The

law

practice

management

platform

MyCase

rolled

out

three

product

updates

today

that

include

MyCaseIQ,

an

AI

conversational

interface;

enhancements

to

its

accounting

module;

and

an

immigration

add-on.

It

also

announced

the

beta

release

of

Smart

Spend,

a

product

that

marries

a

business

credit

card

to

expense

tracking

within

MyCase.

Generative

AI

Enhancements

Last

January,

AffiniPay,

the

parent

company

of

MyCase,

announced

AffiniPay

IQ,

its

strategic

initiative

to

embed

generative

artificial

intelligence

across

all

of

its

products

and

make

AI

a

native

component

of

legal

professionals’

daily

workflows,

along

with

the

beta

versions

of

the

first

two

features

of

that

initiative,

document

summarization

and

text

editing.

Now,

those

two

features

are

coming

out

of

beta

under

the

name

MyCase

IQ.

The

text

editing

feature

is

already

out

of

beta

and

available

within

MyCase,

and

document

summarization

will

launch

within

a

few

weeks.

In

addition,

early

next

year,

MyCase

will

release

an

AI-driven

conversational

interface

will

allow

users

to

source

case

information,

timelines,

and

data,

all

within

the

case

file

itself,

by

asking

questions

in

a

conversational

style.

The

interface

will

be

embedded

directly

in

the

case

detail

page.

It

will

have

suggested

prompts

that

users

can

select,

such

as

to

request

a

summary

of

the

case

or

a

detailed

timeline.

“We

are

on

a

mission

to

make

our

clients

financially

well,

and

to

use

cutting

edge

technology

to

achieve

that

goal

in

partnership

with

them,”

Dru

Armstrong,

chief

executive

officer

of

AffiniPay,

parent

company

of

MyCase,

told

me

during

a

briefing

yesterday.

“So

our

whole

thesis

for

generative

AI

is

to

not

do

it

because

everyone’s

doing

it,

but

to

do

it

because

it

makes

firms

be

able

to

leverage

automation

and

intelligence

to

give

them

time

back

so

they

can

serve

their

clients.”

From

beta

testing

these

generative

AI

features,

Armstrong

said,

one

major

takeaway

has

been

that

attorneys

really

need

to

trust

the

accuracy

of

the

information

the

AI

is

providing.

“So

we’ve

done

a

lot

of

work

to

make

sure

that

everything

that

goes

full

GA

[general

availability]

meets

those

very

high

standards

that

our

attorneys

have,”

she

said.

Accounting

Enhancements

MyCase

also

today

introduced

enhancements

to

its

native

accounting

software.

Among

these

enhancements:

-

1099

vendor

reporting:

To

help

simplify

bookkeeping,

MyCase

Accounting

will

soon

offer

1099

vendor

reporting

directly

within

the

platform. -

Automatic

deposit

slip

creation:

MyCase

accounting

now

offers

automatic

deposit

slip

creation

for

vendors.

When

funds

are

deposited

into

the

firm’s

bank

account,

the

slip

is

created

automatically. -

Automatic

bank

reconciliation:

Once

the

deposit

slip

is

created,

it

is

matched

to

the

corresponding

bank

feed

transaction

from

LawPay,

eliminating

the

sometimes

time-consuming

task

of

reconciling

deposit

slips

and

transactions.

The

deposit

slip

feature

is

available

now,

and

the

other

enhancements

will

be

rolled

out

between

now

and

the

first

quarter

of

next

year.

Armstrong

said

the

bank

reconciliation

is

particularly

powerful

for

its

ability

to

solve

a

core

practice

management

challenge

of

IOLTA

compliance

by

combining

invoicing

within

MyCase,

electronic

payments

via

LawPay,

which

is

also

owned

by

AffiniPay,

and

automatic

reconciliation

within

the

native

accounting

feature.

