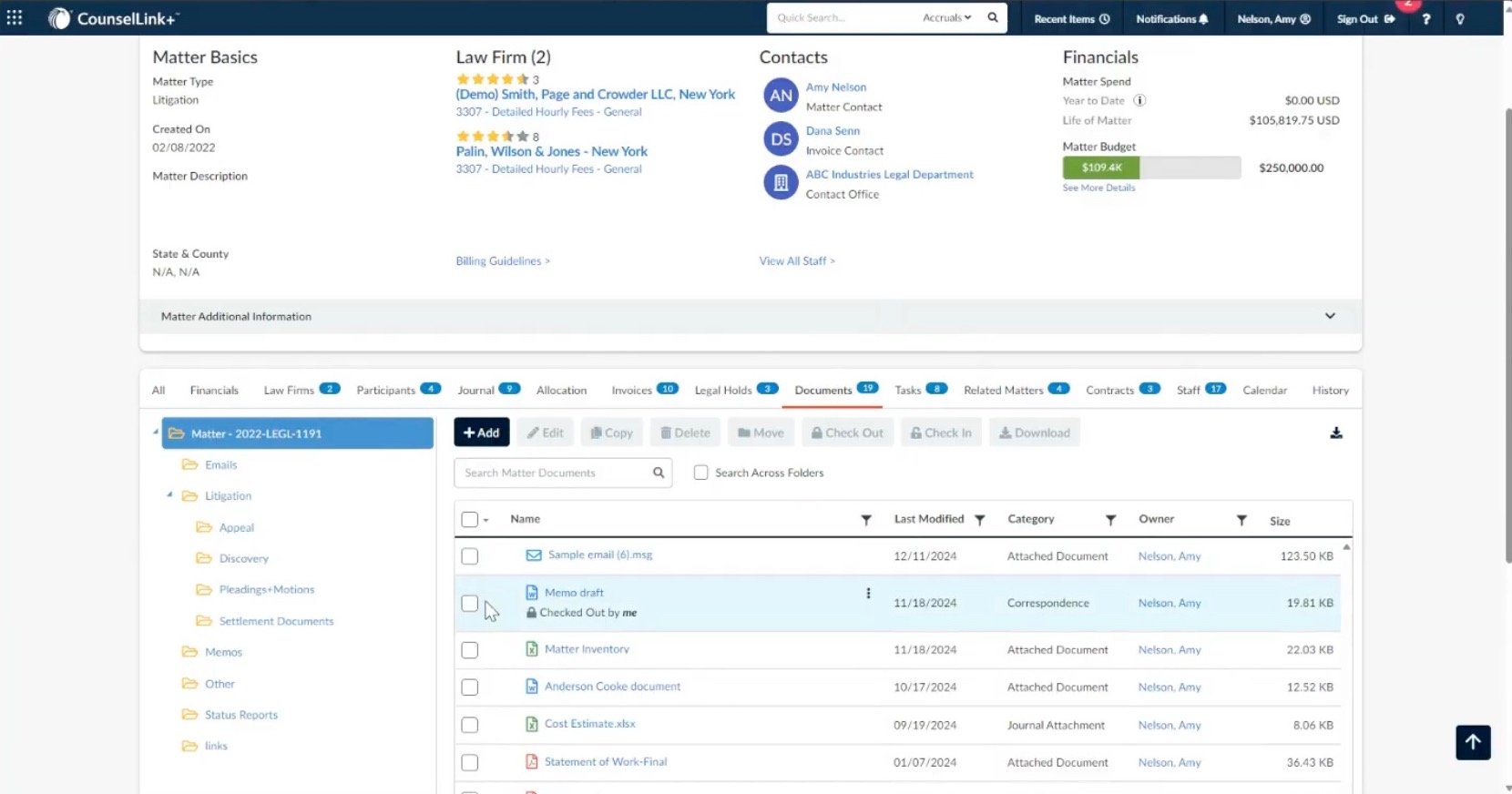

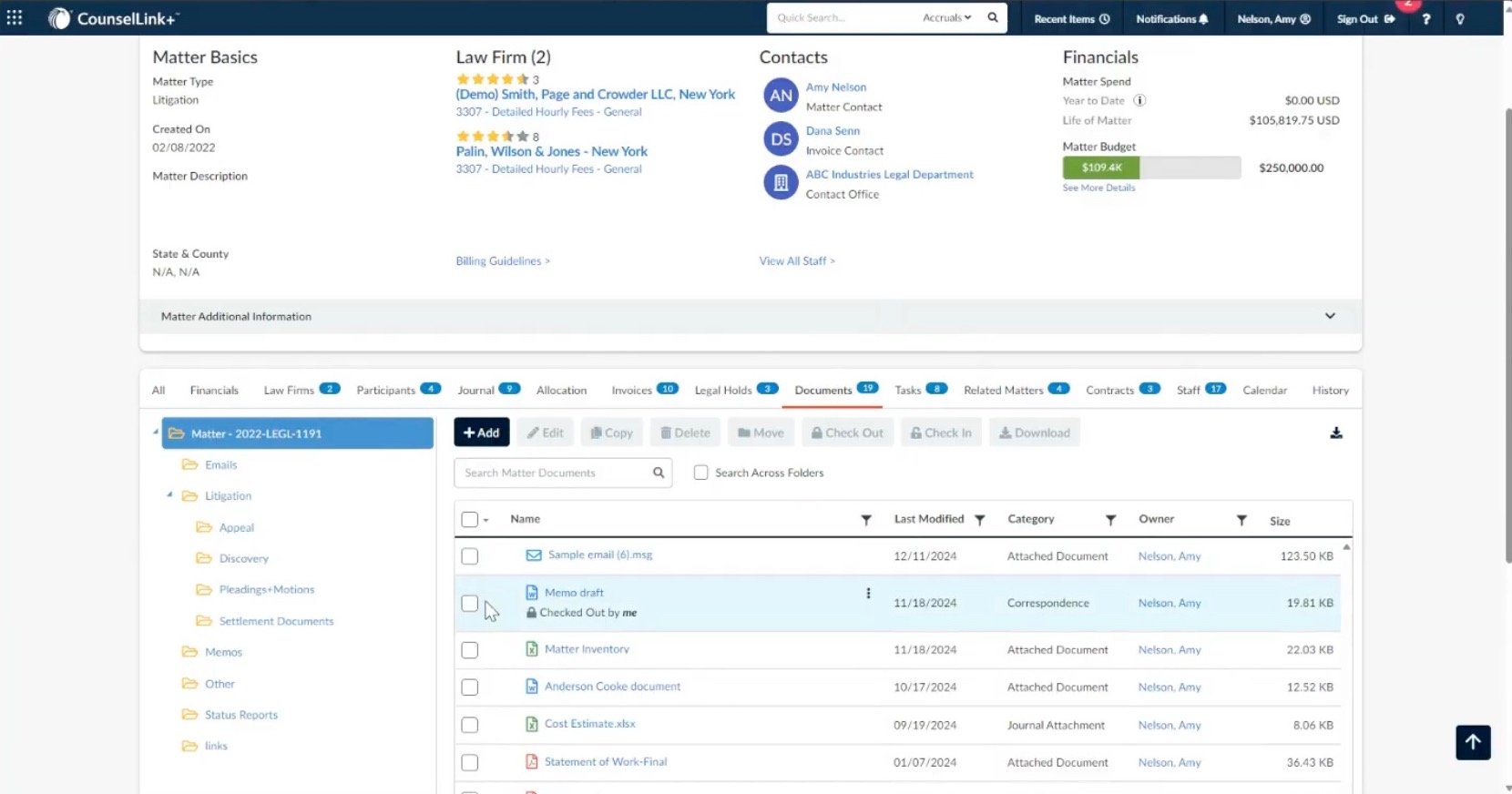

Work

Management

Once

the

work

intake

is

completed

and

a

matter

is

created,

CounselLink+

will

integrate

its

varied

aspects

into

one

easy

to

use

workspace.

