Fuel prices in Zimbabwe have increased for the fourth time in six months. Photograph: Aaron Ufumeli/EPA

Millions of people in Zimbabwe face hardship, hunger and chaos as the economy comes close to “meltdown” and drought worsens.

More than 18 months after the military coup that removed Robert Mugabe from power, the new government is struggling to overcome the legacy of the dictator’s 30 years of repressive rule and the consequences of its own failure to undertake meaningful political reform.

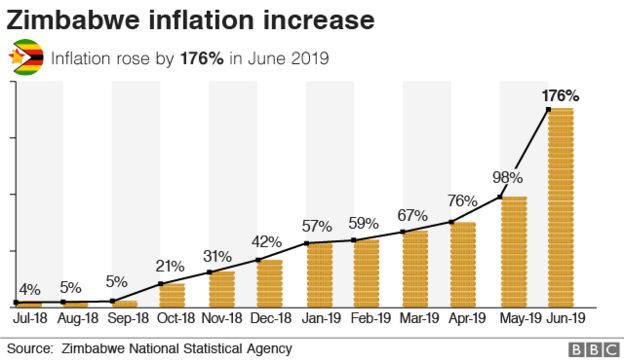

Official figures published on Monday showed annual inflation had almost doubled to 175% in June, adding to the pressure on a population already struggling with shortages of basic foodstuffs, fuel and medicine.

The rising prices reminded many of the economic collapse caused by Mugabe’s policies a decade ago, when hyperinflation emptied shelves of basic foodstuffs and led the southern African country to abandon its currency.

Cleopas Murambwi, 34, a day labourer from the capital, Harare, said the economic crisis had turned him into a “pauper”.

“Just a year ago my salary could sustain my family. Now we just live each day as it comes … It’s like we are sliding back to 2008. The signs are clear and it’s not looking good,” said Murambwi.

Elizabeth Makazhu, who sells vegetables from a stall and earns less than $8 a day, said she was often unable to afford enough to eat.

“Living in the city is now expensive. I hope I can get something to take home to my children. I don’t want them to suffer,” Makazhu said.

A severe drought has caused further hardship and rolling power cuts as water levels in dams have dropped.

The energy minister, Fortune Chasi, said on Monday that the electricity situation was “a very, very big problem”.

The government has repeatedly increased the price of fuel as it tries to end subsidies and is expected to increase electricity prices in coming weeks.

A market stall in Chitungwiza, Zimbabwe. Photograph: Philimon Bulawayo/Reuters

Cecilia Alexander, chair of the Apex Council, a grouping of government workers’ unions, said the government’s austerity plans had reduced even those with jobs to poverty.

“As workers, we refuse to be sacrificed. We … will bring the entire civil service out to protest,” Alexander said.

Protests and a strike in January led to an army crackdown which left more than a dozen people dead and hundreds injured. Authorities were forced to resort to mass trials of detained suspects.

Analysts say the government is making strenuous efforts to stabilise the economy, running a budget surplus for the first time in years and refraining from printing money, a key cause of the hyperinflation of 2008.

Last month, the central bank raised interest rates to 50% to protect the local currency and has made transactions using the US dollar illegal.

But many doubt that Zimbabwe’s new rulers can deliver economic change without wide-ranging political reform. Despite the ousting of Mugabe, the ruling Zanu-PF party remains in control and the army has deep financial interests.

“The trouble with Zimbabwe is a predatory elite that prioritises personal accumulation over public interest and service. Comprised of top ruling party officials, their relatives and friends … It is accountable to no one, relying on coercion to protect its interests,” wrote Siphosami Malunga, director of the Open Society Initiative for Southern Africa, last month. “This economic crisis is politically manufactured.”

Emmerson Mnangagwa, a former vice-president and right-hand man of Mugabe, led Zanu-PF to victory in elections last year. The opposition Movement for Democratic Change contested the result.

Mnangagwa has been either unable or unwilling to push through measures that might have convinced investors and multilateral institutions to provide the funds to resuscitate the economy.

About 7 million people are threatened with hunger.

“We are hard pressed. When there is no money, it becomes difficult to teach and this affects the learners. We are incapacitated. How can someone work without food on the table?” said Prayer Maravamwidze, a 30-year-old teacher from Chipinge.

Some have resorted to selling livestock and land, spending savings, withdrawing children from school and begging, according to a recent report compiled jointly by the Zimbabwe government, UN agencies and aid organisations. Many work two jobs to make ends meet.

Loice Muranganwa, 36, a mother of two from Budiriro, a poor neighbourhood on the outskirts of Harare, earns $57 a month as a nurse.

“I now survive by selling Tupperware. It’s better than waiting for that meagre salary. The government say there is no money,” Muranganwa said.

Staci Zaretsky is a senior editor at Above the Law, where she’s worked since 2011. She’d love to hear from you, so please feel free to email her with any tips, questions, comments, or critiques. You can follow her on Twitter or connect with her on LinkedIn.

Staci Zaretsky is a senior editor at Above the Law, where she’s worked since 2011. She’d love to hear from you, so please feel free to email her with any tips, questions, comments, or critiques. You can follow her on Twitter or connect with her on LinkedIn.

Harare, Zimbabwe – where the price of goods has increased

Harare, Zimbabwe – where the price of goods has increased

Matshela Energy will build a solar plant which is expected to produce 100MW of electricity, in a bid to ease Zimbabwe’s electricity supply crisis which has led to outages lasting up to 18 hours.In a statement released Sunday, the country’s energy regulator, Zimbabwe Energy Regulatory Authority (ZERA) said the company will “construct, own, operate and maintain the 100MW solar power plant called Matshela Energy” in Gwanda, south of Zimbabwe.

Matshela Energy will build a solar plant which is expected to produce 100MW of electricity, in a bid to ease Zimbabwe’s electricity supply crisis which has led to outages lasting up to 18 hours.In a statement released Sunday, the country’s energy regulator, Zimbabwe Energy Regulatory Authority (ZERA) said the company will “construct, own, operate and maintain the 100MW solar power plant called Matshela Energy” in Gwanda, south of Zimbabwe.