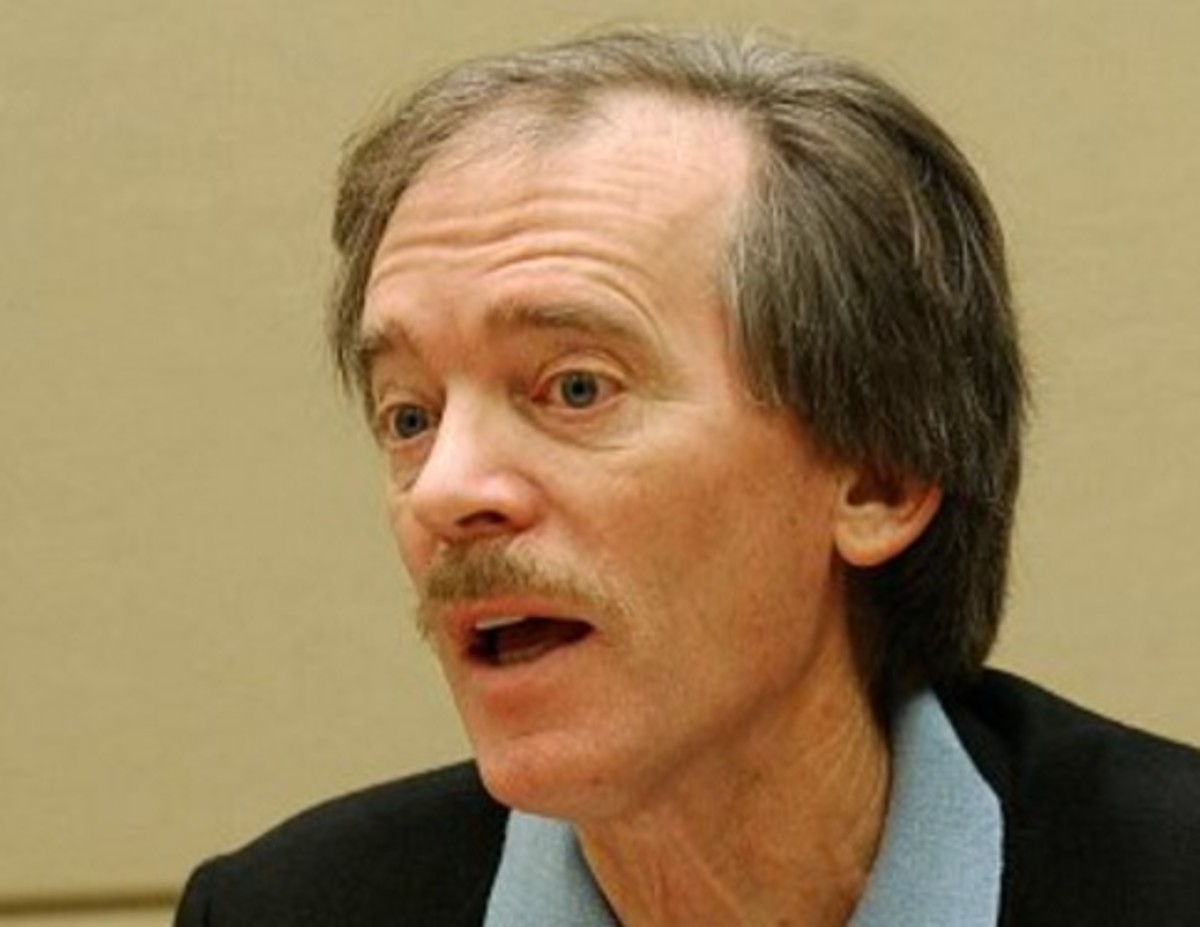

Bill Gross’ Girlfriend Offers Precious Glimpse Into Psyche Of Person Dating Bill Gross

There is a question hanging over the varied litigation that is the relationship between retired Bond King Bill Gross and his Laguna Beach, Calif., neighbor. I mean, sure, there are many questions: What is the point of putting a presumably expensive Dale Chihuly sculpture up in such a way as to both irritate the person next door and require a hideous bit of netting to protect it from the palm trees he placed it under? Is Mark Towfiq really so obsessed with Gross that he installed security cameras to keep a watch on his every move? Did Gross really expect this transparent ploy to work? Why are rich people like this? But none of those is the question:

Bill Gross has a girlfriend?