One

work

management

section

allows

you

to

store

documents

and

contracts

in

one

location.

They

can

be

imported

directly

from

email,

or

added

through

an

upload

form.

The

system

also

integrates

with

document

management

software

like

iManage,

and

has

check-in/check-out

and

version

tracker

capabilities.

CounselLink+

users

can

control

access

to

each

document,

sharing

only

certain

ones

with

an

outside

law

firm,

for

example.

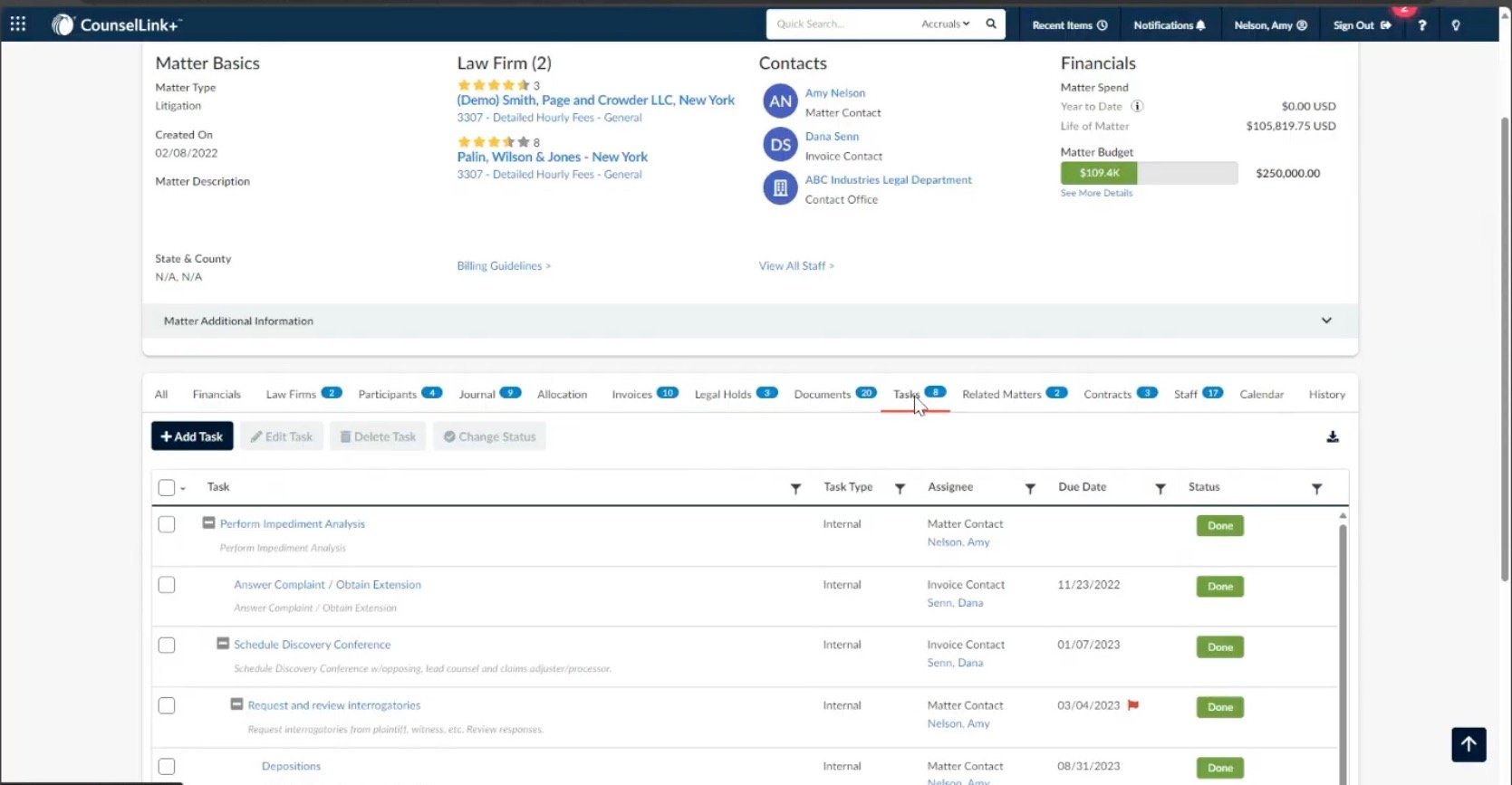

The

matter

file

also

tracks

workflow

with

an

intuitive

calendaring

and

task-management

system.

This

allows

seamless

collaboration

with

other

internal

users

and

external

users.

It

particularly

allows

law

departments

to

collaborate

with

outside

counsel

within

the

same

portal.

