Trigger warning: This article contains a general description of a sexual assault.

I often share stories from other law students and lawyers describing the stigma they face regarding addiction and other mental health issues. These issues often correlate with underlying trauma. I’ve known Drew for years and while his story is not one of addiction, many who have been through similar circumstances do struggle with co-occurring substance use. It’s an important story.

Seventeen years ago, I was sexually assaulted at a Jewish summer camp by a camp counselor, with the help of my cabinmates, who were also around my age (minors). In the world of Judaism, I had just become a man two months or so prior, as I had just completed my bar mitzvah. And in three months, it was taken away.

My name is Andrew Rossow, and I am a lawyer. This is a shortened version of my initial story I shared with readers at Thrive Global. For the full version, please click here.

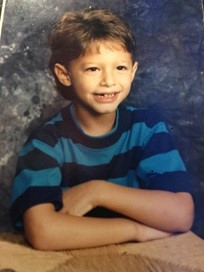

Let me take you back 17 years. At 13, it was an exciting time to be alive for boys my age — with bar mitzvahs occurring what seemed like every other weekend and, of course, the elephant in the room: puberty.

Unlike most kids (and friends) at my age, I dreaded the summers, because I hated going to summer camp. Whether it was being away from my parents for three months out of state or being around kids that were bigger than me and more athletic than me, the feelings were the same.

You see, I was the little guy among my age group — by voice, height, weight, and physique. I hadn’t yet hit puberty, unlike most of the boys around me. And because of this, I had no choice but to fear myself, forced to feel inferior to the boys and girls around me with a total sense of inadequateness.

And who would blame me?

I didn’t have as deep a voice as the boys in my cabin, and by that, I mean it was so high-pitched, that it sounded too like the girls I went to camp with. To those around me, I was “too girly” to “keep up” with everyone else.

I wasn’t even close to being considered “athletically coordinated.” In fact, I sucked at sports so badly that I was often blamed in our camp newsletter for why our team lost at basketball, softball, or whatever the sport was at the time.

I didn’t have an ounce of hair on my body — you could say I was “as smooth as a baby’s ass.” I didn’t have tiny hairs coming off my face, so when it came to conversations with cabinmates about the cuts on their face from shaving, I had nothing to contribute.

“Drew Rossow, the Pubeless Wonder”

But where everything took a turn was right here. Remember the “curtaining” game?

I’m not sure it was something that only happened at our Jewish camp or something that took place everywhere, but boys at 13 were no strangers to games such as “curtaining” that were often described as a “rite of passage.” Yeah, fuck that. For me, it was no rite of passage — it was an assault.

I remember the first time I was curtained. I was in our community bathroom showering at the time, probably washing my hair, when suddenly, the curtain that shielded me from everyone else, opened faster than I could blink. And what I could tell you is that the boys responsible were so shocked as to what they saw, silence couldn’t even keep them quiet.

Laughter and screams filled the air with the two boys staring, pointing, and directing any attention in the bathroom directly to my penis. A boy whose penis at the time wasn’t developed enough, that he didn’t have the faintest sight of a pubic hair surrounding it — and it freaked them out. They didn’t understand it.

By the end of the day, when word reached the rest of my cabinmates, they, in addition to my counselor (no older than 21), already had the perfect theme song to describe “Drew Rossow” for the remainder of the summer:

“Drew Rossow, the pubeless wonder, flying high above the sea; Drew Rossow, the pubeless wonder, flying high above the sea.”

That song, which to this day, is as familiar to me as the Cha-Cha-Slide, I could never live down. It was so catchy, that it somehow survived at least 10 years later (up and until my 10-year high-school reunion).

And my counselor. The adult in the cabin who should’ve known better. The adult who should’ve immediately put an end to that humiliation and chorus, showed his true colors that evening.

Rather than stop it at the source, sparing me from years’ worth of mocking, humiliation, and self-esteem issues, chose to join in and encourage it even more.