And that question, of course, begets many others about Amy Schwartz, the 51-year-old former tennis pro who not only dates Gross but cohabits with him: Knowing all there is to know about Gross and about the way he treats his family and those close to him, knowing the things he’s done and said and written, having access to the voluminous public record about the man, his quirks and his ways, why? How, other than as much vodka as is necessary? What makes such a person tick?

Thanks to the ongoing trial over the aforementioned dispute, we now know all we need to answer that question.

“‘Gilligan’s Island,’ I love that song,” Schwartz said after one of Towfiq’s recordings was played. “But I already told you, I was sleeping. It might have been a mistake that the play list played over….”

Schwartz was asked if she and Gross played the music on a loop — that is with one song playing repeatedly.

“I don’t know how to work a loop,” she said.

Asked if the music had gone off accidentally, Schwartz said, “I don’t control it.” Gross “controls the audio and TVs,” she said.

You don’t say.

Bill Gross’s Girlfriend Denies Playing Music to Harass Neighbor [Bloomberg]

Notorious Sperm Bank Case Settles. Can We Buy Holiday-Sale DNA Kits For Our Donor-Conceived Loved Ones Now?

Breaking News: Before we discuss this week’s legal issue, here’s an update on the Box v. Henderson case, which I wrote about two weeks ago, and which was pending before SCOTUS. As you recall, the State of Indiana had tried to deny same-sex parents the right to both be listed on the birth certificates of their children, and, despite losing at the trial court and before the Seventh Circuit, Indiana tried to take the case all the way to the Supreme Court.

However, in great news, the Justices likely read my column from two weeks ago suggesting that they not grant certiorari on the openly anti-LGBTQ effort to deny same-sex couples from both appearing on the birth certificates of their children. On Monday, we learned that SCOTUS had, indeed, denied certiorari. That leaves in place the Seventh Circuit Court of Appeal’s ruling that the state’s discrimination against same-sex couples was not biologically or otherwise justified, and all Indiana couples should be treated equally, regardless of sex. Nicely done, SCOTUS.

Now, Back To Our Regular Programming: Teuscher Settles.

Almost two years after the news first hit, the Teuscher case is still a bit of a shocker. Who’d have thought that taking a home DNA kit to learn more about personal ancestry — like millions of other Americans — would cause a sperm bank to send a cease-and-desist letter? But for Danielle Teuscher, that’s what happened.

Teuscher had her 5-year-old daughter participate in the popular pastime of DNA testing, along with herself and other family members. The problem was, Teuscher had conceived her daughter with the assistance of donor sperm from a sperm bank. When purchasing the genetic building blocks for her future child, Teuscher signed an online contract with the sperm bank that included provisions that she would not seek out the donor or the donor’s relatives.

Is Taking A 23andMe Test “Seeking Out” An Anonymous Donor?

When Teuscher received her daughter’s 23andMe results back, a paternal grandmother showed up (aka the donor’s mother) with an “open to communication” setting. Teuscher reached out with a short message, and after a brief back and forth, that was it. At least she thought it was.

But it wasn’t.

A few weeks later a large envelope arrived from the sperm bank with a threatening cease-and-desist letter, letting Teuscher know that she had breached the contract terms with the sperm bank not to seek out the donor or donor’s relatives, and was liable for liquidated damages of $20,000! (Hear Teuscher and her attorney, Jill Teitel, tell the story in their own words in this podcast interview.)