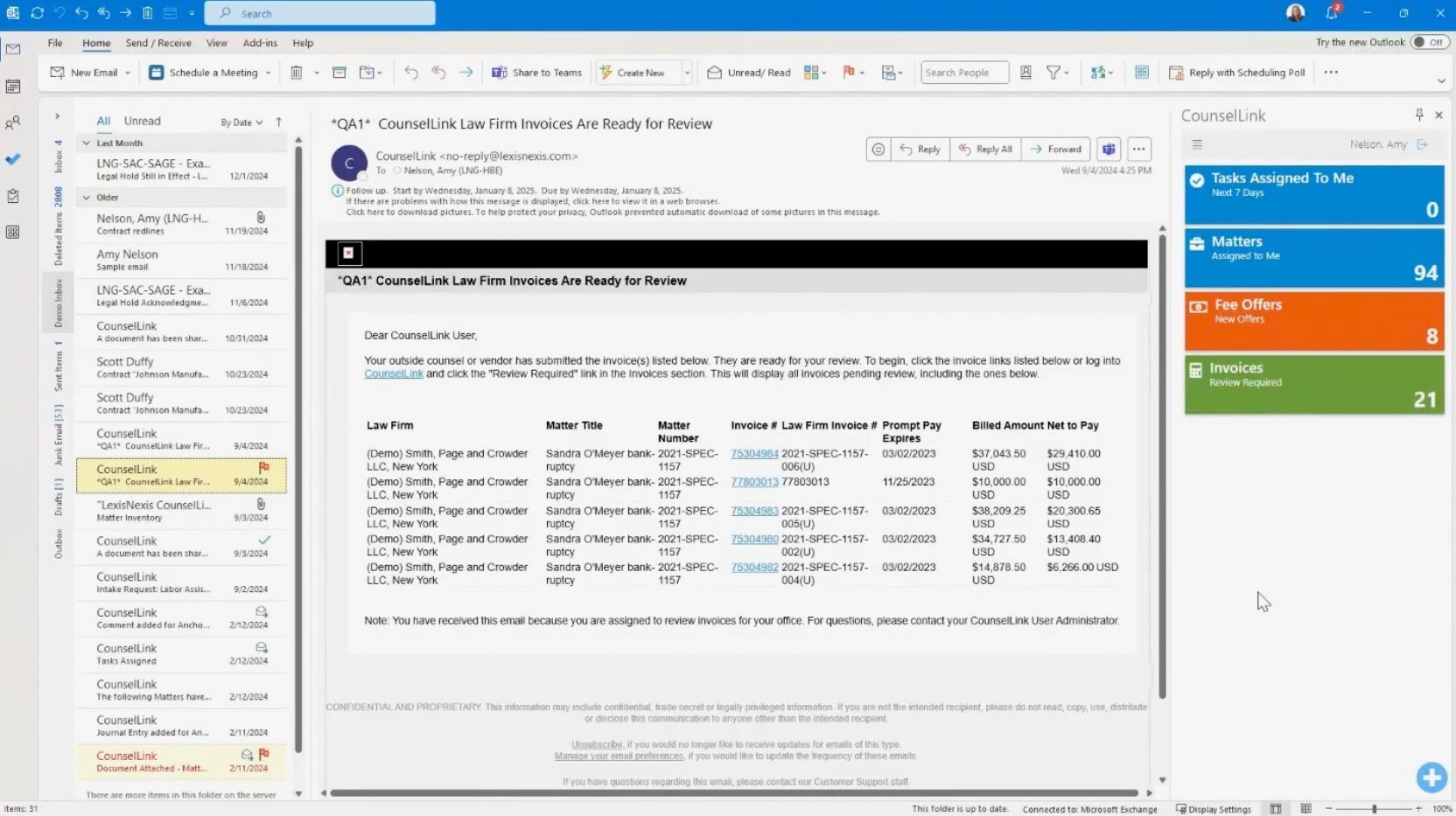

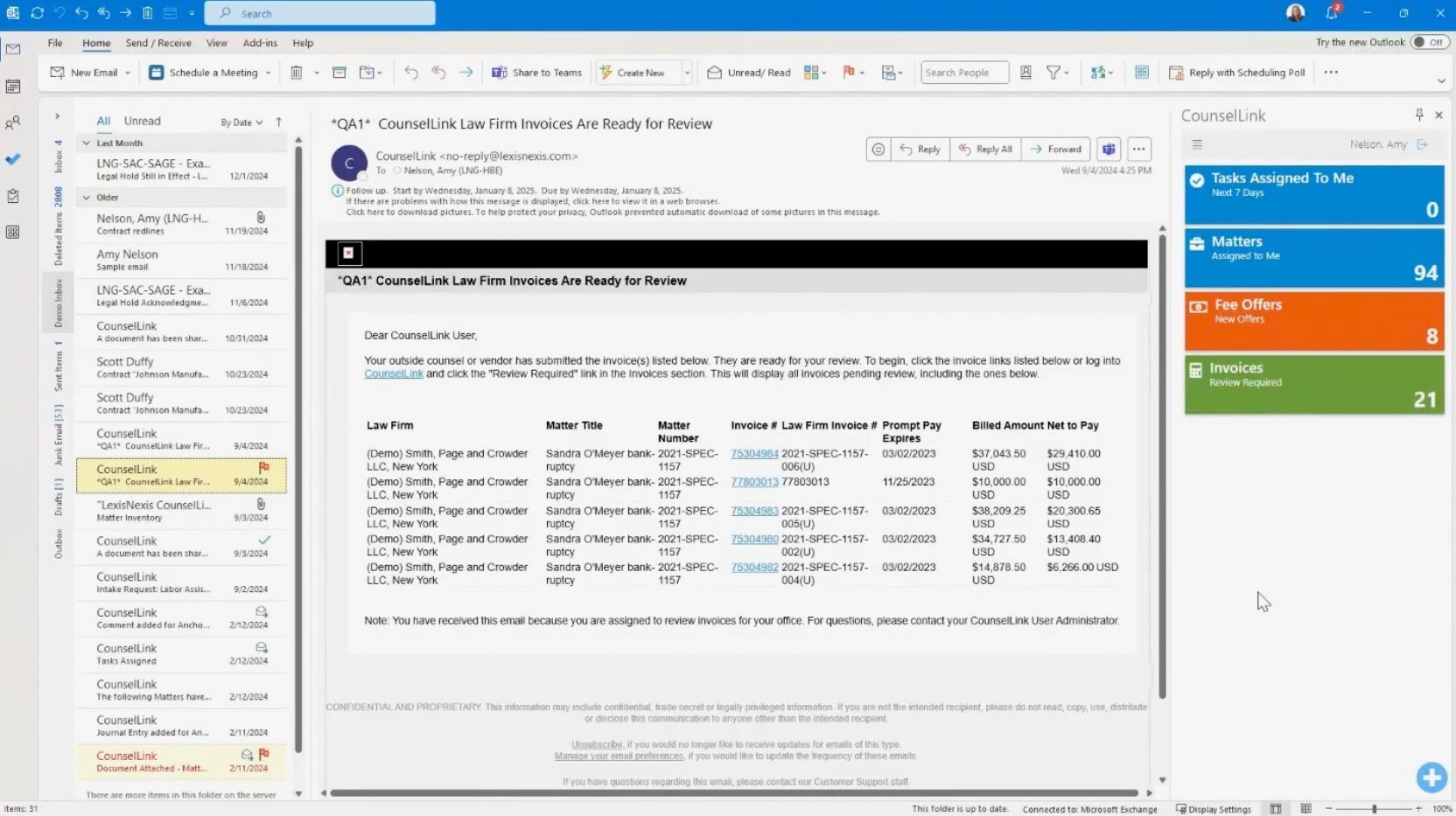

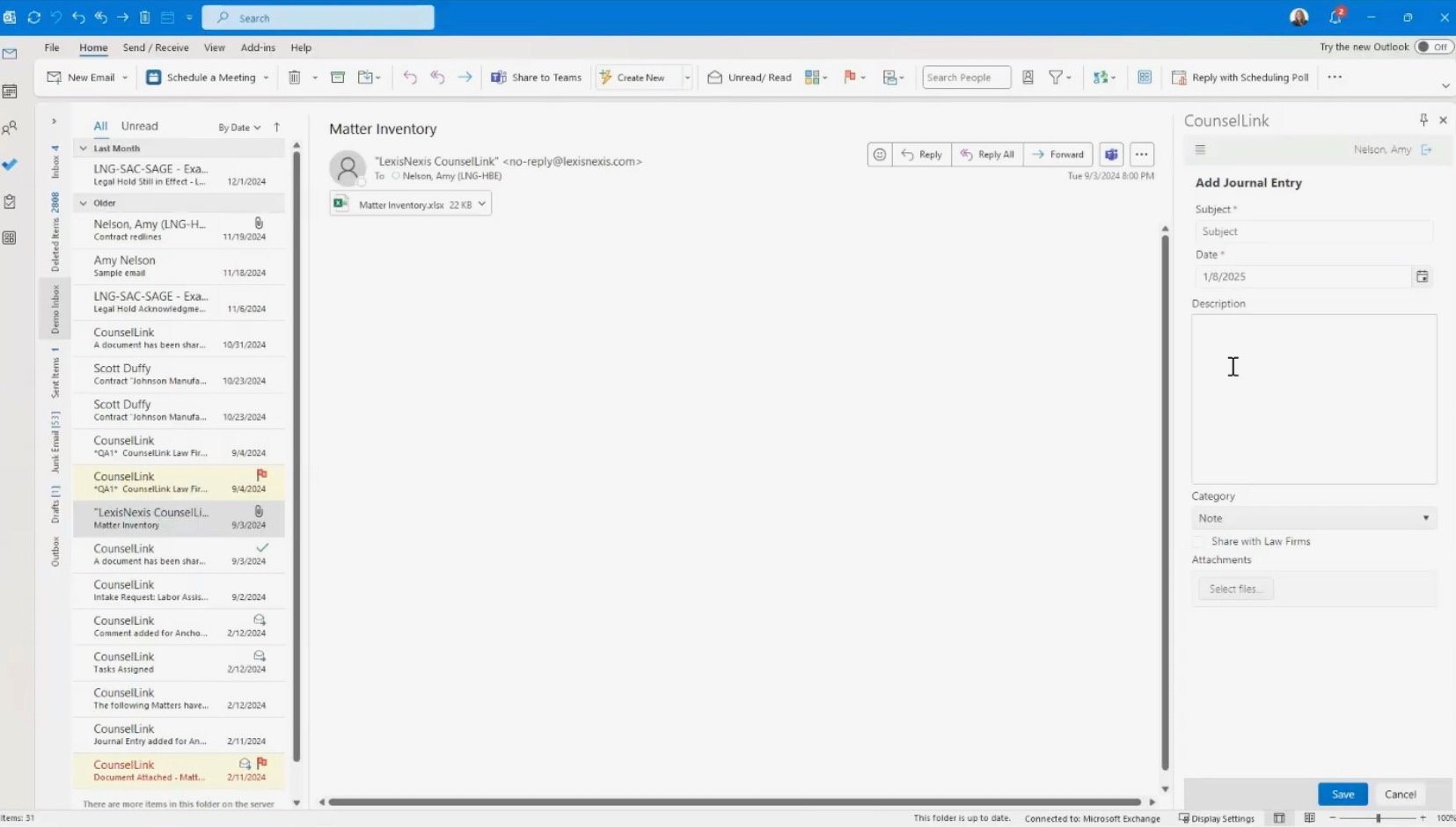

Outlook

Add-In

At

a

large

legal

department,

legal

operations

professionals

will

spend

most

of

their

time

in

the

dashboards,

digging

into

every

available

metric

to

seek

greater

efficiency.

Lawyers,

however,

are

often

working

in

applications

like

Outlook,

while

only

occasionally

utilizing

the

full

system.

That’s

why

CounselLink+

