When relying on analytics to craft litigation strategy, it is essential to know what happened in similar cases. When practitioners are looking into hiring counsel or assessing the competition, they need to answer the question, “Who won?” Similarly, when assessing motion strategy, a judge’s record isn’t complete without information about how the judge ruled at certain points of litigation.

Lex Machina has the most specific Outcome Analytics on the market, which tell you not only which side won but on what claim. Our data team, which consists of attorneys and legal analysts, reviews important orders to verify what happened. Then, the information is presented in easy-to-use tables, graphs, and charts, so that users can quickly assess the record of a judge, counsel, or party.

Only Lex Machina uses our unique combination of natural language processing and human review to read all available documents and produce claim-specific outcomes that tell you exactly what happened in a case. Our Outcome Analytics include:

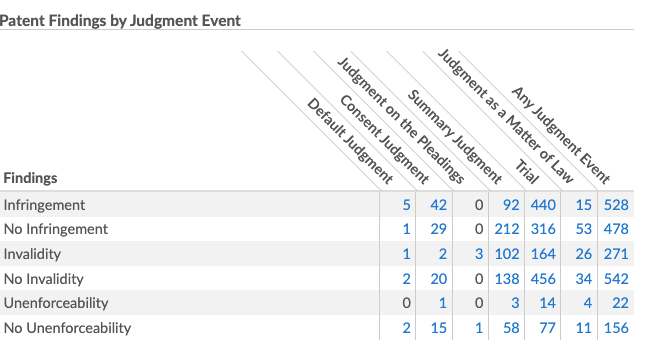

CASE FINDINGS

With nearly 500 claim-specific findings such as “§101 Subject Matter Invalidity” in patent cases or ”Defective Product: Design” in product liability cases, Lex Machina helps users quickly find out how the court ruled on specific issues and at what stage of litigation.

Other Tools: Other products either collect overly-simplified versions of outcomes that are sort of like resolutions or they offer motion practice information that is not based on the substantive arguments. Only Lex Machina can tell you 1) how a court ruled on a particular issue and 2) at what stage of the litigation.

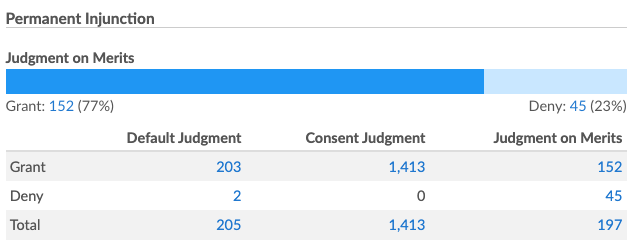

CASE REMEDIES

Find out how the court ruled, including grant/denial rates, on various types of injunctive orders and claim-specific remedies (e.g., specific performance in contracts cases). Practitioners can explore over 50,600 cases that have remedies, and then narrow down using filters to the most pertinent cases to find fact patterns like theirs. Lex Machina doesn’t include noise such as injunctions that are “denied as moot,” so users can quickly see the most relevant cases with injunctions related to their matter.

Other Tools: Other products show whether motions were granted or denied, but do not specify if the ruling was based on the merits of the claim or by consent, etc. Other tools are both over inclusive (they include cases that aren’t pertinent) and under inclusive (they are missing injunctions that require the document itself, rather than just the docket entry text). Don’t waste time going through irrelevant cases.

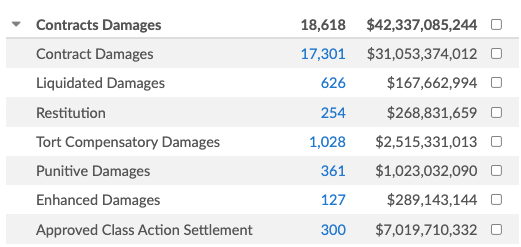

DAMAGES AWARDS

With over 242,000 individual damages awards, Lex Machina allows you to explore damages that are specific to each practice area, including approved class action settlement damages in antitrust cases and pain and suffering damages in torts cases. Get an idea of how often a judge awards certain types of damages, such as attorneys fees or punitive damages.