Joining the fun from the four walls of our cabin, he simply pointed his finger at me, with that shit-eating grin and smirk, and began sucking on his pinky (imagine a newborn baby sucking on their pacifier, repeatedly), making a smacking sound with his lip — referencing how “tiny” I was down there, no different than a little baby.

What a bastard.

“Drew Rossow, the pubeless wonder, flying high above the sea; Drew Rossow, the pubeless wonder, flying high above the sea.”

Over. And over again. And to think I was worrying about which girl I would ask to the Sadie Hawkins dance later that summer. But don’t worry, that issue was resolved instantly when the song made its ways to the ears of almost every girl on that side of the campgrounds.

Now if you ask me the meaning behind it — I still have no fucking idea as to what the second half of the verse meant. But it was a tune so catchy, that boys and girls would simply sing it out loud and point at me laughing, as they walked by.

Our catchy summer camp hits that we’d sing out loud during meals in the dining hall or at bonfires, which included Joni Mitchell’s “The Circle Game,” Original Caste’s “One Tin Soldier,” and, of course, Lorre Wyatt’s “Song of Peace (The Dreamer),” expanded to include my own personal theme song, that followed me for years to come — even as I did finally hit puberty.

It was a haunting reminder of how much I hated myself and blamed myself for my body’s weird development. All for something I couldn’t control.

And the worst part was that, I had nobody to turn to. Nobody who could protect me. Nobody could put a stop to it.

My friends were no longer my friends, but pressured peers who thought it was cool to join into something they didn’t understand themselves, simply to fit in and not be made fun of themselves for attempting to defend me.

But do I blame them? Not entirely. We were 13, what did we know? Fitting in and peer pressure were at the top of our priority list.

But the bastard adult and counselor (now referred to as “The Bastard”) in the cabin who should have known better — who was paid to know better, you’re damn right I do — and I’m finally old enough and brave enough to say so. So, to you, counselor, who luckily for you, shall remain nameless, I do blame you. 100%.

It was only after that summer did I learn that I was missing some growth hormone, which had slowed down the rate at which I was supposed to hit puberty, predicating the need to take growth shots for a certain period. Eventually it exacerbated the puberty process and I did “catch-up.” Hell, look at me now — deep voice and all.

As for the humiliation and abuse, because that’s exactly what it was, well that was something I had to endure every day and night in my cabin, for three months. I cried. I begged. I screamed. I did everything I emotionally and physically knew how to do, hoping it would stop. I was the little guy in the room, so physical strength was not to my advantage. I hated myself. I hated my counselor. I hated my former friends. I hated every single Jewish boy and girl at that camp.

A Knife To The Neck

One night, something did change. I found the courage to stand-up for myself.

Late one night, I waited for my cabin to finally go silent, as each of my cabinmates laughed themselves to sleep or had their CD players to knock them out (yes, I still remember my red transparent CD player that had Santana spinning in its apparatus).

I had quietly pulled out a white plastic knife I had snagged from that day’s lunch or dinner at the dining hall. I remember waking up at some point during the middle of the night, and quietly tip-toeing over to one of the neighboring bunk-beds, where my former friend slept quietly on the lower bunk.

I quietly shook him as my flashlight’s light revealed the shock on his face as I held that knife up to his neck — threatening him that if he didn’t stop this; if he didn’t come back to me as my friend and defend me, I would kill him the next time.

Am I proud of the way I chose to defend myself, fuck no. But at that time, scaring just one person in my cabin, who I came into camp with as a close friend, seemed to be my best (and only) option.

Now, imagine a 13-year-old holding a plastic knife up to someone, who had just been shaken awake in the middle of the night.

Is that terrifying or comical? Pointless either way. It backfired. His response was to scream as loud as he could until my cabin had woken up and the Bastard woke up or came running into the cabin (I can’t remember if he too was asleep or “on duty” at the time).

The Bastard took the knife away and immediately went for me, grabbing me and restraining me to a chair in the cabin. He was in shock that I could ever imagine doing something so “dangerous” and “stupid.”