has

a

feature

that

will

meet

lawyers

where

they

are.

Any

matter

created

in

CounselLink+

will

create

a

mini-homepage

that

can

be

accessed

in

Outlook.

The

homepage

contains

all

of

the

matter

information

relevant

to

a

lawyer

assigned

to

work

on

it,

and

it

allows

lawyers

to

easily

scroll

between

matters

and

find

all

documents,

invoices,

and

other

data

a

matter

includes.

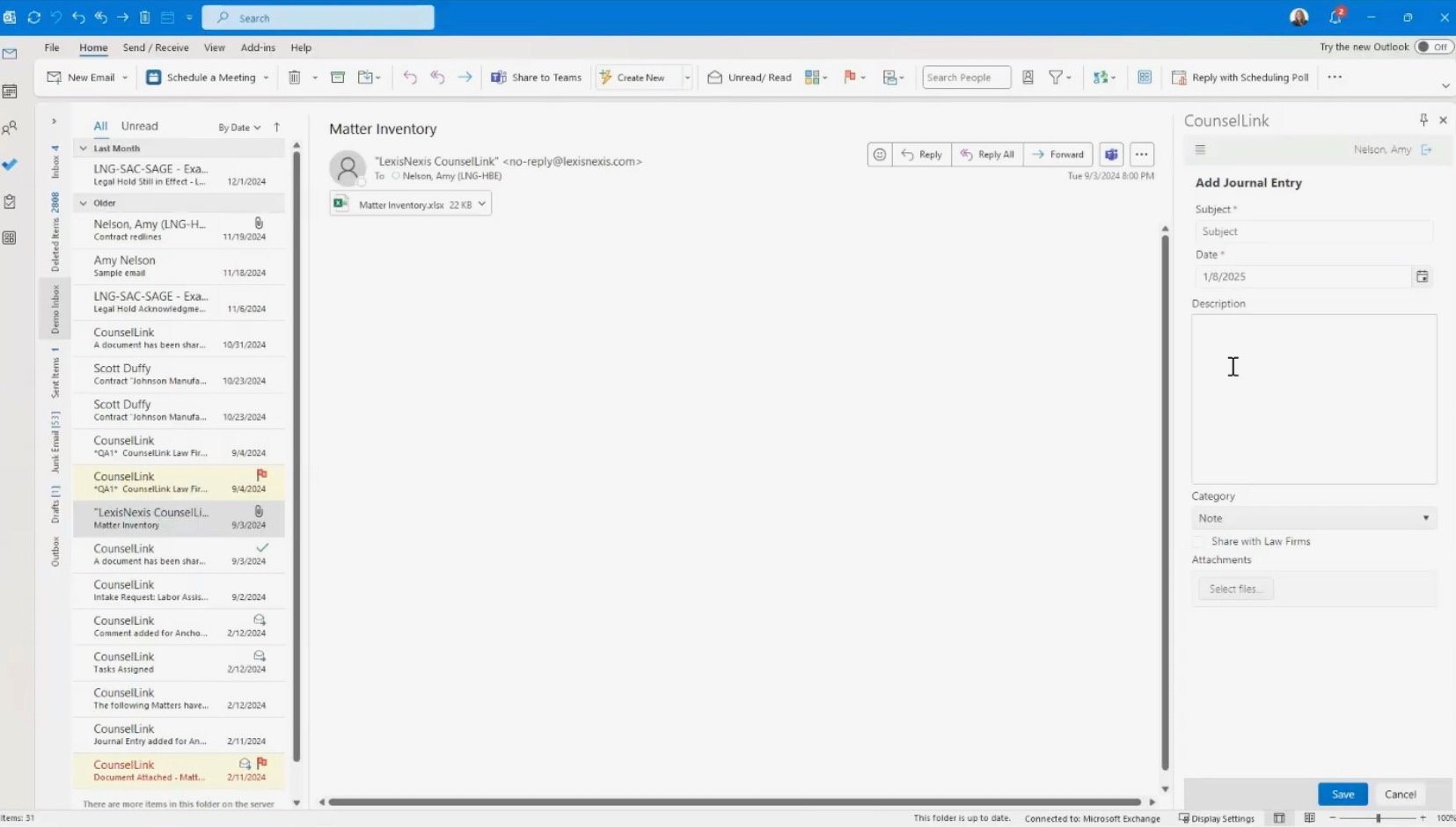

An

“Add

Journal

Entry”