That wasn’t all. The sperm bank informed Teuscher that it would be withholding the remaining vials of sperm, which she had already purchased, and which were still being stored with the sperm bank. Also, the sperm bank cut off her access to its online portal that allowed her to receive medical updates about the donor, as well as her access to a sibling portal where she could connect with parents of children born of the same donor.

All from a DNA kit.

The Settlement

Teuscher brought suit in Washington State against the sperm bank in June 2019, asserting claims for replevin of the sperm and breach of contract, as well as a consumer protection action, among others. In January 2020, three of her claims were dismissed. Not the best news, but Teuscher’s attorney Jill Teitel explains they were still feeling positive given the court’s recognition of Teuscher’s personal property rights. Moreover, there was no attempt to dismiss the claims brought on behalf of Teuscher’s daughter.

Earlier this month, Teuscher settled the suit on behalf of herself and her daughter. One can hardly blame her for wanting to move on with her life.

The terms of the settlement are confidential, but the raw numbers are public. The sperm bank will pay Teuscher and her daughter $75,000. Of that, $11,250 will be put aside for Teuscher’s daughter until she turns 18 years old. It may not be a huge settlement, but definitely way better than potentially paying the sperm bank the $20,000 it had demanded. And while it would have been interesting to see the rest of the claims play out, the settlement is certainly a victory for Teuscher and her daughter.

Where Does That Leave Us On DNA Tests?

Unfortunately, without further appeal or argument in the case, we are left with the judge’s January 2020 decision on a motion to dismiss certain claims. There, the court ruled that the Customer Agreement that Teuscher signed “reasonably limited” her ability to seek information about the donor’s background. The sperm bank agreed to provide relevant medical information from the donor, “representing a reasonable balance of the interest at issue.” “Importantly, [Teuscher] could still perform DNA testing to discover genetically relevant medical information without seeking information on genetic ancestry or other information that would destroy the donor’s anonymity.” Per the court, it was the procurement of ancestry information, not genetic medical testing that was problematic.

So we are left with the answer: yes, you can do genetic medical testing to find out medical information. But you can contract away your right to figure out who your children’s ancestors are, and finding out ancestry information from a direct-to-consumer genetic test may be a breach of such a contract.

That seems pretty wild, if you think about it. After all, ancestry results from a place like Ancestry.com or 23andMe can be used to tell you a lot of other information that has nothing to do with the donor, including your own (nondonor-related) ancestors! And of course, the contract that you enter with the clinic can’t bind your child from looking up their own DNA when they have the ability to do so.

For Teitel, the takeaway is an ongoing need for the fertility industry to be held accountable to ethical norms and procedures, recognizing changing trends involving technology and the concerns and rights of donor-conceived persons. And those concerns and rights may include a donor-conceived person’s desire, or need, to find out their own ancestry, despite whatever assurances of anonymity may have been given to donors in times gone by.

Ellen Trachman is the Managing Attorney of Trachman Law Center, LLC, a Denver-based law firm specializing in assisted reproductive technology law, and co-host of the podcast I Want To Put A Baby In You. You can reach her at babies@abovethelaw.com.

Ellen Trachman is the Managing Attorney of Trachman Law Center, LLC, a Denver-based law firm specializing in assisted reproductive technology law, and co-host of the podcast I Want To Put A Baby In You. You can reach her at babies@abovethelaw.com.

Randy Rainbow Slays Rudy Giuliani In New Holiday-Themed Music Video

(Randy Rainbow, a comedian who’s known for his parody music videos, put together a holiday-themed song for Trump’s personal lawyer, Rudy Giuliani, changing the lyrics of “Rudolph the Red-Nosed Reindeer” to “Rudolph the Leaky Lawyer.”)

Staci Zaretsky is a senior editor at Above the Law, where she’s worked since 2011. She’d love to hear from you, so please feel free to email her with any tips, questions, comments, or critiques. You can follow her on Twitter or connect with her on LinkedIn.

