“Oh say, can you see – this is the American Dream / Young girl, hustling on the other side of the ocean / You can be anything at all in America / I say if you can’t see / Just close your eyes and breathe” — Rihanna

In the past year, Asian Americans have been targeted in almost 3,800 hate incidents, with over two-thirds targeting women of Asian descent.

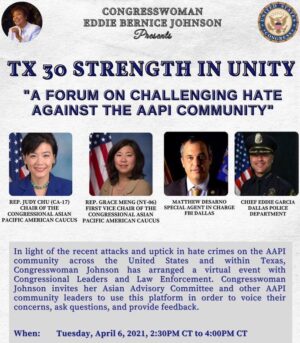

Inflammatory rhetoric and xenophobia have led to increased attacks and an uptick in hate crimes on the AAPI community across the United States and within Texas. Currently, Texas ranks fourth in the highest number in Asian-American hate-crime incidents.

Last week, in Arlington, Texas, GOP candidate Sery Kim responded to a question about immigration with the following remarks:

I don’t want them here at all. They steal our intellectual property, they give us coronavirus, they don’t hold themselves accountable. And quite frankly, I can say that because I’m Korean.

On Saturday, former Arkansas governor and Republican presidential candidate Mike Huckabee tweeted:

On Tuesday, Congresswomen Eddie Bernice Johnson (TX-30), Judy Chu (CA-17), and Grace Weng (NY-6), along with FBI Special Agent Supervisor Matthew DeSarno (Dallas) and police chief Eddie Garcia (Dallas) gathered together for the virtual forum: “Texas30 Strength in Unity — A Discussion on Challenging Hate Against the APPI Community.”

At age 85, Johnson, the elder stateswoman, reminded the audience that we are a nation of nations, and that we must weather this storm together as a unified front. It was why she founded the Congressional Tri-Caucus, which represents over half of the Democratic Caucus and includes the Congressional Asian Pacific American Caucus (CAPAC), Congressional Black Caucus (CBC), and Congressional Hispanic Caucus (CHC). As Johnson recalled:

In 2001 when I was chair of the CBC, I started the Tri-Caucus because I thought it would give us more clout in issues common to the three groups. Our issues have always been pretty much the same, and we go into different phases of experiences with nearly the same statistics.

As covered by The Dallas Morning News writer Elizabeth Thompson, Congresswomen Chu instructed us:

There are many steps we can take, but let me tell you what the most powerful one is, it is to come together, no matter what our backgrounds, united, and speaking out against Asian hate. The Asian American community has been in pain for so long, but we cannot be silent anymore.

And Congresswoman Meng implored:

We simply cannot wait another day. The safety of fellow Americans is on the line.

Both congresswomen brought up the Chinese Exclusion Act, Executive Order 9066 (Japanese internment camps), and the murder of Vincent Chin.

Listening to Johnson, Chu, and Weng call for solidarity reminded me of former NBA Warriors and Knicks player Jeremy Lin’s words last month:

It would be hypocritical of me to say I’m anti-racism if I only stand up for people who look like me. There is definitely power in unification and solidarity. … We as minorities also have to collaborate, unify and use our voices and stand up for each other.

And Jesse Jackson’s words last year:

Like Emmett Till triggered our movement in the South, Vincent Chin was the Emmett Till of the Asian movement. It made us have something concrete to react to. Vincent Chin sort of summed up the notion that walking around Asian is dangerous.

When Trump blames China for unleashing a germ on us, a kind of germ warfare, it affects Asian everywhere. It’s not true. We must defend Asians in that sense. We must defend each other. We have to cover each other’s backs. It’s a relationship and it’s communication.”

Growing up in the late 1980s in Detroit, Michigan, the death of Vincent Chin — during a rise in anti-Asian American sentiment due to the auto war between U.S. and Japanese carmakers — haunted my family. Chin was beaten to death with a baseball bat on his bachelor party by two white autoworkers who blamed Chin for being unemployed — and who would end up facing the first federal hate crime charge involving an Asian American victim — but they would never face a day in prison. Because, as Michigan Third Circuit Court Judge Charles Kaufman ruled: “these aren’t the kind of men you send to jail.”

In May of 1984 — while standing next to Vincent Chin’s mom, Lily Chin, in San Francisco’s Chinatown — Jackson proclaimed:

We’ve been drawn together by death, an unplanned family reunion. Our hearts are made heavy by a mother who sits here with us whose son was brutally killed… What can we do in the aftermath? Those who live, we must redefine America so everybody knows everybody fits in the rainbow somewhere.

In 1984, Jackson started the Rainbow Coalition movement, albeit with some controversies.

In 2001, Johnson founded the Congressional Tri-Caucus, which has hit its stride by coalescing around a few critical issues: diversity, health disparities, immigration, and environmental justice.

Now 20 years later, with the historic momentum from the Black Lives Matter movement and recent Stop Asian/AAPI Hate campaigns, communities of color are becoming more and more empowered socially and politically to transform their communities. To rethink what it means to be a part of America’s fabric and agents of change in redefining America.

Now 20 years later, with the historic momentum from the Black Lives Matter movement and recent Stop Asian/AAPI Hate campaigns, communities of color are becoming more and more empowered socially and politically to transform their communities. To rethink what it means to be a part of America’s fabric and agents of change in redefining America.

If you’re interested in this topic and continuing the conversation, then I’d like to invite you to the following event:

Speak Your Truth & Give Voice To Others — COVID-19 One Year Later: Dealing with the Recent Attacks on Asian Americans & Fostering Diversity, Equity, & Inclusion in this New Era

Hosted and sponsored by The Diversity Movement, Blue Cross NC, Duke Clinical Research Institute, Pluto Health, Medullan, and ZoomDJs.com.

This virtual event is free and takes place Friday, April 16, from 11 a.m. to 12:30 p.m. EST.

We look forward to your attendance and participation!

T.R. Chung is the Diversity Columnist at Above the Law. You can contact him by email at projectrenwei@gmail.com, follow him on Twitter (@fnfour), or connect with him on LinkedIn.

Staci Zaretsky is a senior editor at Above the Law, where she’s worked since 2011. She’d love to hear from you, so please feel free to email her with any tips, questions, comments, or critiques. You can follow her on Twitter or connect with her on LinkedIn.

Staci Zaretsky is a senior editor at Above the Law, where she’s worked since 2011. She’d love to hear from you, so please feel free to email her with any tips, questions, comments, or critiques. You can follow her on Twitter or connect with her on LinkedIn.

Now 20 years later, with the historic momentum from the

Now 20 years later, with the historic momentum from the

Kathryn Rubino is a Senior Editor at Above the Law, and host of

Kathryn Rubino is a Senior Editor at Above the Law, and host of