field

is

particularly

popular

among

CounselLink’s

lawyer

end-users.

The

panel

(seen

at

the

right

above)

allows

lawyers

to

include

things

like

status

updates,

meeting

notes,

or

documents

that

will

be

attached

to

a

matter,

as

well

as

to

tag

other

users

to

bring

it

to

their

attention.

The

entry

will

be

reflected

in

the

main

CounselLink+

system,

but

the

end-user

lawyer

only

needs

to

create

it

in

Outlook.

It’s

a

process

that

reflects

seamless

user

adoption

for

any

lawyer

currently

using

Outlook.

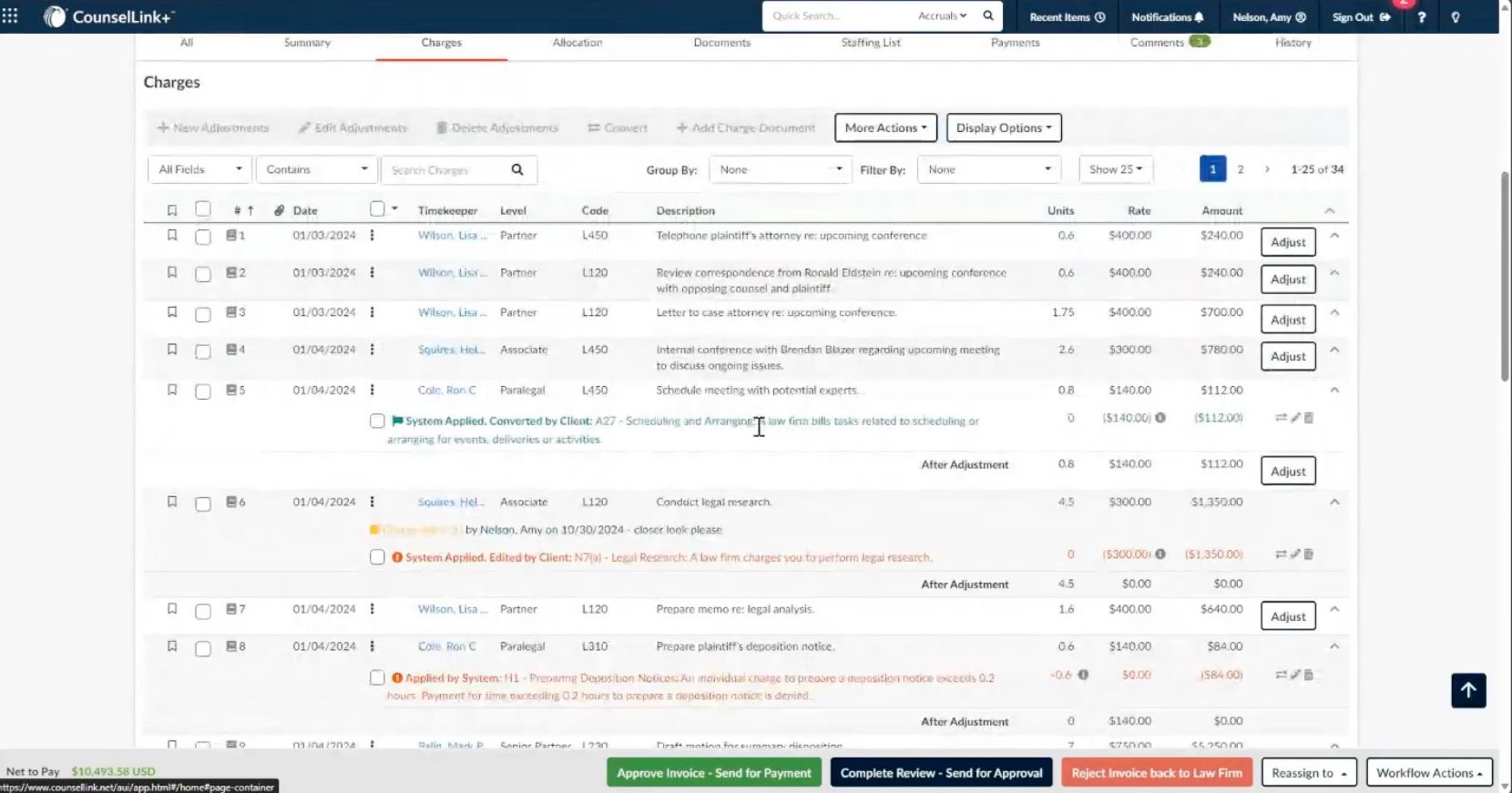

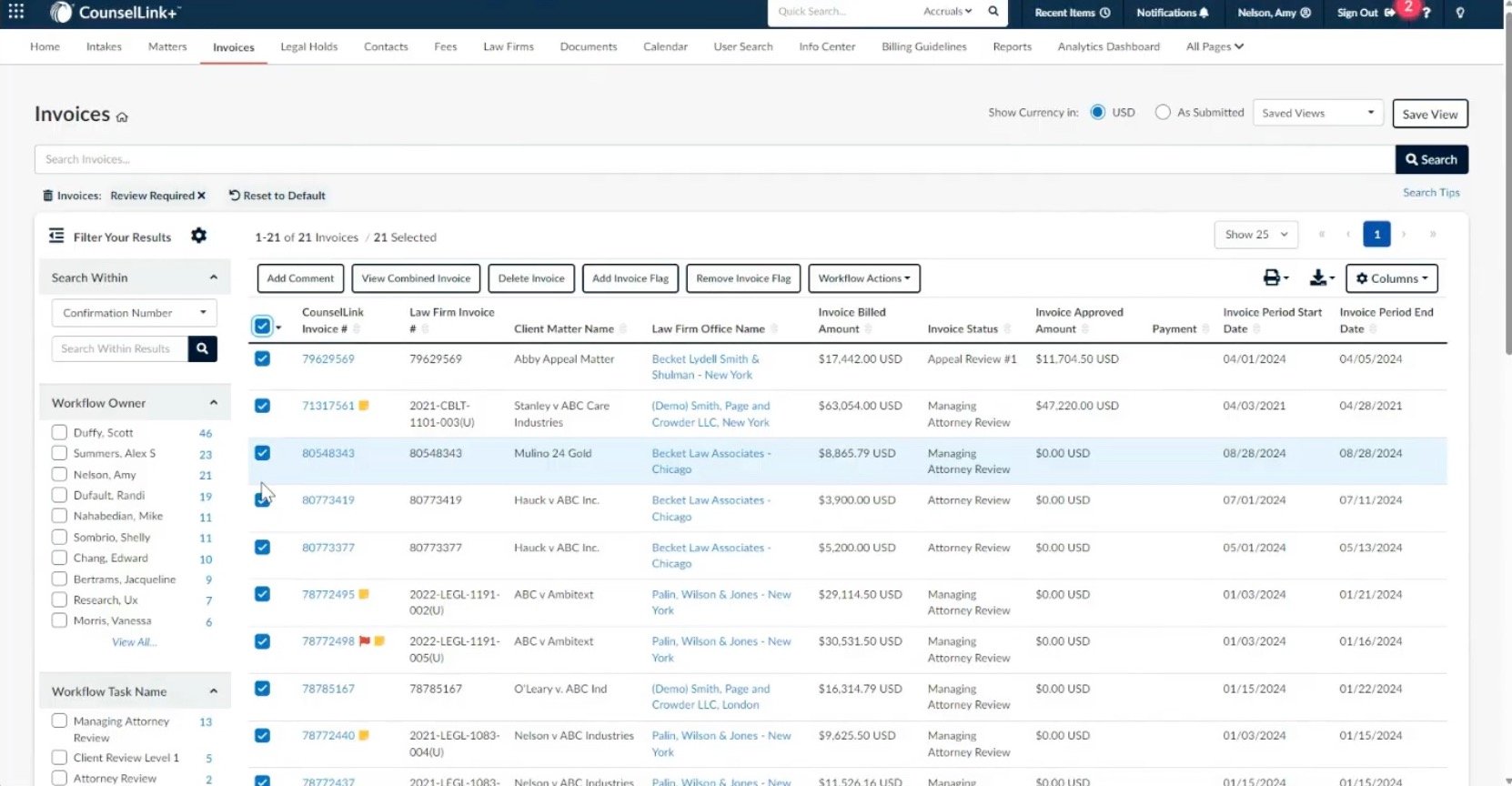