As my anxiety and fear grew, I began kicking and screaming, trying to free myself from his restraint. But it did nothing. When I did calm down, enough for him to loosen his grip on me (but still restraining me to the chair), I demanded that he and the rest of my cabin “leave me alone” because in the morning, I would be going to the camp’s director and telling him everything that had been happening the past few days.

Big mistake.

Little did I know that my courage would keep me restrained to the chair, by rope, for the next day, so as to prevent me from reporting it to any other counselor (two in particular I was close with) and the camp’s director.

I was given an ultimatum of how “this was going to go.” Otherwise, I would be staying in that chair longer than I wanted to. I couldn’t fight it. I couldn’t fight them. I was small and weak, and one boy against 10 13-year-olds and a 21-year-old counselor was a battle that I simply could not win.

So, the ultimatum? If I didn’t want to remain tied to a chair for the days to come, I needed to speak out loud and agree that:

I was not to go to the camp’s director, counselor, or anyone at the camp to report on what was happening — because nobody would believe me as against my cabin and our counselor;

Even if I tried report my cabinmates and the Bastard, I wouldn’t be able to, because I would now have to stay in the cabin during meals in the dining hall, tied to the chair, and have food brought to me — you know, just to minimize the risk of me slipping out or finding someone to squeal to;

Even if I could be trusted, I would be escorted to and from sports activities and extracurricular events, meals in the dining hall, rest hour, the bathroom, and the shower; and;

At one point, the Bastard said the only way I’d get the attention I wanted from everyone was the day that “I would be sucking dick for crack.”

The Bastard poked me on my penis with his hand, or would slide his hand on my leg, so that I knew his power over me.

So, I played their game. I let it happen. I agreed to their terms. But they didn’t trust me. So, for the first few days, I spent my time in the cabin under supervision, missing sports activities and meals, in hopes I wouldn’t squeal. Don’t worry, I had meals brought to me, like room service.

From each day forward, for the remainder of the summer, I spent my time being escorted to and from extracurricular activities, meals, and yes, even to the bathroom to piss, shit, and shower.

My time in the shower, which included more curtaining and jams to my theme song, included my own escort service, as my counselor or one of my cabinmates would “stand guard” outside the curtain, waiting for me to finish cleaning my underdeveloped self, knowing there was no possible way I could “dart out” and risk sharing what was happening to someone else nearby.

As for my mail that I would write to my family and friends, they were carefully read and scrutinized for any mention of what was happening.

If only I knew the law at this point, right?

And yes, during this entire time, I still had to hear:

“Drew Rossow, the pubeless wonder, flying high above the sea; Drew Rossow, the pubeless wonder, flying high above the sea.”

To My Colleagues And Fellow Survivors

Now, as I said at the beginning, this confession is not an attempt to gain your sympathy or pity, but rather, my decision in allowing you to understand why I chose to enter the legal field, advocating for those who are not strong enough to help themselves, especially when it involved sexual assault, online harassment, and other forms of bullying.

Over the years, people have asked me why I am “so mushy” or “emotional,” to which I was never ready to explain — primarily because I didn’t think I had to.

But I recognize that throughout the years, my display of certain affections of trust, warmth, and love, may have warped relationships with certain individuals (often women), because I was only looking for the warmth, comfort, attention, and security that I never had those years at camp, dances, or attempts at “dating” girls my age.

I wanted to let you, reader, into the deepest hallways of my heart, hoping you understand that the person you see before you today, is built upon every decision I’ve made (knowingly or not), immediately preceding.

That summer left me an empty vessel when I returned home to my family. You would think that would’ve been the first thing I shared with my family when they picked me up from the Missouri airport — but I had been trained. I had been “reset” so as to never speak of what happened there, again.

For years to come, I couldn’t speak to girls, let alone look them in the eye. My closest relationships with girls my age were only through AIM (AOL Instant Messenger), but god forbid when I saw my crush the next day at school — I pretended that I had no idea who they were, until 4 p.m. hit, and I was back on AIM.

I was afraid to try out for any sports teams — having quit track and cross-country after six weeks and spending time on my high school’s wrestling team (lowest weight class of course) for a lengthy two weeks.

