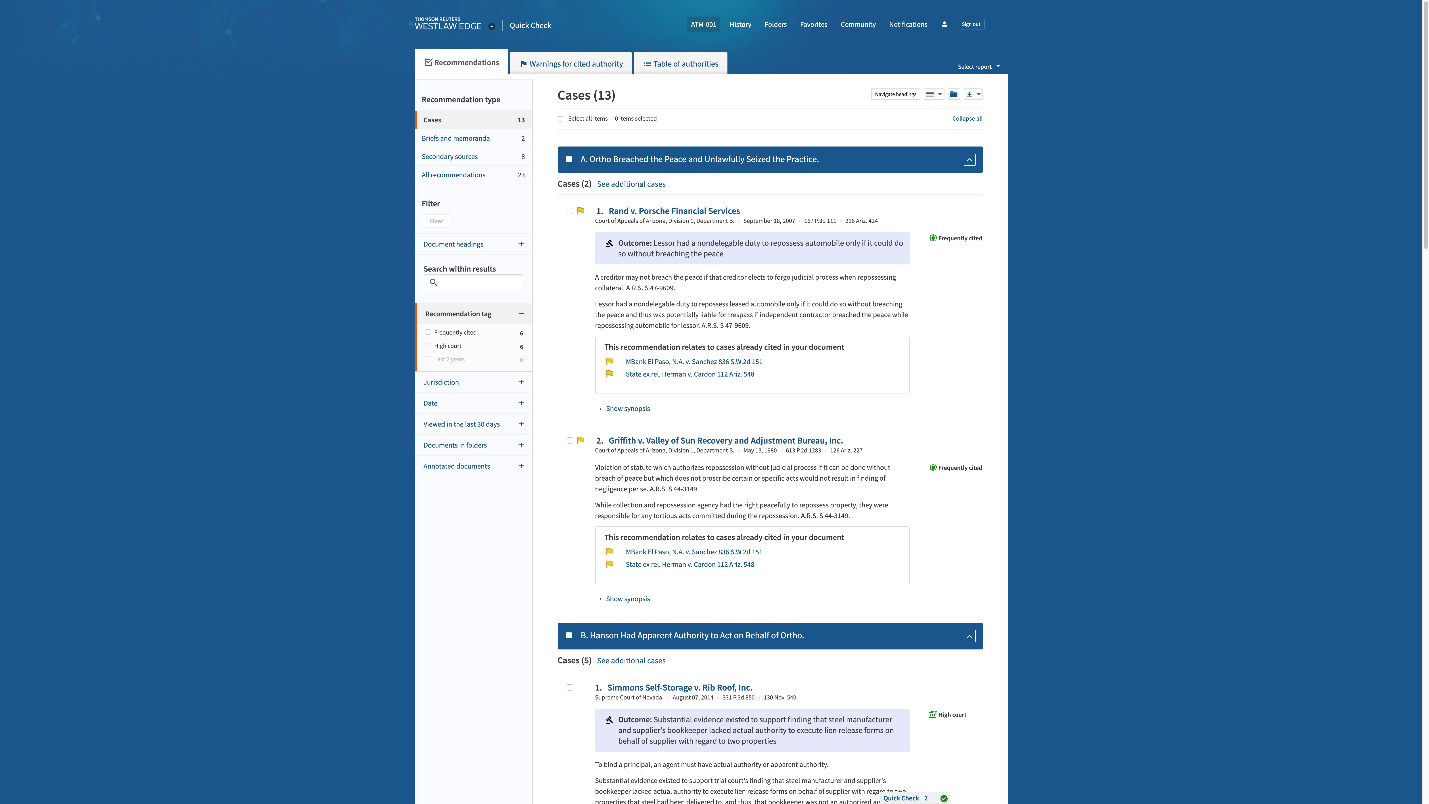

The grave of Sarah Francesca “Sally” Mugabe, the first wife of Robert Mugabe is seen next to two un-occupied graves at the National Heroes Acre in Harare, Zimbabwe September 10, 2019. REUTERS/Siphiwe Sibeko

President Emmerson Mnangagwa’s government wants Mugabe, who led Zimbabwe from independence in 1980 until the November 2017 coup that ousted him, buried at a national monument to heroes of the liberation war against the white minority Rhodesian regime.

But some of Mugabe’s relatives have pushed back against that plan. They share Mugabe’s bitterness at the way former allies including Mnangagwa conspired to topple him and want him buried in his home village.

Mnangagwa has taken the threat to snub a burial at National Heroes Acre sufficiently seriously that he has dispatched a delegation to Singapore, where Mugabe died in a hospital on Friday, to negotiate with the family, government sources said.

