“Zimbabweans are heartbreakers, trust you me,” drawls Prince Matsika as he reworks a hand-strung necklace in front of his stall at an outdoor city market. People bustle by, but few even glance at the beaded trinkets and wooden crafts crowded onto tables and baskets. With rapidly rising inflation and food shortages across the country, now only the wealthy and foreign tourists can afford his wares.

“Even if [tourists] come, they would think our prices are ridiculous,” Matsika says. He’s selling a piece of his own design for $20, a king’s ransom for the developing world. “But we are trying to earn that little money,” he explains, even though “it doesn’t really have serious value around here.”

It is January, and the coronavirus epidemic in China has just begun making headlines in the West. But Zimbabwe has been in a state of economic crisis since 2018, shortly after a coup d’état toppled the 37-year reign of dictator Robert Mugabe and installed his longtime political ally Emmerson Mnangagwa as president. Major factors in the sharp economic decline include government corruption, a horrific drought, and rampant inflation and cash shortages after the reintroduction of a Zimbabwean dollar (ZWL, colloquially called “bond”) following almost a decade under a multi-currency system.

In Matsika’s city of Bulawayo, the second largest in Zimbabwe, hungry citizens helplessly watch the staggering devaluation of their wages, savings, and pensions. Even as the public education system raises school fees, teachers cannot afford to get to work. Recently, doctors in public hospitals reluctantly ended a four-month strike, even though their salaries are now worth just 10 percent of what they were promised and despite the lack of basics, including bandages.

A minimum-wage employee in Zimbabwe may earn ZWL$600 per month (about $35), with a loaf of bread costing around ZWL$16, according to Godfrey Kanyenze, director of the Labour and Economic Development Research Institute of Zimbabwe. So Zimbabweans have become entrepreneurs by necessity. Over 90 percent of those who work are informally employed, frequently under the table, Kanyenze said in a lecture. They make jewelry at local markets, grow bananas and sell them from curbside carts, set whatever wares they can find atop cardboard stands on the street, hawk black-market gasoline, or illegally change U.S. dollars into bond in front of shopping malls.

“It’s not healthy for us,” Matsika says. “You have to be working flat-out all the time.”

Seven days a week, Christine, a softspoken seamstress in her 50s, hunches over her sewing machine in a cramped workshop she shares with Patrick, a young shoemaker. (Their names have been changed for fear of government retaliation.)

“If you don’t work, there’s nothing,” Christine says. “We have no weekend, no holiday. We work every day.” She starts cutting fabric before dawn, then comes into the workshop at 9 a.m.

Matsika is also up at 5 a.m. most days to make the trek, via privately operated minibus, into the city from a low-income township outside Bulawayo. While transportation is readily available, fuel shortages have driven fares up and up. Many interviewees for this article say only a year ago they paid ZWL$0.50 for a one-way trip. That has risen to ZWL$5, a 900 percent increase. The government recently introduced a more affordable bus service, but demand is so high that people can wait in line for hours for a spot at rush hour.

When Christine finally gets home in the evening, she often works well into the night—if the lights will come on. “The electricity is a nightmare,” she says. The townships will sometimes be without it for more than 15 hours at a time.

Power outages are scheduled for two five-hour chunks during the morning and evening peak hours, but “the durations may be longer in the event of increased power shortfall to avoid the collapse of the National Electric grid,” a notice from the Zimbabwe Electricity Transmission and Distribution Company reads.

“People are living an abnormal life,” Christine says. “When the electricity comes at 11 [p.m.], they wake up and start cooking, then do the ironing, the washing, because in the morning it will be gone.”

Three days a week, the local government schedules neighborhood-wide water shut-offs due to drought, according to the Bulawayo City Council website. But “with the water [service], at least you know it will be 72 hours before it comes back,” Christine says.

Between reused plastic jugs and buckets, Christine has at least 100 liters of water stored at her home. “Every container you find, you just fill it with water…inside and outside the house. Even the bath,” she says.

Utility bills can be paid electronically, which is fortunate, because getting hold of hard cash is tough. When the new Zimbabwean dollar was introduced in June 2019, the government pegged it one-to-one with the U.S. dollar. Today, the exchange rate is about ZWL$18 to $1.

The first Zimbabwean dollar originated in 1980 after the country, then called Southern Rhodesia, fought and won a guerrilla war for independence against its British colonizers. As white settlers made up 1 percent of the population but controlled the majority of arable land, former freedom fighter and new government leader Mugabe put into place a moderately successful “resettlement” program, which compensated landholders and redistributed their property to black Zimbabwean farmers. In 2000, Mugabe’s party amended the constitution to allow the legal seizure of farmland without compensation. The mismanagement of that program contributed to severe famine, according to a report by the U.K.’s Africa All-Party Parliamentary Group. The food instability in Zimbabwe today is an ongoing symptom of this.