More Law Firms Should Buy Work-From-Home Items For Employees

Many individuals within the legal industry are working from home in order to promote social distancing and keep everyone safer as the COVID-19 pandemic continues to rage. Although some law firms have inexplicably reopened their offices too soon, most managers realize that employees can complete almost all of their work tasks from home instead of trekking to an office. Many partners have lamented in recent months that having employees work from home has decreased productivity and hurt the profits of many shops. In order to boost the productivity of workers, and give employees the support they need, more law firms should be open to the idea of purchasing work-from-home items like furniture, computer monitors, and other equipment for employees.

There is nothing new about employers purchasing work-from-home items for employees. Most law firms provide their employees with laptops that they can use to complete work tasks from pretty much anywhere. In addition, some employers take their commitment to virtual work a little further and are open to purchasing computer monitors, furniture, and other items needed to effectively work from home.

About five years ago, my brother worked at a financial company that allowed employees to work from home once a week. The employer bought computer monitors for my brother so that he could more easily see the spreadsheets and other financial documents he needed to review in order to successfully complete his job. The investment required to equip my brother with the monitors and other items needed to be more productive working from home cost only several hundred dollars, but this investment likely paid dividends in the output my brother was able to provide his employer and their clients.

There is no reason why more law firms could not make a similar investment in work-from-home items, which would empower employees to be more productive while working from home. Law firms already pay for their employees to attend conferences, comply with CLE rules, attend business development outings, and other professional development expenses. The several hundred dollars it would take to equip each employee to work from home would be just a drop in the bucket compared to all of these other costs.

In some instances, employees could really use the equipment firms would purchase in order to be productive at home. Many workers across the country are making do with whatever arrangement they have at home to perform work. Numerous individuals are working from the couch, and I have seen a few attorneys I know set up card tables and folding chairs in order to create makeshift home offices. Such arrangements are not ideal, since they do not provide workers the best opportunity to type and be effective at their tasks. In addition, and I am no expert, but sitting on a folding chair or in other arrangements can hurt your back and potentially cause health issues.

Employers may argue that it is up to employees to create a proper home office so that they can be productive at their jobs and they can always come to the office if they can’t work from home. However, some people simply do not have the money needed to properly create a home office. It can cost hundreds of dollars or more to outfit a home office depending on the equipment a worker already has at home and what they may need to effectively complete their work. Many people are having a difficult time getting by in these tough times, and it may be onerous for some workers to pay for work-from-home items themselves. In addition, since there is less job security than there was in recent years, workers may not feel comfortable shelling out money to outfit a home office that may be useless if they lose a job. Employers should step up here by providing employees the support they need to thrive at virtual work. Arguing that employees can come to the office if they can’t be productive at home is no excuse because health worries and social distancing makes this impractical in most situations.

Some employers may argue that it is difficult for them to purchase all of this equipment for workers. Indeed, employers may believe it onerous to have such equipment returned after an employee leaves a firm and to process all of the requests to have work-from-home items paid for by a law firm. However, the amount of money needed to outfit most home offices is relatively small, and if law firms are so worried about practicalities, they can just let workers keep the items when they leave the firm. Indeed, I have heard of employers doing this in the past, since some employers do not care about recouping the several hundred dollars of work-from-home items they may have paid for an employee. Maybe employers can emblazon any work-from-home equipment with their firm’s name like they do for other swag so that even if an employee keeps the items, the firm gets free advertising!

All told, partners should not lament a reduction in productivity during the pandemic unless they have done everything needed to support the virtual work of their employees. Paying for work-from-home items could help employees be more productive and assist workers at a time that they could really use the support. Although some practical matters need to be hammered out, this should not keep more firms from paying for work-from-home items needed to boost the productivity of virtual workers.

