A scholarship program implemented by California Western School of Law has added yet another predatory pricing tactic to the arsenal of law schools seeking to stay financially afloat.

For the upcoming school year, Cal Western will award the “Admissions Scholarship” to students as an apparent alternative to conditional scholarships. Also known as a bait-and-switch scholarship, a conditional scholarship is one where the student must maintain a particular class rank or GPA to keep it. While this program appears more generous than its predecessor, a closer look at a scholarship award letter sent to an accepted applicant and obtained by Law School Transparency makes clear that this is not the case.

The law school did not respond to questions emailed to Marilyn Jordan, the Director of Community Relations. Ms. Jordan says that the school has begun a review of its current policies, which according to its website govern “most entering scholarships.”

According to the award letter, the Admissions Scholarship is a one-year award that covers a percentage of tuition. The student will receive an additional award in the second and/or third year commensurate with the student’s class standing. However, if the student transfers from Cal Western at any time, the student must repay “the total value of the scholarship awarded up to that point . . . in full within 30 days.”

Jerry Organ, Bakken Professor of Law at the University of St. Thomas School of Law (Minnesota), has studied law school scholarships extensively. He could not find any references to similar policies. “I do recall either reading about or having a conversation with someone a few years back about the possibility of this approach to discouraging transfers. I remember at the time thinking it was problematic, so I am surprised to see it being utilized.”

A student who receives an award for 100% of tuition for the upcoming academic year would pay the school an additional $56,080 more or less immediately if they decide to transfer after the first year under the terms of the award.

According to several experts, the threat of repayment is likely to play a dramatic role in that choice. Heather Jarvis, an attorney and expert on law school finance who served on the ABA Task Force on Financing Legal Education, said that this program is “obviously intended to coerce people into staying. They don’t want to lose enrollment.”

Nikki Laubenstein, a law school consultant with Spivey Consulting Group, agreed. “It clearly comes across as a huge retention effort.” Laubenstein added, “If I were a student and saw the threat of having to repay a large sum of money that I was awarded, it would weigh on me. It’s a lot of money to have to think about returning to the school.”

Less than half of Cal Western’s graduates obtained full-time lawyer jobs last year, principally within California. Students often transfer to different schools for improved employment opportunities, geographic reasons, or familial reasons. Jarvis said that it is “particularly harsh” for the school to limit options in the middle of a pandemic. “I would hope and expect that the school would allow for flexibility under these circumstances.”

Knowing that it is not reasonable for law students to come up with this money quickly, the school offers an institutional loan to help with repayment, although the terms, interest rates, and underwriting factors were not included in the offer. The offer indicates that this information is available for review in Cal Western’s business office and that students are generally approved for these loans if they submit the required documentation. The law school declined to comment on the terms of these loans and how accepted students can access them.

The upper-level awards come with additional stipulations as well. The most notable is that the student must obtain permission to take the bar exam outside of California. The consequence for sitting for the exam elsewhere without a waiver from the school is not apparent from the award letter. The law school declined to specify the consequence for proceeding to first take the bar exam in another state without a waiver.

The Program Avoids ABA Disclosure

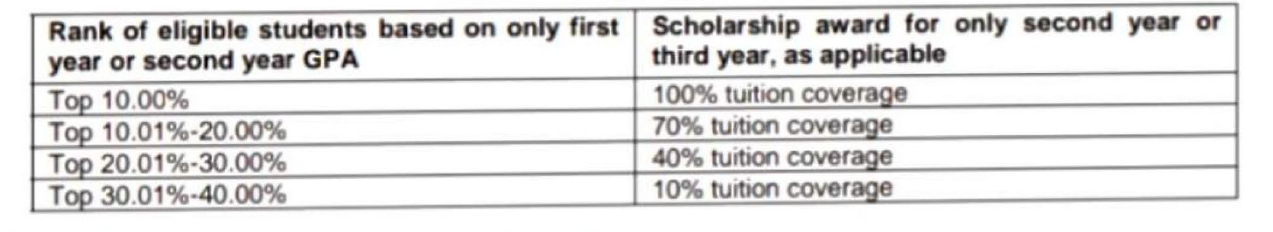

Law schools must report conditional scholarships according to rules set by their accreditor, the ABA Section of Legal Education and Admissions to the Bar. A school must report the number of conditional scholarships it awards as well as the number of students who lose them. By restructuring their conditional scholarships as one-year awards, with awards in subsequent years dependent solely upon class rank and GPA performance, the school successfully circumvents the ABA’s requirement to disclose.

According to Professor Organ, who played a key role on an ABA committee tasked with creating the definition nearly a decade ago, the Cal Western award has the same effect as its previous conditional scholarship program but does not qualify as a conditional scholarship as defined by the ABA. However, he added, “with the specific information about scholarships awarded to returning second-year students, it creates a potential misperception by the incoming students similar to that associated with conditional scholarships.”