During the global recession of 2008, the Zimbabwean dollar saw inflation hit 500 billion percent before it was abandoned in favor of the multi-currency system. In its original incarnation, Zimbabwean bill denominations reached 100 trillion—not even enough to buy a loaf of bread. (Ironically, those bills are now sold on eBay for around $40 U.S.)

“The light at the end of the tunnel in 2008–9 was dollarisation,” wrote University of Zimbabwe economist Tony Hawkins in the Zimbabwe Independent last year. “Inflation came to a shuddering halt, the economy returned to positive growth for the first time in a decade and a financial sector, ravaged by hyperinflation, recovered strongly.”

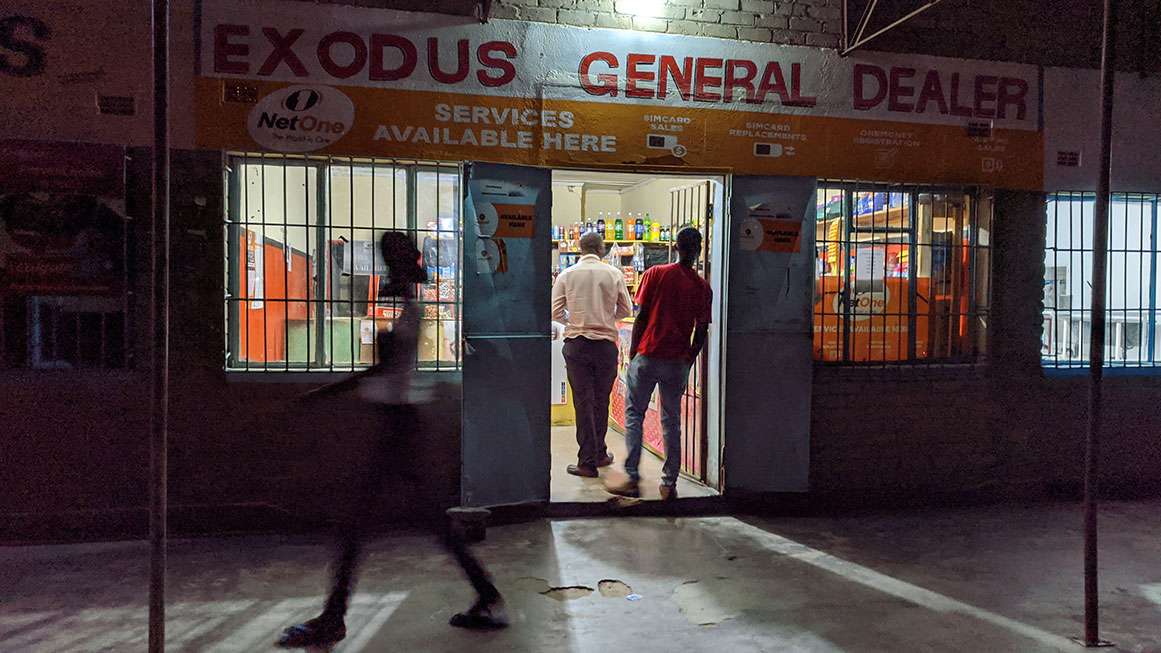

Reecy PontiffTownship minimarket

A national shortage of the U.S. dollar starting in 2015 prompted the government to mint “bond,” a substitute currency that acted as a placeholder for foreign cash, according to Al Jazeera. When bond devalued swiftly, thanks to the black market, the government attempted to integrate it into a new Zimbabwean dollar and banned most use of foreign currencies.

“De-dollarisation in 2019 has turned the clock back towards hyperinflation without achieving its basic objective of providing a viable alternative to the United States dollar, trusted by the community,” Hawkins’ article explained.

Most businesses today are prohibited from listing prices in foreign currency, though many continue to do so because of the lack of bond available on the ground, Kanyenze says. The government has been drip-feeding bond into the country, but the highest denomination is currently a five-dollar note—and thanks once again to inflation and price hikes, many businesses refuse to accept coins from customers. Lines form at ATMs early in the morning, as people wait in the hope that cash will be available that day.

“Sometimes you queue for the whole night and you can’t even get that cash, so it’s a total waste of time,” says Brian, a bartender in his 30s. (In fact, he’s a trained electrician, but he says no one can afford to hire him to do skilled work right now.) His current job doesn’t allow him time to line up anyhow. He pulls in ZWL$1,000 per month (about $55), and like many others, he’s paid in Ecocash.