Jordan Rothman is a partner of The Rothman Law Firm, a full-service New York and New Jersey law firm. He is also the founder of Student Debt Diaries, a website discussing how he paid off his student loans. You can reach Jordan through email at jordan@rothmanlawyer.com.

Jordan Rothman is a partner of The Rothman Law Firm, a full-service New York and New Jersey law firm. He is also the founder of Student Debt Diaries, a website discussing how he paid off his student loans. You can reach Jordan through email at jordan@rothmanlawyer.com.

Class-Action Gender Discrimination Case Against Jones Day Dropped

Jones Day (Photo by David Lat)

Say goodbye to the class-action gender discrimination lawsuit against Jones Day.

As you may recall, the purported class-action gender discrimination case alleged a “fraternity culture” at the firm and unequal pay behind the firm’s notorious “black box” compensation system. The plaintiffs were spread throughout the country — Nilab Rahyar Tolton, Andrea Mazingo, Meredith Williams, and Jaclyn Stahl worked in California offices of the firm, while Saira Draper was an associate in Atlanta, and Katrina Henderson was in the firm’s New York office — and a core allegation is that the same black box compensation systems kept their pay below that of men working at the firm.

After contentious discovery, U.S. District Judge Randolph Moss of the District of Columbia ordered Jones Day to provide plaintiffs with salary information about every associate nationwide from 2012 to 2018. But that data didn’t turn out how the plaintiffs anticipated, and after an analysis, the plaintiffs have decided to drop the class-action claims against the Biglaw firm, as reported by Law.com:

In a joint status report filed late Monday, attorneys for the six women suing the firm and for Jones Day indicated the women had decided to cast aside the class action claims after analyzing the nationwide evaluation and compensation data provided by the firm. They also agreed to drop their individual disparate impact claims related to the firm’s compensation model, while other individual claims will remain active.

Henderson, Draper, and Williams still have individual Equal Pay Act claims and there are also pending claims under the California Private Attorneys General Act, Title VII of the Civil Rights Act, the Family and Medical Leave Act, and various state and District of Columbia laws.

Attorney for the plaintiffs, Sanford Heisler Sharp’s Deborah Marcuse, said they’ll continue to pursue their individual claims:

“The six named plaintiffs brought this case in the name of transparency and equity in the legal profession and we will continue to vigorously pursue their compelling individual and statutory claims, including their individual claims of unequal pay.”

The firm’s statement on the latest development in the case noted the timing of the decision to drop the class-action claims and that they’ll continue to fight the individual claims:

Jones Day spokesman David Petrou noted that the women were required to submit expert reports in early December supporting their allegations that the firm’s evaluation and compensation processes led to systemic discrimination against women.

“But after their experts analyzed nationwide data for the period 2012–2018, they concluded—as Jones Day has said from the outset of the case’s filing—that there was no basis to pursue these claims,” he said in an email. “The firm will continue to litigate the limited—and equally meritless—claims that remain.”

It’s a quiet end to the class-action case we once hoped would blow open the firm’s notorious black box compensation system.

Earlier coverage: Jones Day Hit With Explosive Gender Discrimination Case

Jones Day Facing Second Class-Action Lawsuit Over ‘Fraternity Culture’ Of The Firm

Partner Whose Behavior Features Prominently In Jones Day Gender Discrimination Lawsuit Is Out At The Firm

Jones Day Wants Gender Discrimination Plaintiffs To Reveal Themselves To The Public

Plaintiffs Throw Shade At Jones Day In Gender Discrimination Lawsuit

Gender Discrimination Lawsuit Against Jones Day Gets Yet Another Plaintiff

Gender Discrimination Lawsuit Against Jones Day Dropped — Well, One Of Them At Least

Jones Day Gender Discrimination Case Spreads To New York

Amended Gender Discrimination Case Brings The Real Scoop On Jones Day Compensation

Jones Day To Gender Discrimination Plaintiffs: You Don’t Deserve To Be Paid On The Cravath Scale