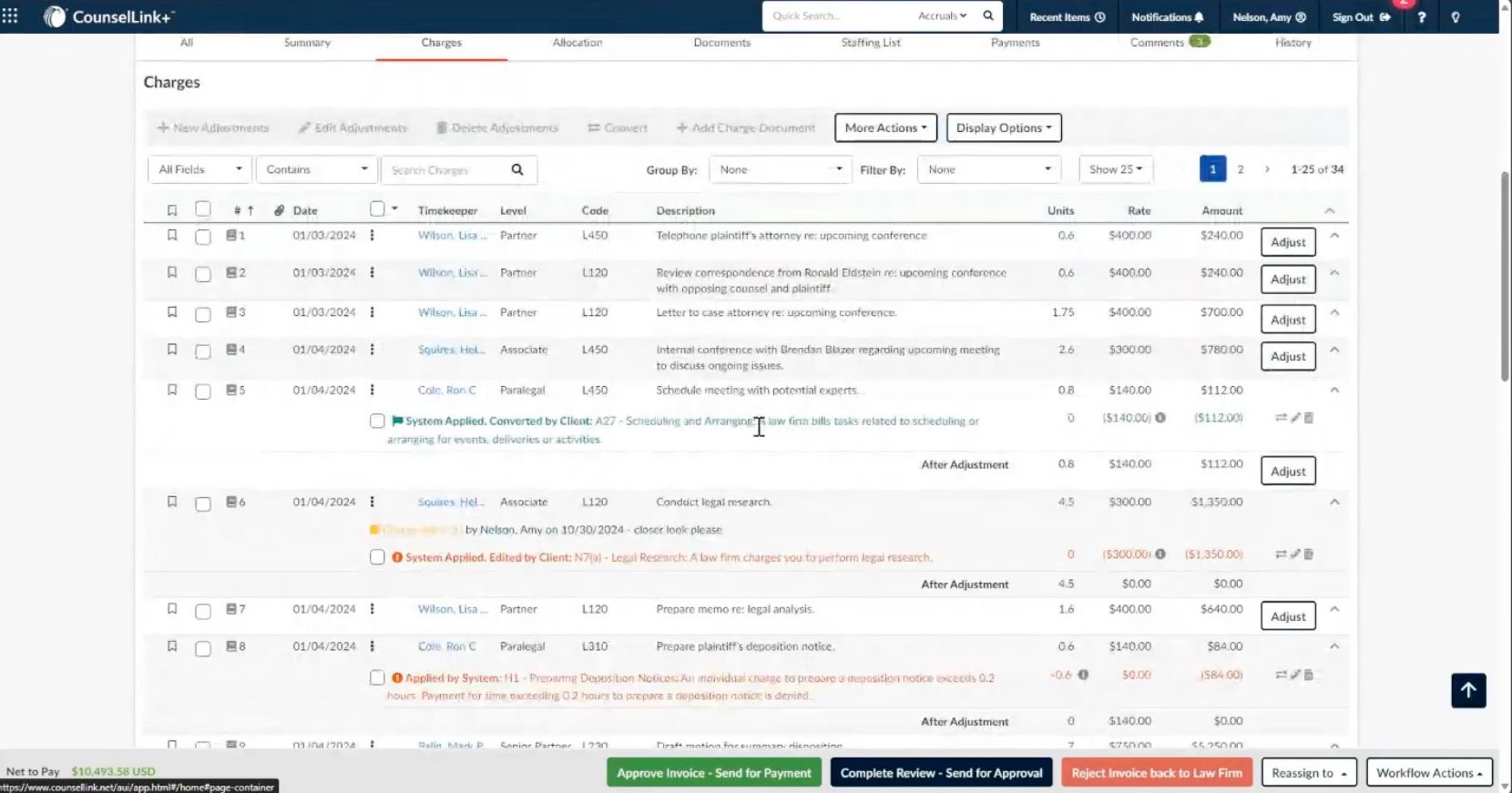

AI-Powered

Bill

Review

Whether

your

law

firms

bill

hourly

or

through

AFAs,

CounselLink+

can

transform

the

widely

dreaded

task

of

bill

review.

To

populate

the

system,

law

firms

can

submit

invoices

directly

through

CounselLink+

at

no

cost.

Once

an

invoice

is

in

the

system,

a

proprietary

Smart

Review

functionality

will

examine

all

of

the

charges.

The

system

will

immediately

validate

the

invoice

and

reject

items

like

hours

billed

by

unknown

timekeepers.

CounselLink+

will

then

review

all

of

the

items

in

an

invoice,

and

call

out

certain

ones

for

additional

scrutiny.