Other Tools: No other product has a comprehensive set of damages in a specific practice area or offers damage types at such a granular level. Products that claim to have damages only include a fraction of the information because they are not going through the documents themselves. A sample set of damages cannot fully answer questions about what types of damages are at stake.

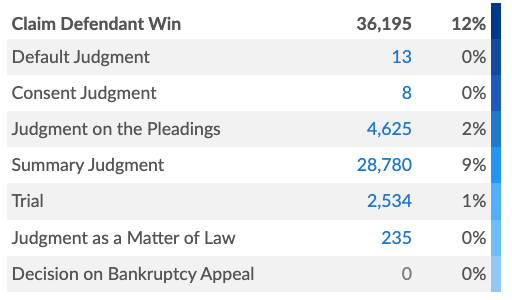

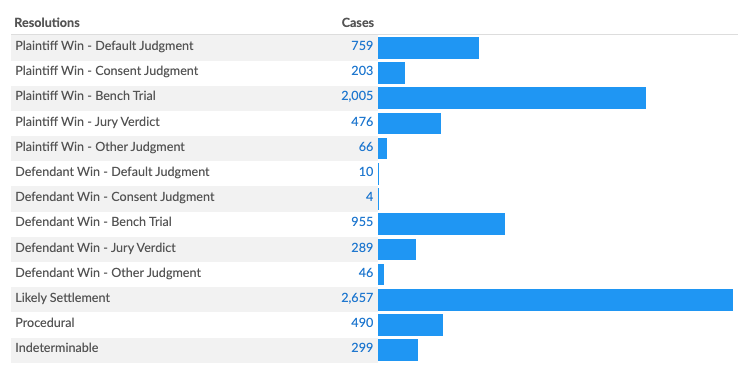

COMPREHENSIVE CASE RESOLUTIONS

Lex Machina helps attorneys determine how often claimants win, defendants win, cases settle, or cases resolve procedurally. You can see at what stages cases resolved, e.g., how often claimants win on summary judgment or whether this court has ruled on a judgment as a matter of law.

Other Tools: Other products either collect overly simplified versions of outcomes based on docket headings or do not collect this type of information in analytics form, requiring users to collect it on their own through keyword searching for individual cases.

STATE COURT RULINGS AND RESOLUTIONS

As the only state court analytics provider using a combination of natural language processing and human review to read underlying documents to understand what happened in a case, Lex Machina gives practitioners the best understanding of what is going on in state court. Lex Machina users can discover whether plaintiffs or defendants win more often in front of their judge or see all cases with bench or jury trials where opposing counsel appeared.

Other Tools: Other products subscribe to a do-it-yourself approach to state analytics, where they can count cases for you but do not provide any outcome information. Users have to do keyword searching in order to get outcome information and organize the data points they find to show outcomes in state courts.

USING OUTCOME ANALYTICS

Legal Analytics are used to win business and win cases. Here’s how having specific outcome information helps legal professionals win more business and win more cases:

- Tout your firm’s record by showing that your clients won, that they were awarded damages, and the specific amounts.

- When advising a client, knowing whether a judge actually grants motions on specific issues is imperative. For example, knowing whether a judge has granted a motion to dismiss based on a failure to identify a trade secret.

- Knowing whether opposing counsel has ever gone to trial on a particular issue allows you to better plan for settlement or trial.

By knowing what happened in cases like yours, you are armed with strategic information to create winning pitches and craft winning litigation strategies. Lex Machina has by far the most comprehensive information on findings, damages, remedies, and resolution information that allow you to confidently make data-driven decisions.

Jordan Rothman is a partner of

Jordan Rothman is a partner of

Kathryn Rubino is a Senior Editor at Above the Law, host of

Kathryn Rubino is a Senior Editor at Above the Law, host of

Chris Williams became a social media manager and assistant editor for Above the Law in June 2021. Prior to joining the staff, he moonlighted as a minor Memelord™ in the Facebook group

Chris Williams became a social media manager and assistant editor for Above the Law in June 2021. Prior to joining the staff, he moonlighted as a minor Memelord™ in the Facebook group