On every episode of the A&E television series “Intervention,” there is a moment when the addict is confronted with an example of what their addiction has done to their life. Oftentimes, that is showing them a clip of their troubling, usually self-harming behavior. At that moment, the interventionists get their best shot at convincing the addict to seek treatment and try to get healthy before it’s too late.

On that note: Wall Street, we’d like to show you something…

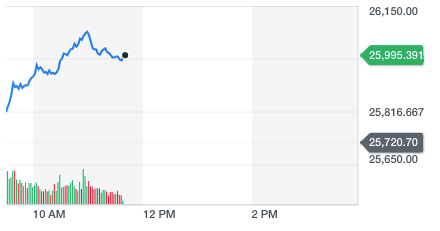

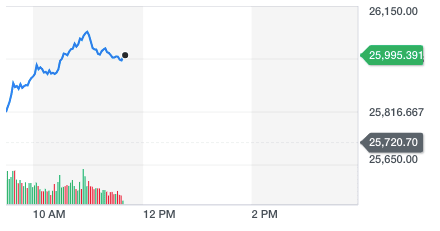

We spent the morning getting vague, Trumpish updates on our totally inane tariff skirmish with Mexico that looks to drag on into the deadline of next Monday, and then learned an hour before the bell that U.S. job growth slowed so quickly in May that the nonfarm payroll increase missed expectations by six digits [75,000 vs 180,000]. That blistering morning of negative indicators was met by this response from the DJIA:

Yeah, the markets are loving this terrible employment data and future trade chaos. Because it all means one thing: The Fed might have to cut interest rates, and that’s really all you care about these days, isn’t it? Isn’t it, Wall Street?

You have a problem, and it’s affecting your life in a negative way. You’re addicted to cheap money, Wall Street. You need to seek treatment.

Remember when you looked at trade wars and huge misses on jobs data as bearish? Because that’s how data works? But now you love that kind of stuff because all you think about are interest rate cuts. You’re literally shaking in your seat as we merely mention an “easing cycle.” Stop licking your lips, Wall Street, it’s shameful.

Is cheap money that great? Is it worth this? Sure, it gives us fun things like the Lyft and Uber IPOs, the cannabis market, ignoring a trade war with China, showing our children cave paintings depicting savings accounts…and who doesn’t love having a Sweetgreen on every Manhattan corner? But if you keep this up you’re going to end up with a rubber tube between your teeth on a bathroom floor buying WeWork IPO shares on your Robinhood account while Brian Moynihan cries about the leveraged loan market imploding and White House chief economist Liz Claman is on television saying that the economy is one more rate cut away from a rebound.

We remember before you got this way. The way your eyes used to twinkle when you bitched and moaned about Janet Yellen not doing enough to get rates back up during the recovery, and fretting that there might not be enough room to ease if things did go south. How you mused about the return of value investing after 2008, and had that healthy fear of bubble investing. Well, now you’re…different.

You say the most horrible things about Jay Powell, and yet you sweat him so hard. When he’s standing there holding rate cuts in the bathroom, you’re all smiles and charm, but when he leaves the room and acts like you can’t cop a rate cut, you immediately turn violent, plotting with the president to jump the poor guy and find someone who will give you what you want.

It’s time to let go and seek the assistance of a higher power, Wall Street. You need to love yourself better than to let cheap money control you. It’s time to embrace the fundamentals of the economy again, live that simple life. Jay Powell can’t make you happy unless you make yourself happy. We understand that the world feels upside down right now and that cheap money makes China, the bond market and this White House’s decision-making a little less scary, but you’ve gone too far and it’s starting to feel like you’re not coming back.

What’s it going to take to get you in the van, Wall Street?…How much do you need to keep you comfortable on the way to a facility?…Can Powell give you a basis point?… Maybe five?…NO, you can’t have 50! Unemployment is steady at 3.6%, inflation remains steady and Disney still has plans to make three more “Avatar” movies! This is what we’re saying, Wall Street, you need help!