Plaintiff Backs Out Of Gender Discrimination Lawsuit Against Jones Day Rather Than Reveal Her Name

Plaintiffs In Jones Day Gender Discrimination Case Want It To Be A Class Action

Jones Day Files For Sanctions In Ongoing Gender Discrimination Lawsuit

Jones Day Argues That Everyone’s Happier Not Knowing They’re Underpaid

Jones Day’s ‘Black Box’ Compensation One Step Closer To Being Blown Open

Kathryn Rubino is a Senior Editor at Above the Law, and host of The Jabot podcast. AtL tipsters are the best, so please connect with her. Feel free to email her with any tips, questions, or comments and follow her on Twitter (@Kathryn1).

Kathryn Rubino is a Senior Editor at Above the Law, and host of The Jabot podcast. AtL tipsters are the best, so please connect with her. Feel free to email her with any tips, questions, or comments and follow her on Twitter (@Kathryn1).

I Wonder If The Big City Lawyer Will Choose Love Or Career?!?!?

Her high school crush is now a widower with a precocious 5-year-old? But the Globotex deal closes on the 28th!!!!

Joe and Kathryn discuss the 2020 slate of new holiday movies that seem to always put lawyers on the wrong end of work-life balance. We also check in on Naomi Biden’s move to D.C. Biglaw and an attorney who apparently decided that Zoom trials meant the end of dress codes.

Spoiler alert: The judge disagreed.

Trump’s Elite Strike Force Lawyer Jenna Ellis Bombed Out Of Traffic Court

(Photo by Rey Del Rio/Getty Images)

“The number of cases in which the claimant committed an irreparable, egregious act was not significant compared to the total number of cases she processed,” wrote the hearing officer in Jenna Ellis’s 2013 unemployment claim. High praise, indeed.

“Doctor” Ellis, a self-described constitutional law attorney who represents the president on his Elite Strike Force, began her legal career in the Weld County Colorado District Attorney’s Office in August of 2012. The 2011 graduate of University of Richmond Law School spent her time prosecuting low-level misdemeanors until she was fired after just six months “because she refused to bring a case to trial that she believed was an unethical prosecution,” according the Wall Street Journal.

But the Colorado Sun went looking and found a slightly different version of the story in Ellis’s unemployment claim. Because you can’t bullsh*t a local reporter, so don’t even try.

In Colorado, government employees can’t collect unemployment insurance if they’ve been fired for cause. Apparently Ellis’s bosses, who terminated her for “unsatisfactory performance,” deemed her conduct sufficiently lousy that it should disqualify her from collecting unemployment. And they felt strongly enough to argue it twice before the Colorado Department of Labor and Employment.

But Jenna Ellis prevailed in the end because she was just too incompetent to be blamed for screwing up. Elite Strike Force, FTW!

While acknowledging “the appearance in case documentation the claimant did not follow proper protocol for some of the cases she handled,” including failure to comply with the Victim’s Rights Act, the hearing officer felt that “the claimant did the best she could with her education and training to meet the expectations of the employer.”

The hearing officer concluded that “There are insufficient facts the claimant was not performing the duties to the best of her ability. There were some deficiencies in her education and experience that account for some of the errors she committed while learning on the job under high volume conditions.”

She did the best she could. And even though her best was crap, she got full unemployment benefits because, really, who could expect more from her?

By amazing coincidence, the Elite Strike Force has also done the best they could with their education and training but failed to meet the expectations of their employer. And when this is over, they, too will probably collect full benefits from the Right Wing Unemployment Board on the basis of “You Tried.”

Third verse, same as the first.

Jenna Ellis, President Trump’s lawyer, was fired from Weld County DA’s office for “mistakes,” records show [Colorado Sun]

Elizabeth Dye lives in Baltimore where she writes about law and politics.

