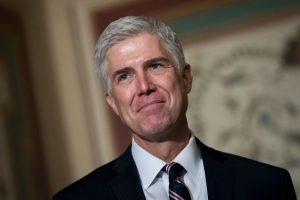

Justice Neil Gorsuch

Gavin Grimm can finally pee in peace.

Yesterday the Fourth Circuit ruled that it was illegal for schools to exclude students from restrooms appropriate for their identity, in a massive win for LGBTQ rights.

In holding that the Gloucester County High School illegally barred 2017 graduate Gavin Grimm from using the boys restroom, the court cited the recent Supreme Court decision Bostock v. Clayton County. Writing for a 6-3 majority, Justice Gorsuch authored the Bostock decision holding that discrimination based on sexual orientation or gender identity violates Title VII of the 1964 Civil Rights Act.

So, thanks, Justice Gorsuch!

Future law students will recoil in horror at the facts of the Grimm case. After his transition in 2014, Grimm used the boys restroom for several weeks without incident. But then a group of parents got riled up on Facebook and the school board met — without telling Grimm or his parents — to pass a new rule restricting restroom use to the gender listed on a student’s birth certificate.

Grimm could travel to the nurse’s office, or a few single-use stalls in the building for students with “gender identity issues,” which he characterized as a stigmatizing “walk of shame.” But at football games when the school building was locked, he had no appropriate bathroom at all. Grimm suffered multiple urinary tract infections and at one point became so depressed that he was hospitalized for suicidal ideation.

In 2015, the Virginia Department of Motor Vehicles issued Grimm a state ID as a male. In 2016, the state amended his birth certificate to identify him as male. But none of this was good enough for the school board, which continued to insist he was a girl and fought this case through 2020, three years after Grimm graduated, to avoid issuing him a high school transcript reflecting his appropriate gender.

In short, they were assholes. As the Fourth Circuit said in 2016, and the trial court affirmed in 2019 after the Supreme Court sent the case back for review in light of the Trump administration’s reversal of Obama-era guidelines ordering schools to stop being ghouls and just let the trans kids pee already. (This may be a slight paraphrasing of Department of Education language.)

But yesterday the court finally put an end to this madness. Noting that Grimm’s fellow students didn’t care what bathroom he used, and that it was only adults high on the fumes of their own prejudice “act[ing] to protect cisgender boys from Gavin’s mere presence—a special kind of discrimination against a child that he will no doubt carry with him for life,” the court ordered the school district to pay his Grimm’s legal fees and give him a correct transcript.

U.S. Circuit Judge Henry Floyd, writing for the majority, was keenly aware of the importance of this landmark civil rights decision.

The proudest moments of the federal judiciary have been when we affirm the burgeoning values of our bright youth, rather than preserve the prejudices of the past. Compare Dred Scott v. Sandford, 60 U.S. (19 How.) 393 (1857), and Bowers v. Hardwick, 478 U.S. 186 (1986), with Brown v. Bd. of Educ. of Topeka, 349 U.S. 294 (1955), and Obergefell v. Hodges, 135 S. Ct. 2584 (2015). How shallow a promise of equal protection that would not protect Grimm from the fantastical fears and unfounded prejudices of his adult community. It is time to move forward. The district court’s judgment is AFFIRMED.

Because this was never about the children. They don’t care about who uses what bathroom, or gender pronouns, or the chromosomal makeup of their favorite YouTube influencer. The kids are more than alright, and if we can just stop trying to drag them back to the last century, we adults will be, too.

Grimm v. Gloucester County School Board [USCA4 Appeal: 19-1952, August 26, 2020]

Elizabeth Dye lives in Baltimore where she writes about law and politics.

Winter Wheeler is a civil litigator turned full-time mediator based in Atlanta, Georgia. Winter left big firm life to build a full-time mediation practice right before the pandemic struck. She quickly pivoted from solely providing services in-person to strictly offering services online for a time. She was able to pivot so quickly, in fact, that she was sought out by several law firms to teach their lawyers how to translate their usual mediation preparation and presentations to the online forum. Winter has become a vocal member of the legal community urging litigants to use the online mediation tools available to them to keep their cases moving forward. In addition, she has become a significant voice in the dialogue regarding whether binding virtual jury trials are a reasonable option in this most unusual time.

Winter Wheeler is a civil litigator turned full-time mediator based in Atlanta, Georgia. Winter left big firm life to build a full-time mediation practice right before the pandemic struck. She quickly pivoted from solely providing services in-person to strictly offering services online for a time. She was able to pivot so quickly, in fact, that she was sought out by several law firms to teach their lawyers how to translate their usual mediation preparation and presentations to the online forum. Winter has become a vocal member of the legal community urging litigants to use the online mediation tools available to them to keep their cases moving forward. In addition, she has become a significant voice in the dialogue regarding whether binding virtual jury trials are a reasonable option in this most unusual time.

Jill Switzer has been an active member of the State Bar of California for over 40 years. She remembers practicing law in a kinder, gentler time. She’s had a diverse legal career, including stints as a deputy district attorney, a solo practice, and several senior in-house gigs. She now mediates full-time, which gives her the opportunity to see dinosaurs, millennials, and those in-between interact — it’s not always civil. You can reach her by email at

Jill Switzer has been an active member of the State Bar of California for over 40 years. She remembers practicing law in a kinder, gentler time. She’s had a diverse legal career, including stints as a deputy district attorney, a solo practice, and several senior in-house gigs. She now mediates full-time, which gives her the opportunity to see dinosaurs, millennials, and those in-between interact — it’s not always civil. You can reach her by email at