It

flags

these

items

with

a

review

that

goes

far

beyond

just

UTBMS

codes

—

leveraging

AI

to

scrutinize

every

part

of

the

charge,

like

the

date,

the

level

of

timekeeper,

the

charge

text,

the

units,

and

the

rate.

In

the

example

above,

the

system

identified

a

line

item

coded

for

trial

and

hearing

attendance

where

its

description

indicated

it

was

billing

for

setting

up

a

meeting.

Every

CounselLink+

client

can

customize

the

rules

Smart

Review

uses

in

its

bill

review.

They

can

also

be

customized

for

different

types

of

matters

—

different

rules

for

IP

invoices

versus

those

for

litigation,

for

example.

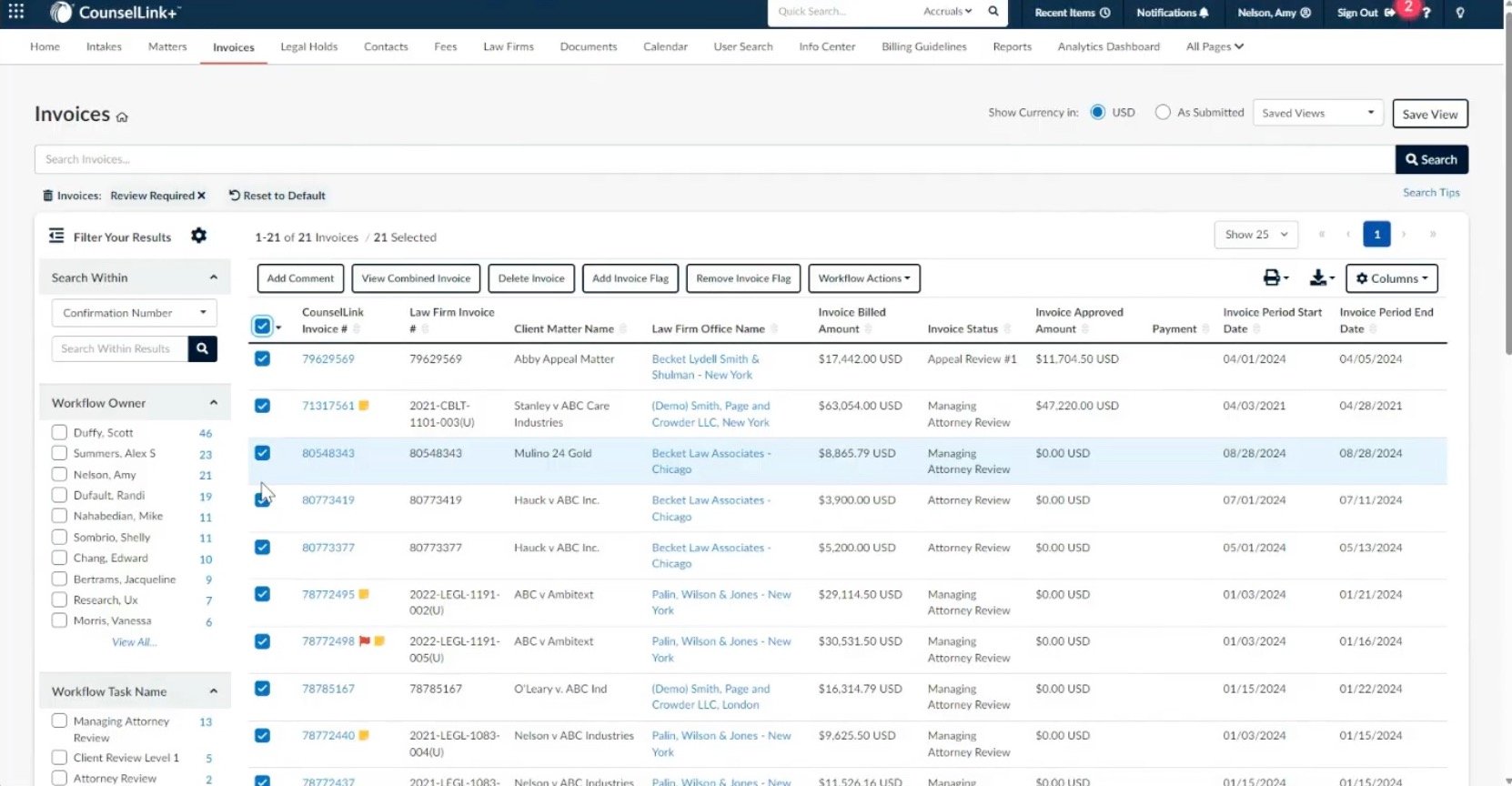

CounselLink+

also

has

a

Combined

Invoice

Review

functionality

that

allows

it

to

review

multiple

invoices

at

once.

This

feature

allows

law

departments

with

a

high

volume

of

invoices

to

review

them

all

simultaneously,

as

opposed

to

opening

and

closing

each

one.

It

can

also

provide

in-depth

spend

analysis

on

a

particular

matter

—

quickly

seeing

how

much

of

a

particular

matter

was

handled

by

partners

versus

associates,

for

example.