“When

you

have

MyCase

with

the

invoice

and

billing

engine

combined

with

LawPay,

and

then

having

the

legal

accounting

package

built

natively

in

the

platform,

it

really

makes

it

a

pretty

automagical

experience

to

be

able

to

reconcile

the

invoices

with

the

transactions

with

the

bank

account,”

she

said.

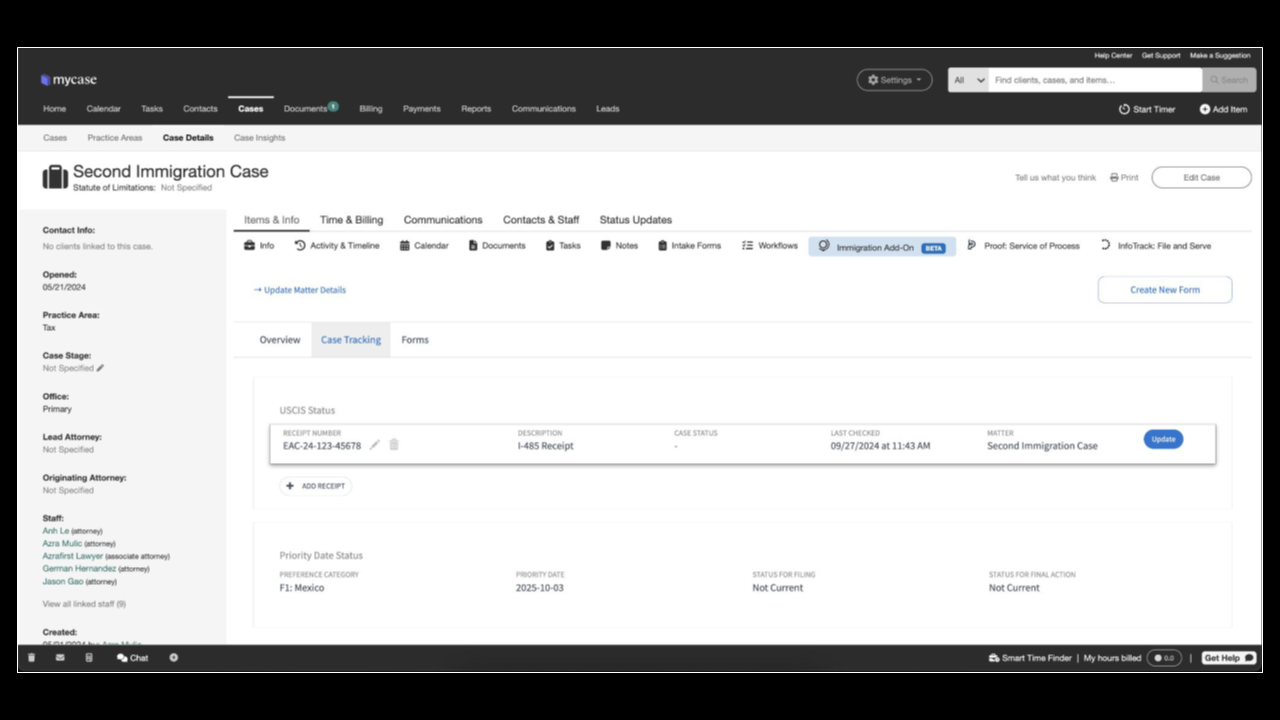

Immigration

Add-On

The

immigration

add-on

uses

an

application

programming

interface

(API)

to

connect

MyCase

with

its

sibling

company

Docketwise,

a

case

management

platform

for

immigration

lawyers.

The

add-on

integrates

immigration

case

management

into

the

MyCase

practice

management

platform,

enabling

immigration

attorneys

to

get

the

benefits

of

both

case

management

and

practice

management

without

having

to

switch

between

platforms.

Armstrong

said

that

many

immigration

customers

wanted

more

of

a

full

practice

management

platform,

while

keeping

the

immigration-specific

case

management

features

of

Docketwise,

such

as

its

Smart

Forms.