Students are inclined to overestimate their ability to succeed among peers who are just as capable in the classroom. The result: Students under both the previous and current programs think they will pay less for law school than they really will. Under the new program, Cal Western avoids a key safeguard from the ABA against consumer unfriendly practices: transparency.

“Without knowing the percentage of first-years receiving [this Cal Western] scholarship (and the percentage then who will not have a scholarship as second-years), students with a scholarship may be overconfident about their ability to perform well enough to be one of the 40% of second-year students who will have a scholarship under the upper-level scholarship policy,” according to Professor Organ.

These Awards May Actually Be Loans

While Cal Western calls their award a scholarship, it may be a misclassified loan that the school will forgive if the student does not transfer. According to Jennifer Bird-Pollan, the Robert G. Lawson Professor of Law at University of Kentucky J. David Rosenberg College of Law, “if it were a forgivable loan, there would be tax liability associated with the forgiveness.” Canceled debt under the Internal Revenue Code triggers an income event.

The initial question is whether it is actually a scholarship or a loan disguised as a scholarship.

A Cal Western student with a traditional scholarship would receive a tuition bill for $28,040 for the fall trimester. If the scholarship covers 40% of tuition, the student’s bill would indicate a scholarship of $11,216 and a balance of $16,824, which would usually be paid for with a federal student loan. After the trimester, the student may continue at Cal Western, drop out, fail out, take a leave of absence, or transfer—but there are no further transactions between the school and the student for the fall trimester.

Based on the award letter, Cal Western will approach this the same way this academic year with their Academic Scholarship recipients. However, in the event the student transfers, the school will convert the fall trimester award of $11,216 to a loan that must be repaid within 30 days. This part is rather straightforward. Per the award agreement, the student must repay the award amount.

The students who do not ever transfer, however, face a slightly different scenario. They do not need to repay the $11,216 from the fall trimester. These students satisfy their obligation not to transfer.

“To me, it’s clearly a loan from the start,” said Jarvis. “Additionally, this sounds like a student loan – not a scholarship – and this is even worse for the student because it’s more difficult to discharge a student loan in bankruptcy.” As a private student loan, it would also not have the affiliated protections of the federal student loan program.

The consequences for misclassifying the award as a scholarship rather than a loan would be borne by both the students and the school. If the loan amounts to canceled debt, a student would need to pay income tax on the canceled debt of $11,216 for the fall trimester, as well as any other awards they received prior to transferring to a different law school. Cal Western would need to satisfy state and federal lending laws and disclosure requirements. The law school declined to comment on the award classification and did not say whether it has satisfied any legal requirements for loan providers.

Professor Bird-Pollan agrees that the award looks more like a loan than a scholarship from the start. “I think if the government wanted to make the argument, they would have a very compelling case. But given that there are government programs that have similar features, my guess is they’re not going to make that argument.”

She added if she were a judge hearing the argument that this was a loan, she’d say, “Wow, that sounds pretty convincing.” But as a practical matter, “the government doesn’t pursue every tax law that we know ought to be enforced.” She gave the example of “politicking from the pulpit” as a tax law that the “government is totally not interested in enforcing.”

According to Professor Bird-Pollan, the best legal argument for the school is that scholarship money is used to repay the loan. Under this framing, the student would have received a loan, declined to transfer, and subsequently received a scholarship to extinguish the loan. The scholarship would not be subject to income tax under Section 117 of the IRC and the debt would not have been canceled. This may alleviate student fears about taxable income from the award.

Still, Professor Bird-Pollan does not feel good about the program. “It’s kind of skeezy. [The transfer stipulation] feels very underhanded. But does that change the tax analysis?” She didn’t think it changed the outcome, but did say it may change the analysis, in part because it’s coercive.

She compared it to blackmail. “Why don’t you get your students to stay because you’re doing a great job educating them? Why don’t you get them to stay because you’re getting them good opportunities? For the ones who want to leave because they’re going to have a better opportunity somewhere else: Why don’t you say, congratulations and good luck? It’s disheartening that this is going to be the reason they’re going to be able to keep people.”

On August 1, 2020, Sean M. Scott will begin her term as president and dean of the law school. According to Ms. Jordan, the school’s spokesperson, the incoming dean “has begun a review of existing policies and prefers we not comment until after she has had a chance to complete her review.”

Kyle McEntee is the executive director of Law School Transparency, a 501(c)(3) nonprofit with a mission to make entry to the legal profession more transparent, affordable, and fair. You can follow him on Twitter @kpmcentee and @LSTupdates.

Adam Manaa is a project manager at Law School Transparency. He starts law school at Pepperdine University Caruso School of law this fall.