Ecocash is a private, mobile phone–based money transfer service that most Zimbabweans have come to rely on. The fees are a source of frustration. When getting cash from their accounts, customers can be dinged up to 25 percent—on top of which the government added a 2 percent tax per transaction in 2018.

“I put [Ecocash] on my phone, and later on I looked at the charges and said, ‘This is the worst rip-off I’ve ever seen,’” says George—not his real name—while visiting Bulawayo from his residence in Canada. He’s appalled at how bad things have gotten in the country where he spent his childhood. “When you go to the supermarket, someone will beg you to [let them] pay [for you] by Ecocash, and you give them the cash,” he says. These days it’s common for people to turn their electronic money into hard currency in this manner. Sometimes even cashiers will offer it as an illicit service.

Customers can also be penalized by businesses for an Ecocash transfer. At a local butcher, George found the price for beef was listed at ZWL$58 per kilo in hard currency but ZWL$79 per kilo for Ecocash.

“I miss the days when things were cheap cheap cheap!” says 23-year-old Autumn Jade Paishotam, a bistro server. When you went shopping, “they wouldn’t have change, but they’d give you a pen and say, ‘There’s your change,’ or they’d give you bubble gum or something. Now there’s nothing like that.”

At her last job, Paishotam was paid $100 in U.S. greenbacks per month. While preferable to Ecocash, having that much money on hand made her nervous because of personal experience with muggings. On payday, she would immediately convert some of the dollars into bond with a black market money-changer—abundant on Bulawayo’s streets, blatantly flashing stacks of currency, despite the illicit nature of their trade. Paishotam got a better exchange rate there than at the shops, which might overcharge her if she paid in U.S. dollars.

Finding work can be hard, and sometimes employers take advantage of this. Her cousin, who shares a small three-bedroom house with Paishotam, her father, and her aunt, is working “on trial” repairing and installing air-conditioner units.

“If they say, ‘I’m assessing you for two months,’ that means you’re working two months for free,” Paishotam says. “Transport [and] everything is on you, which is not fair. And at the end of the day they can still say, ‘We don’t want you.’”

She says her cousin’s last employer at a mobile phone shop did exactly this, releasing him without any compensation after months of work. This practice contributes to the preference for self-employment, often in the black markets. In many cases, people can’t afford to take a formal job.

George doesn’t have much hope for the country under this administration, which he believes is essentially a continuation of Mugabe’s regime but with added military control. “The political situation is so oppressive,” he says. Given “the way this country has dragged these people back to almost a primitive stage,” he believes he made the right decision to move his family to Canada. “People are worse off in terms of freedom of expression. If someone was to see we were talking, we’d get very much into trouble.”

The quashing of political dissent has been more profuse under Mnangagwa’s government than even under the iron-fisted Mugabe, according to Roselyn Hanzi, director of the group Zimbabwe Lawyers for Human Rights. In 2019, during protests over a government-imposed fuel price hike of more than 100 percent, more than 1,000 protesters were arrested within two weeks. Some were dragged out of their homes by police after the fact, tortured, and prosecuted without legal representation. “That has never happened [on this scale], as far as I can remember,” Hanzi says. “Every other day [activists are] getting attacked by the police…brutally and arbitrarily.”

Brian the barman thinks the city streets are more dangerous these days. “You have a slip of the tongue and the police will arrest you,” he says.

Confidence in the democratic process is also low. Human Rights Watch reported an uptick in intimidation of and violence against opposition supporters by police and the military around the 2018 presidential election that solidified Mnangagwa’s power. Exactly how “free and fair” the voting was is still up for debate, according to a number of outside election observers. Plenty of Bulawayans are convinced the race was rigged.

To vote is “wasting time,” Brian says. He believes that even if the opposition party won in a landslide, the ruling party would just “steal the election.”

“Voting’s dangerous. It has to be so secret who you vote for,” says Paishotam. And “no matter who you vote for, whoever [the government] thinks should be there is going to be there.”

“As long as the government is not willing to implement reforms and open up the country to investment or even just to ensure there is rule of law in enforcement,” Hanzi has little optimism. These things “would probably go a long way to improve the lives of normal Zimbabweans.”

An “inclusive approach to dialogue is particularly critical given the loss of confidence and trust in authorities and government institutions and the perception that they are conflicted and engage in rent-seeking behaviour and corruption,” writes Kanyenze, the economist, in an email.

But “because of the situation on the ground, there are far less people who are willing to be active…around human rights,” Hanzi says. “They are busy trying to make ends meet.”

“Life in Zimbabwe is terrible,” says Christine the seamstress, whose three grown children are all living in South Africa. “Here, there is no future for them. No future.”

“I think this place needs a serious engine overhaul,” says Matsika, standing in front of his jewelry stand. “Only God can help us through this.”