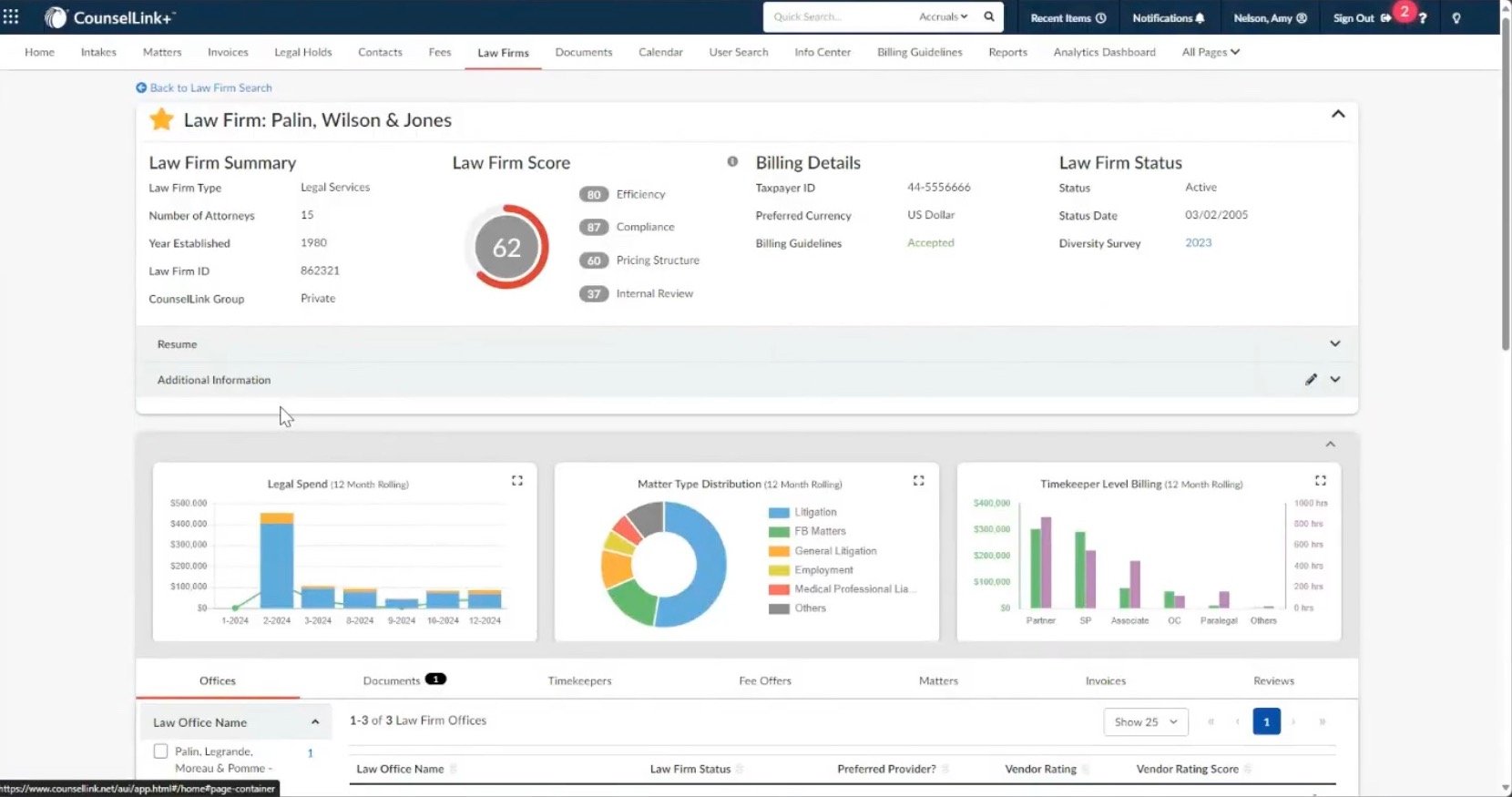

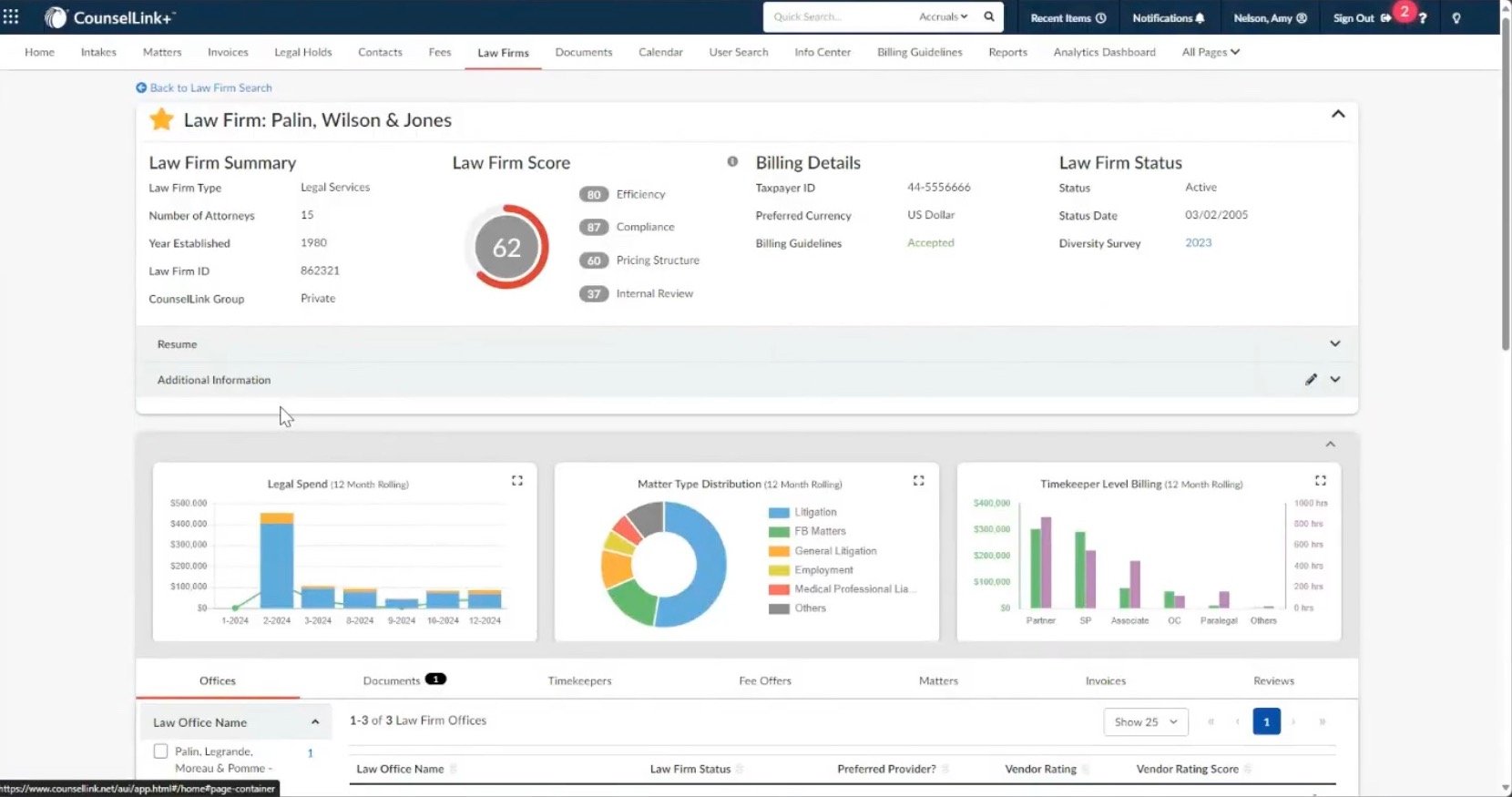

To

manage

your

roster

of

law

firms,

CounselLink+

will

also

provide

a

360

degree

view

of

your

law

firm

relationships.

Law

firms

have

a

weighted

score

—

customizable

by

the

in-house

law

department.

The

system

also

maintains

a

law

firm

diversity

survey

and

can

track

timekeeper

diversity.

Each

corporate

client

can

leave

Yelp-style

reviews

of

their

law

firms

as

well,

to

be

maintained

in

the

internal

system.

The

internal

star

rating

can

be

incorporated

into

the

law

firm

score

as

well.

See

for

Yourself

An

article

like

this

can

only

scratch

the

surface

of

the

capabilities

of

a

program

like

CounselLink+.

If

you’re

curious

about

this

product

and

would

like

to

book

a

demo,

you

can

do

so

here.

And

stay

tuned

to

Above

the

Law

for

our

follow-up

article,

where

we’ll

dive

into

additional

CounselLink+

capabilities,

including

its

contract

lifecycle

management

integration.

Staci

Staci

Kathryn

Kathryn

Chris

Chris

Jill

Jill