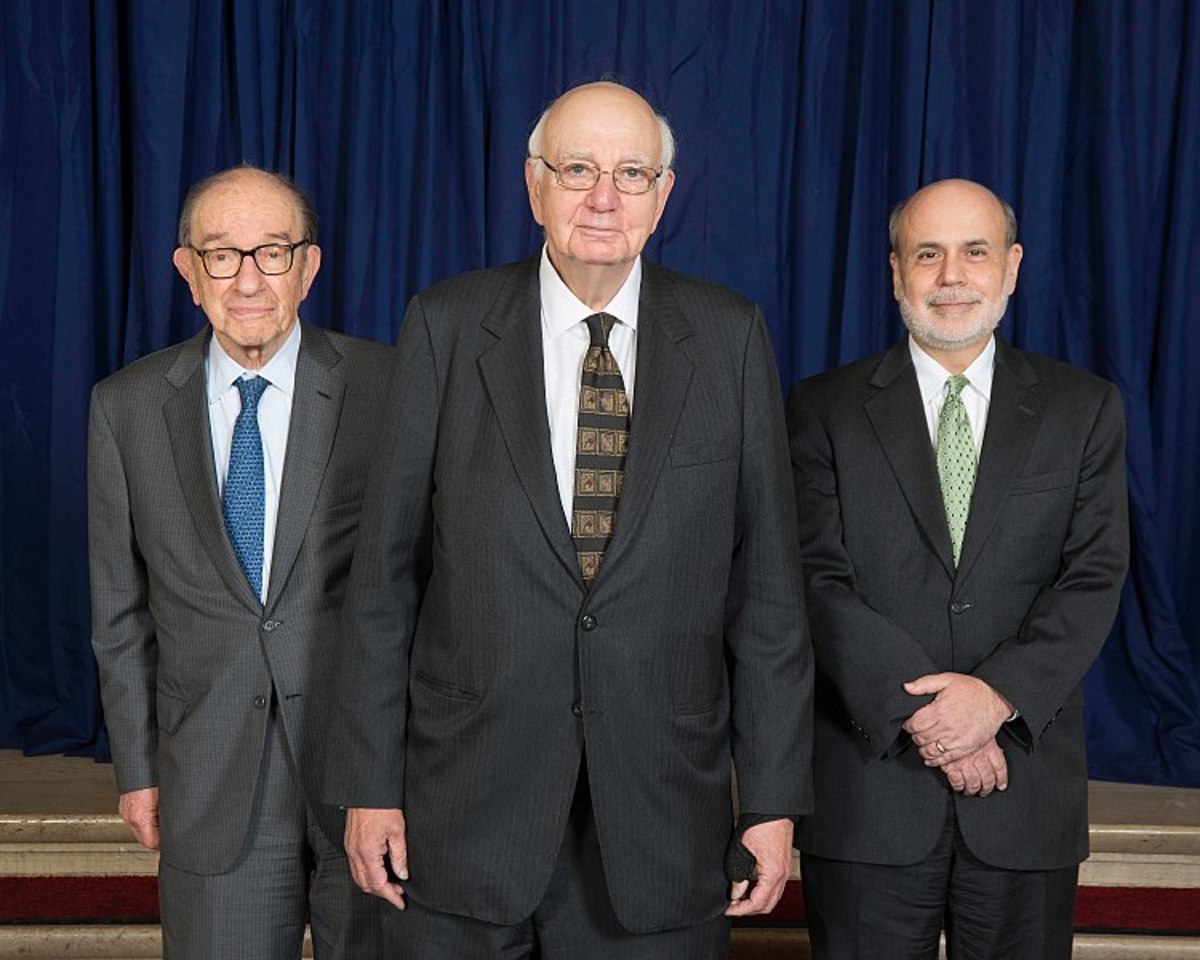

The top ranks of America’s banks and other financial institutions are almost blindingly white; there are more Australians leading one than there are people of color (or, for that matter, women). Not coincidentally—if you could not already discern this from the actions they take—America’s top financial regulators look pretty much the same.

Today, only one of 21 politically appointed financial regulators at eight agencies is Black…. Since the founding of the agencies in the 19th and 20th centuries, only 10 of 327 people appointed to the most senior jobs at financial watchdogs—such as the Federal Reserve and Federal Deposit Insurance Corp.—have been Black… The Securities and Exchange Commission, founded as part of the government’s New Deal programs in 1934, has had two Black commissioners in its history. The Federal Reserve, established in 1913, has had three Black governors.

But, please, by all means, make room for these two, especially Judy Shelton, who just a few months ago had the Republicans who just voted to send her nomination to the full Senate wondering whether her “beggar-thy-neighbor mutual currency devaluation” plans and “fatal attraction to nutty ideas” might not make her the perfect person to serve in a leading capacity at a central bank. Surely she’s better than any person of color this president could find (a depressingly true statement, it turns out).

The Senate banking committee on Tuesday approved controversial Federal Reserve nominee Judy Shelton as well as Christopher Waller for two vacancies on the central bank’s board of governors…. She faced persistent and at-times hostile questions about her support for the gold standard, her beliefs on whether bank deposits should be insured and whether the Fed should be independent of political influences.

Anyway, getting back to the people Shelton will soon be pretending to regulate, let’s talk about the bank that’s fixed its race problems so comprehensively that it no longer needs a chief diversity officer. (You know, the one with the Australian CEO.)

At least six former employees are asking Morgan Stanley to release them from confidentiality agreements so they can tell their stories of alleged racial discrimination at the investment bank…. Christensen, the lawyer acting for former employees requesting release from non-disclosure agreements, countered on Tuesday that Morgan Stanley “must disclose the percentage of black employees and persons of color that were part of the [layoffs] as compared to white employees”.

The lawyer said the bank should “welcome greater transparency, including about who is selected for termination” if it has “nothing to hide about the racial composition of its workforce, including data about hiring, retention, promotion and pay”.

Black Regulators Rarely Appointed to Oversee Wall Street [WSJ]

Key Senate committee approves Shelton, Waller for Fed positions [CNBC]

Morgan Stanley: ex-employees seek contract to allege racial discrimination [Guardian]