I begin to look elsewhere for the warmth and security as the years went by, through art, writing, and silly television shows and movies like Friends, Gilmore Girls, and my all-time favorite saga, Star Wars.

I didn’t date much in high school (obviously), much to the amazement and wonder of my family and the small group of friends I had. Often, people wondered if I was homosexual, considering my absolute fear of women.

But you see, I was afraid. I was afraid of myself. My body. Exposing myself to another person ever again, hoping they would never get to see the “flaw” that was my body and penis in the same way that I had been forced to believe all those years ago.

And then February 2, 2016, came, and I passed the Ohio Bar Exam and became licensed by the Ohio Supreme Court. I had become everything I ever wanted and more.

Up and until a month ago, I was still trying to figure out who I was and the type of person I wanted to be. I didn’t care much for dating anyone — I cared about my career and making a name for myself, so never again would anyone ever dare question who I was. Did I explore the dating apps like Hinge, Bumble, Tinder, OKCupid, and Plenty of Fish? Absolutely. But I always felt a void, like something (or someone) was missing.

My life felt like Joni Mitchell’s “Circle Game,” constantly searching for the missing puzzle piece.

And it wasn’t until four weeks ago, thanks to the love of my life, Cassie, did I find the strength to finally share my story with you.

I didn’t share my story for the validation or acceptance, but for me and other survivors. Unfortunately, when I chose to share my story to my community, I was removed from a media outlet to which I helped build and grow, because I refused to take down my Thrive Global article.

To my fellow survivors, you have a voice. We all have a voice. Don’t let the bastardization of today’s politics and bastardization of the legitimate #MeToo movement drive you into darkness and silence.

To my colleagues, we need to fight against the injustice our legal system has allowed and fight against those who wish to silence survivors.

Was I ready to tell my story? No. Am I glad I did? Absolutely. Because it is time the world knows the truth about #MeToo. And that truth is that this is not a game. It does happen to men. And there are people out there who will do everything in their power to make all of us, collectively, out to be the aggressors. This is an injustice that has severe consequences and only seeks to diminish the power that the #MeToo movement has.

Andrew Rossow is an Ohio-based millennial lawyer who focuses his practice on internet law and criminal defense. A graduate of the University of Dayton School of Law and an adjunct law professor, he has worked to minimize instances of poor digital hygiene online while addressing the gray areas the intersection law and technology bring. He has made it his mission to stand up against online harassment and bullies through his #CYBERBYTE® Movement. In addition to his law practice, he also writes for a number of outlets, including Bloomberg Law, Law360, Thrive Global, Luxe Beat Magazine, and CoinTelegraph. He is a former contributor with Forbes and HuffPost, and has been featured in Entrepreneur, Fast Company, and Forbes for his activist endeavors and journalistic integrity. You can reach him by email at andrew@rossowlaw.com and on Twitter (@RossowEsq).

Brian Cuban (@bcuban) is The Addicted Lawyer. Brian is the author of the Amazon best-selling book, The Addicted Lawyer: Tales Of The Bar, Booze, Blow & Redemption (affiliate link). A graduate of the University of Pittsburgh School of Law, he somehow made it through as an alcoholic then added cocaine to his résumé as a practicing attorney. He went into recovery April 8, 2007. He left the practice of law and now writes and speaks on recovery topics, not only for the legal profession, but on recovery in general. He can be reached at brian@addictedlawyer.com.

Jordan Rothman is a partner of The Rothman Law Firm, a full-service New York and New Jersey law firm. He is also the founder of Student Debt Diaries, a website discussing how he paid off his student loans. You can reach Jordan through email at jordan@rothmanlawyer.com.

Jordan Rothman is a partner of The Rothman Law Firm, a full-service New York and New Jersey law firm. He is also the founder of Student Debt Diaries, a website discussing how he paid off his student loans. You can reach Jordan through email at jordan@rothmanlawyer.com.

Ellen Trachman is the Managing Attorney of

Ellen Trachman is the Managing Attorney of