Hunter Biden’s Tax Troubles

Hunter Biden (Photo by Moses Robinson/Getty Images for Usher’s New Look Foundation)

Last week, President-elect Joe Biden’s son Hunter announced to the public that the U.S. Attorney’s office in Delaware is investigating his tax affairs.

According to the Associated Press, the investigation began in 2018, a year before Joe Biden announced his candidacy. At the time, investigators were also looking for potential money-laundering activities. The investigation was kept quiet until recently due to Justice Department guidelines prohibiting its staff from taking overt actions that can affect an election.

Not much is known about the investigation but it was reported that the Department of Justice has issued a subpoena demanding that Hunter Biden disclose information related to two dozen entities, including Ukraine gas company Burisma and his business dealing with Chinese companies.

In 2014, Hunter Biden was hired by Burisma to serve as a member of its board of directors. He was compensated up to $50,000 per month for his work.

It was revealed that Hunter Biden’s former business partner sent him an email informing him that his 2014 tax return needed to be amended to disclose $400,000 in earnings from Burisma.

He also joined the board of directors of the BHR Equity Investment Fund Management Co., a China-based private equity firm in 2013. However, Biden’s lawyer stated that Hunter Biden was not compensated for his work as a board member. He did not acquire an ownership interest in the fund until late 2017, when his father was no longer vice president.

One part of the investigation involved Hunter Biden’s receipt of a 2.8 carat diamond from a Chinese businessman. Hunter, in an interview, said that he felt weird receiving the diamond and gave it to other associates.

How does one give a diamond to other associates? Last I checked, it is quite difficult to cut up a diamond.

President-elect Biden did not comment on the investigation. Nor has the Department of Justice. Hunter Biden said: “I take this matter very seriously but I am confident that a professional and objective review of these matters will demonstrate that I handled my affairs legally and appropriately, including with the benefit of professional tax advisors.”

Hunter Biden does not have a good history when it comes to paying his taxes. The IRS issued a tax lien for the amount of $112,805. The lien was released a short time later which usually means that the balance was paid in full. The District of Columbia issued its own tax lien totaling $453,890. This lien was also released and likely paid off.

Right now, the investigation is just that, an investigation. Assuming Hunter Biden cooperates with the investigation, the prosecution may decide based on the evidence they have to end the investigation without charges or send it to a grand jury who will then decide whether Hunter Biden should be indicted. And during every step of the investigation, Hunter Biden and his lawyers will try to convince the Department of Justice that prosecution is unwarranted.

There is no news that President-elect Biden is under investigation. Nor is there any indication that he has illegally profited from Hunter’s activities.

There seems to be questions as to whether Joe Biden will somehow influence the Department of Justice on the decision to prosecute his son once he is inaugurated next month. He has pledged that he will ensure that the department will maintain its independence once he is in office.

Also, Joe Biden’s pick for attorney general is also likely to be scrutinized by Republican senators about this matter. They may want assurance that everyone involved in the investigation will not be pressured in any way to drop it.

Regardless of what happens, Hunter Biden is not running for office. In light of this investigation, his chances of being nominated for treasury secretary or any position at the IRS is near zero. It would be wrong to attribute Hunter Biden’s transgressions to his father, provided the president-elect did not help him in any way.

On the other hand, Republicans will likely keep a close eye on Hunter Biden’s activities for the entirety of Joe Biden’s first term to make sure that he will keep the Justice Department independent. They will also see it as payback for the Democrats’ and the media’s constant negative stories about Donald Trump’s children. If this is a case where “it’s not a crime if Democrats do it,” there will likely be another shift in power after the midterm elections.

Time will tell as to what the investigation will produce. But Hunter’s tax problems can also be the president-elect’s depending on how he reacts to an unfavorable conclusion.

Steven Chung is a tax attorney in Los Angeles, California. He helps people with basic tax planning and resolve tax disputes. He is also sympathetic to people with large student loans. He can be reached via email at sachimalbe@excite.com. Or you can connect with him on Twitter (@stevenchung) and connect with him on LinkedIn.

