America does nothing for decades.

Then it jolts forward a century in the space of a couple of weeks.

It’s wonderful. But I’ve heard from a few people who find it jarring. (I’m writing about people from outside the joint where I work, naturally. We’re actually doing pretty well with these conversations.)

“I know we’re in a new world,” my correspondents say. “But I don’t know the rules of that world. What can I say? When people say the wrong thing they’re being fired without severance. I’m not saying a peep. I don’t think they can fire me for silence.”

What’s the problem?

Renaming military bases that bear the names of Confederate generals is easy. I never thought about who Braxton Bragg (of Fort Bragg) was until this week. It turns out he was an inept Confederate general. We’re thus glorifying him for being a traitor and a racist. We shouldn’t do that. Eliminate his name.

What’s the limit on this rule?

You might think that the rule is this: “No statues or military bases or other accolades for people who are being celebrated solely for things that are plainly wrong.” Put the statues of Confederates in museums. But celebrate people who were simply creatures of their time and are being celebrated for things that are good.

Thus: You would be permitted to celebrate Washington and Jefferson because they did stuff we think was good, like winning the Revolutionary War, writing the Declaration of Independence, and so on. Washington and Jefferson both owned slaves, but we’re not celebrating them for that, and we recognize that they were men of their times.

Similarly, one could celebrate Ezra Pound, a great poet, even though he was an outspoken fascist, saved from life imprisonment or execution after World War II only by other writers who convinced the government to spare him and instead put him in a psychiatric hospital for the rest of his life. Pound was a scumbag — but he did write The Cantos, and T.S. Eliot did dedicate The Wasteland to him. We’re allowed to celebrate the good bits, right?

How about the Edmund Pettus Bridge in Selma? I know that name only for the good — the police unleashed the dogs and fire hoses but that prompted America to pass the Civil Rights Act. I learned only this week that Edmund Pettus was a grand dragon of the KKK. Should we rename the bridge because Pettus was a scumbag or keep the name because the name is now associated with a good cause?

Washington and Lee University? Lee was a Confederate general. The fact that he was also the president of what was then called Washington College doesn’t matter. He’s being celebrated for the treason part; rename the school.

I recently got out a crayon and made some changes to my diploma. I graduated from the Woodrow Wilson School of Public and International Affairs at Princeton University. Way back when, I thought: “Wilson? Princeton student who made good. President of Princeton. Governor of New Jersey. President of the United States. World War I. League of Nations. Led to the United Nations and the system of international institutions that help to preserve the peace today. No problem with the name.”

It turns out Wilson was a scumbag. Raised in Georgia during the Civil War, he was a vicious racist, re-segregating the federal civil service, among other things. Thus, the need for a crayon: I’ve now graduated from the Princeton School of Public and International Affairs.

Look at the statues we’re tearing down. Christopher Columbus? Winston Churchill? Ulysses Grant, for heaven’s sake? I was pretty sure he was one of the good guys: He was given one slave and voluntarily freed the man. Won the Civil War. Two-term president who oversaw the good parts of Reconstruction. Prosecuted the KKK. I guess I have to study harder to figure out why we can’t celebrate Grant.

What about the pyramids, erected as tombs for and tributes to folks who held slaves? What about the nasty bits in the Bible about Sodomites?

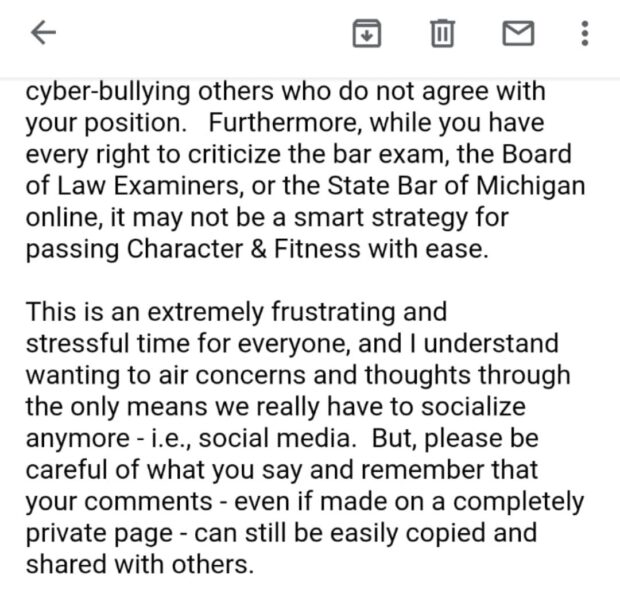

The times they are a-changin’. The rules are uncertain. But free speech matters, even in changing times.

I understand why I’m hearing from people who are afraid to speak. But institutions should be flexible during times when we’re both drawing new lines and trying to adjust our bearings.

Mark Herrmann spent 17 years as a partner at a leading international law firm and is now deputy general counsel at a large international company. He is the author of The Curmudgeon’s Guide to Practicing Law and Drug and Device Product Liability Litigation Strategy (affiliate links). You can reach him by email at inhouse@abovethelaw.com.

Kathryn Rubino is a Senior Editor at Above the Law, and host of

Kathryn Rubino is a Senior Editor at Above the Law, and host of