The current record-holder for world’s largest IPO had a pretty bad day. The company aiming for its crown had a worse one. Much, much worse.

The Shanghai Stock Exchange suspended the initial public offering of Ant Group, the internet finance spinoff of the Chinese e-commerce giant Alibaba, an extraordinary turn of events for what had been set to be the largest share sale in history.

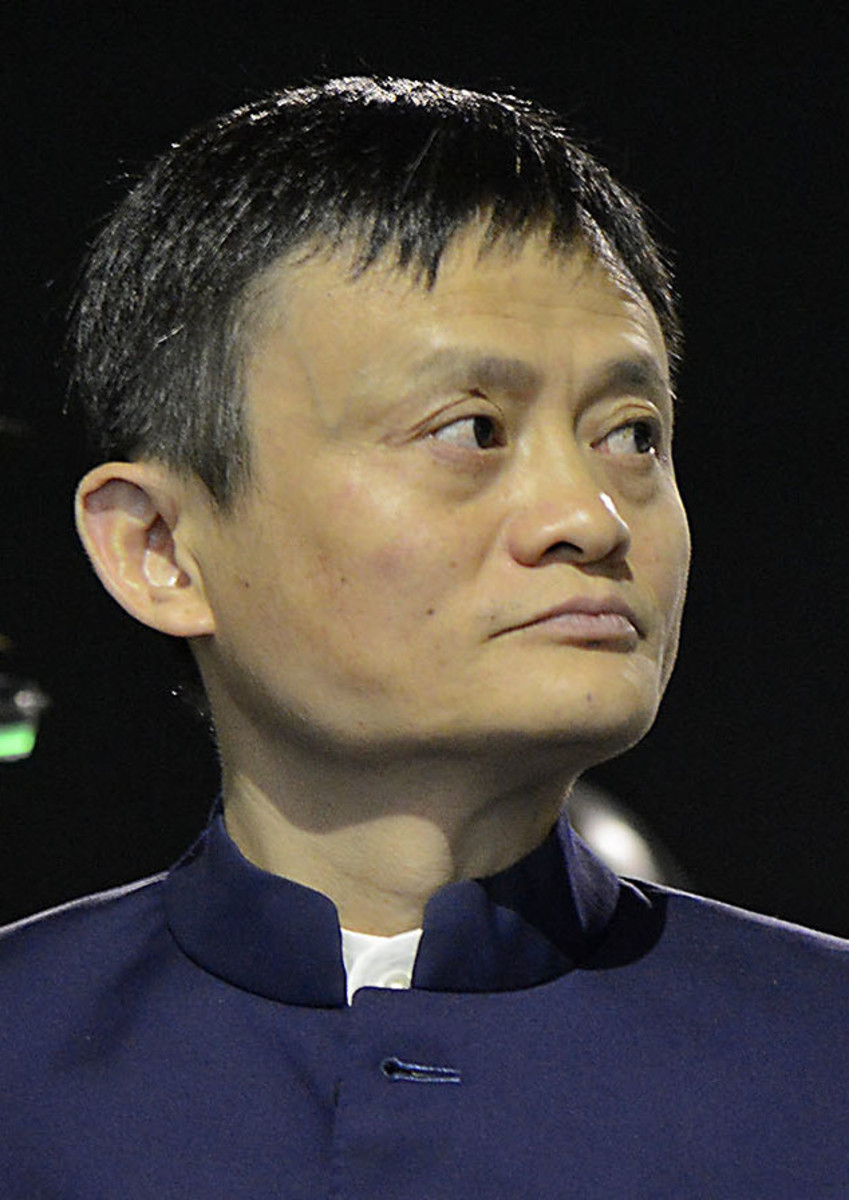

A meeting called by four financial regulators on Monday changed all that. The People’s Bank of China, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission and the State Administration of Foreign Exchange said late in the day that they had summoned Mr. Ma, Ant’s executive chairman, Eric Jing, and its Chief Executive Simon Hu to a meeting, without providing details.

Ant said Monday that “views regarding the health and stability of the financial sector were exchanged” at the meeting, and that it would embrace regulation and service China’s economy and its citizens.

It seems that Jack Ma—no stranger to leading record-breaking IPOs—may be getting a bit too big for his britches as far as Xi Jinping is concerned.

Mr. Ma did not ingratiate himself with the authorities when he said, in a recent speech in Shanghai, that financial regulators’ excessive focus on containing risk could stifle innovation….

The head of consumer protection at China’s banking regulator, Guo Wuping, slapped back on Monday, calling out two popular features in Alipay by name in a sharply critical article in the 21st Century Business Herald, a government-owned newspaper.

China Halts Ant Group’s Blockbuster I.P.O. [NYT]

Ant’s Record IPO Suspended in Shanghai and Hong Kong Stock Exchanges [WSJ]

Aramco Sticks by $18.75 Billion Dividend, Despite Sharp Fall in Profit [WSJ]