5 big healthcare lawsuits of 2020 – MedCity News

Though the healthcare industry spent most of the year attempting to understand and fight the deadly new coronavirus sweeping across the U.S., the legal landscape still saw several companies, patients and organizations go head-to-head on a variety of issues. Here are five big lawsuits of the year.

AbbVie versus Takeda

An AbbVie unit, AbbVie Endocrine Inc., filed a suit against Takeda Pharmaceutical Co., claiming it did not produce the amount of cancer drug Lupron determined in a supply agreement between the two companies, Bloomberg reported. AbbVie Endocrine alleged that the Japanese drug maker either didn’t produce enough units of Lupron or is providing the drug to other customers improperly. But Takeda said that the Lupron shortage was a result of the company fixing manufacturing problems at its plant in Japan that produces the drug.

In the suit, AbbVie said it is seeking the “specific performance” of the supply agreement, as well as damages, according to Bloomberg.

Suzanne Stone versus UnitedHealthcare

Suzanne Stone, who had an employer-provided health plan operated by OptumHealth Behavioral Solutions of California, filed a suit against UnitedHealthcare, OptumHealth’s parent company. The suit alleges that the payer violated the Federal Parity Act and the California Parity Act, which requires that health plans provide equal coverage for mental and physical illnesses.

Stone sent her daughter to an out-of-state residential treatment program for anorexia nervosa, but UnitedHealthcare and Optum denied coverage, leading Stone sue.

In a Nov. 9 opinion, the U.S. Court of Appeals for the 9th Circuit sided with UnitedHealthcare, saying that the “denial of coverage was based solely on the plan’s exclusion of coverage for out-of-state treatment, which applies equally to mental and physical illnesses.” The appellate court concluded that UnitedHealthcare did not violate the Parity acts.

Lawsuit against Mayo Clinic

A complaint, filed in the Olmsted County District Court, alleges that Mayo Clinic failed to protect patients’ health data after a former employee inappropriately accessed records for more than 1,600 patients, according to the Star Tribune.

In October, the health system disclosed that a former employee accessed the records and viewed names, dates of birth, demographic information, clinical notes and digital images. The employee did not view Social Security or bank account numbers, the Star Tribune reported.

The lead plaintiff, Olga Ryabchuk, was one of the patients whose records were accessed. In the complaint, she alleges the incident violated the Minnesota Health Records Act, which bans unauthorized access to patient health records. She also alleges the employee’s actions invaded her privacy and caused emotional distress.

The filing seeks a class designation for all the patients whose records were viewed, the Star Tribune reported.

ACA legality case

On Nov. 10, the Supreme Court — with the newly confirmed Justice Amy Coney Barrett — heard the first arguments in a case that challenges the constitutionality of the Affordable Care Act’s individual mandate. The challengers in the case claimed that after Congress reduced the penalty for not purchasing health insurance to $0 in 2017, it could no longer be considered a tax, which would make the individual mandate unconstitutional.

The challengers also argued that the individual mandate could not be separated from the rest of the ACA, which may mean other provisions of the law could be deemed unconstitutional if the mandate is overturned.

But, despite the 6-3 conservative majority, the court appeared hesitant to strike down the entire law, with Chief Justice John Roberts and Justice Brett Kavanaugh questioning the individual mandate’s centrality to the ACA.

Teladoc versus AmWell

Teladoc Health Inc., filed a lawsuit against American Well Corp., alleging its rival is infringing on its patents for several types of technology. The disputed patents cover technology developed by Dr. Yulun Wang and his colleagues while working for InTouch Technologies, a telehealth company that Teladoc acquired in July.

In the suit, Teladoc alleges that AmWell is selling and promoting telemedicine carts and products that infringe on the patents it gained after buying InTouch.

Teladoc is seeking monetary and injunctive relief and demanding a jury trial.

Photo credit: artisteer, Getty Images