The body is expected to arrive in Zimbabwe on Wednesday, adding time pressure to Mnangagwa, who is under fire over an economic crisis and clampdown on dissent that has drawn parallels with the worst excesses of the Mugabe era.

Both men have blamed Western sanctions and accused the United States and Britain of driving opposition protests.

“Mugabe has always been a controversial figure, in life as it is now in death,” said Eldred Masunungure, a politics professor at the University of Zimbabwe. “If the founding father of Zimbabwe wasn’t buried at National Heroes Acre, it would set a very bad precedent and tarnish the image of the head of state.”

In public, senior ZANU-PF officials express confidence that Mugabe will be buried at the monument on Sunday, after a state funeral in a sports stadium a day earlier. In private they say the feud with Mugabe’s family could have been handled better.

One factor that could help Mnangagwa’s delegation, which is led by Vice President Kembo Mohadi, is that Mugabe’s family is divided over where the former president should be laid to rest.

Leo Mugabe, Mugabe’s nephew, is leading a group of relatives who want the former president to buried in his home village of Kutama, some 85 km (52 miles) from Harare, two relatives who have attended planning meetings for Mugabe’s burial said.

That group is also backed by some members of the faction within ZANU-PF that is closely aligned with Mugabe’s wife Grace and wants to get back at Mnangagwa.

Other family members, including Mike Bimha, who is from Grace’s side of the family, think it would be best to mend ties with Mnangagwa by burying Mugabe at National Heroes Acre, the relatives said.

On Tuesday, a tour guide at the monument said he was sure Mugabe would be buried there. A place has been left next to his first wife Sally’s grave within the grandiose structure, which North Korean architects helped design soon after independence.

DIVIDED LAND

Mugabe left behind an economy wrecked by hyperinflation, dollarization and deeply entrenched corruption, and a raging political rivalry between the country’s two largest political parties, ZANU-PF and the opposition MDC.

But many Zimbabweans also remember Mugabe as their country’s liberator from white minority rule and for broadening people’s access to education and land.

Mnangagwa, Mugabe’s former deputy whose power base mainly lies in the military and security sectors, has tried to associate himself with the successes of the Mugabe era and distance himself from his ruinous economic legacy.

He used his powers as president to confer national hero status – Zimbabwe’s highest honour – on Mugabe within hours of his death, making him eligible to be buried at National Heroes Acre, which sits atop a ridge overlooking Harare.

Mugabe wielded those same powers to bestow or deny that privilege to dozens of his former comrades, so it would be highly incongruous for his family to refuse to bury him there.

The influential war veterans, who broke with Mugabe in 2016 and played a key role in bringing Mnangagwa to power, think it would be an affront to the liberation movement if Mugabe is not buried at the shrine.

“If Mugabe identifies with the sacrifices of the Zimbabwean people for whom he was president, he should go there,” chairman of the Zimbabwe National Liberation War Veterans’ Association Chris Mutsvangwa told Reuters.

‘TROUBLED WATERS’

Mnangagwa’s government has not yet released an official programme for Mugabe’s burial.

But in a memo sent to embassies in Harare on Sunday it encouraged foreign heads of state to leave immediately after the funeral service wraps up on Saturday.

Ibbo Mandaza, a political analyst who is writing a biography of Mugabe, said Mnangagwa was trying to avoid the possibility of a situation where heads of state would attend a burial service in Mugabe’s home district to which he was not invited.

“That is the dilemma Mnangagwa faces, he can’t be sleeping well,” Mandaza said.

A senior ZANU-PF politburo member, who requested anonymity to speak freely, said there were lessons to be learned.

“Probably President Mnangagwa should have persuaded and cajoled comrade Mugabe’s family more to avoid this dispute spilling into the public and embarrassing him and the party,” the politburo member said. Mnangagwa’s spokesman George Charamba could not be reached for comment.

Yet analysts are not expecting the country’s opposition parties to be able to capitalise on the row, noting that cracks in the ruling party had opened and closed again previously.

If Mnangagwa persuades Mugabe’s family to bury him at National Heroes Acre, he will be able to use the occasion to cement his position as the country’s pre-eminent politician, politics professor Masunungure said.

“If Mnangagwa plays his cards well the departure of Mugabe is likely to consolidate his control.”

Post published in: Featured

Kathryn Rubino is a Senior Editor at Above the Law, and host of

Kathryn Rubino is a Senior Editor at Above the Law, and host of

Ellen Trachman is the Managing Attorney of

Ellen Trachman is the Managing Attorney of