Ever

since

AffiniPay

acquired

MyCase,

which

already

owned

Docketwise,

bringing

together

the

capabilities

of

the

two

platforms

“had

been

a

core

part

of

our

vision,”

Armstrong

said.

To

take

advantage

of

the

integration,

MyCase

users

will

required

to

purchase

a

subscription

for

the

Docketwise

add-on.

The

monthly

cost

of

the

add-on

will

be

$79

per

user

or

$69

if

purchased

annually.

Once

purchased,

all

Docketwise

features

will

be

available

directly

within

MyCase,

without

having

to

switch

platforms

or

even

ever

use

the

Docketwise

platform.

Among

the

features

the

add-on

provides:

-

Smart

Forms:

Users

can

auto-populate

immigration

forms

with

client

data,

eliminating

manual

entry. -

USCIS

case

tracking:

Track

the

status

of

immigration

cases

through

automatic

USCIS

updates,

keeping

attorneys

and

clients

informed,

from

within

MyCase. -

E-filing:

Enables

electronic

submission

of

immigration

forms

directly

to

government

agencies

(USCIS,

DOL

FLAG,

DOS

CEAC)

from

within

MyCase. -

Priority

date

tracking:

Monitors

key

dates

to

ensure

timely

actions

are

taken

on

immigration

cases,

minimizing

the

risk

of

missed

deadlines.

The

immigration

add-on

is

being

soft-launched

before

the

end

of

the

year

and

will

be

made

generally

available

to

all

users

sometime

next

year.

Smart

Spend

Beta

MyCase

also

said

today

that

the

Smart

Spend

feature

it

announced

last

February

will

become

available

for

beta

testing

by

select

customers

staring

Oct.

21.

It

will

be

released

for

general

availability

in

the

first

quarter

of

next

year.

MyCase

had

initially

said

it

would

be

released

in

beta

in

the

second

quarter

of

this

year

and

then

to

general

release

in

the

third

quarter.

The

Smart

Spend

feature

promises

to

offer

a

business

credit

card

for

law

firms

that

is

tied

to

software

that

directly

channels

client-related

expenses

into

the

associated

matters

and

invoices

within

the

MyCase

platform.

It

provides

law

firms

with

a

LawPay-branded

Visa

credit

card

for

their

attorneys

and

staff.

All

spending

on

the

card

is

tracked

to

a

dashboard

where

the

firm

can

monitor

all

of

its

business

and

client

expenses.

Spending

is

also

integrated

within

MyCase,

so

client

expenses

are

directly

tracked

to

the

matter,

including

the

nature

and

category

of

the

expense

and

any

associated

receipts.

‘Big

Moves’

Ahead

In

July,

it

was

announced

that

Genstar

Capital

had

made

a

significant

investment

in

AffiniPay,

while

TA

Associates,

which

had

been

the

company’s

largest

investor

since

2020,

would

continue

to

retain

a

“meaningful

stake”

in

the

company.

During

our

briefing

yesterday,

Armstrong

said

that

she

was

“super

excited”

about

the

new

investor,

which

now

owns

the

larger

share

of

the

company.

“They’re

a

phenomenal

software

investor

with

just

an

amazing

track

record

of

helping

build

best-in-class,

high-growth

software

businesses,”

she

said.

She

said

the

driving

force

behind

the

deal

was

to

be

able

to

invest

more

in

product

research

and

development

in

order

to

deliver

more

for

the

company’s

customers.

“It’s

giving

us

an

opportunity

to

think

more

strategically

about

our

position

in

the

market,”

Armstrong

said.

“We

were

super

successful

with

our

MyCase

acquisition,

and

I

think

you’re

going

to

see

us

making

some

big

moves,

whether

it’s

in

products

that

we’ve

built

or

products

that

we’ve

partnered

with

or

products

that

we

bought.”