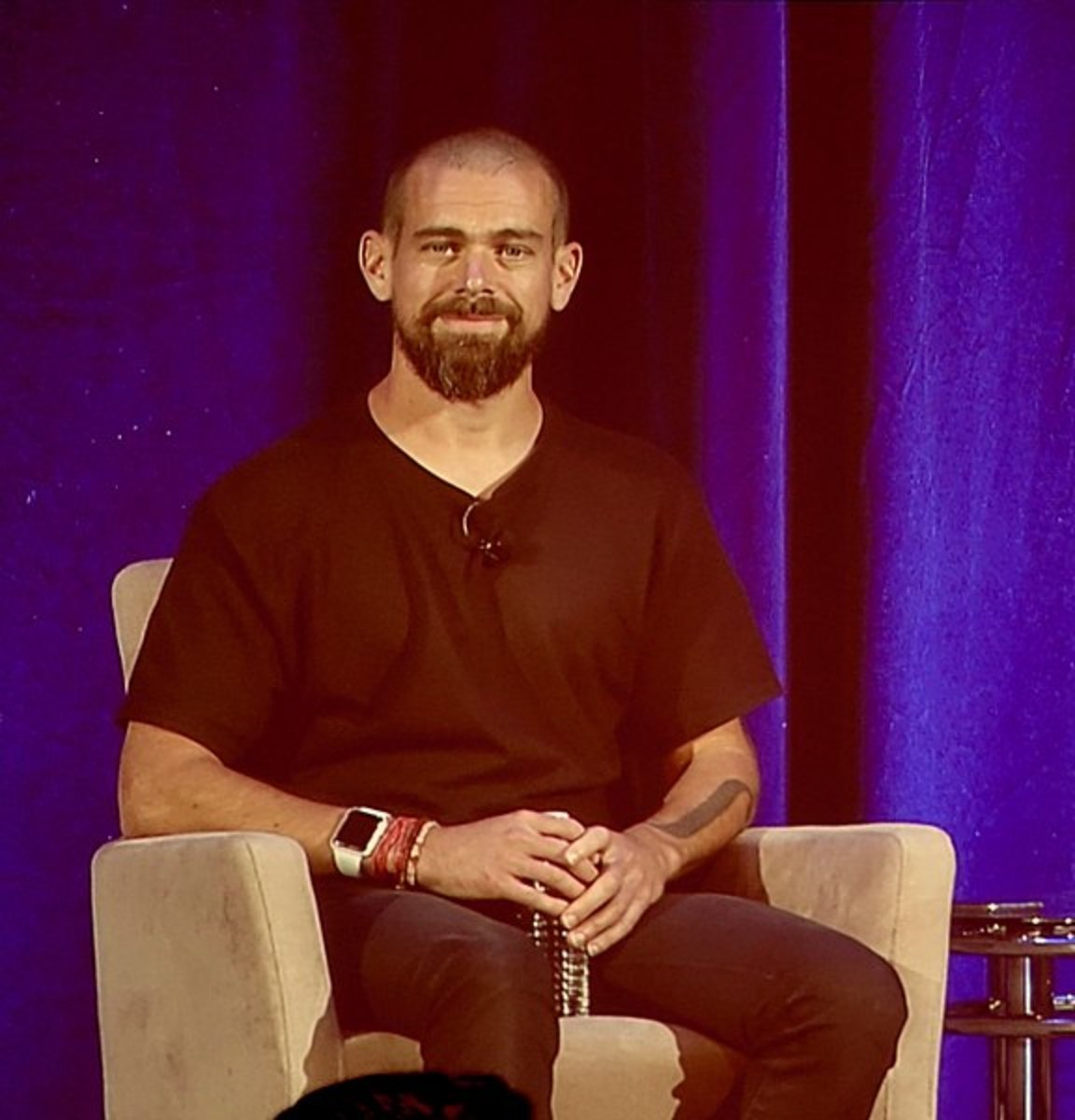

Last week, Elliott Management had a little sit-down with the people who run Twitter—badly, as far as the hedge fund is concerned. Why, for instance, Paul Singer & co. wanted to know, was Twitter falling behind in terms of innovation? Why was its stock tanking when other tech companies were soaring, at least before the global economy got the sniffles? Could it potentially have something to do with a CEO who was running two companies while spending half of the year on the other side of the world? Perhaps things would be a bit better if he chose between Africa and Silicon Valley, and one of the two companies, preferably Square, so that Paul Singer could make some goddamned money on his president’s favorite medium?

Certainly, Elliott’s not the first to have this idea. But it is arguably the most fearsome to strike upon it. But Jack Dorsey hasn’t managed to be this weird and still employed without some tricks, like conjuring $1 billion from the same people who saved Michael Dell from Carl Icahn.

The agreement calls for Twitter to appoint two new board members, with a promise to search for a new independent director, and make $2 billion in share repurchases, the company said. The buyback is to be funded in part by a $1 billion investment from technology-focused investment firm Silver Lake.

The agreement notably doesn’t include the removal of Mr. Dorsey, CEO and co-founder of Twitter, a central pillar of Elliott’s campaign, which came to light last week.

Of course, Paul Singer is known for playing the long game.

Elliott had also nominated four directors to Twitter’s board including Jesse Cohn, its head of U.S. activism who will now join Twitter’s board along with Egon Durban, co-CEO and managing partner of Silver Lake…. The agreement leaves open the possibility of executive change at Twitter. Both Messrs. Cohn and Durban will join a new committee to examine Twitter’s leadership structure—including the role of Mr. Dorsey—with plans to announce its findings by the end of the year.

Twitter, Elliott Strike Truce That Leaves CEO Dorsey in Place [WSJ]